Analyst James Check Argues Bitcoin Cycles May Track Adoption Trends Rather Than Halving Events

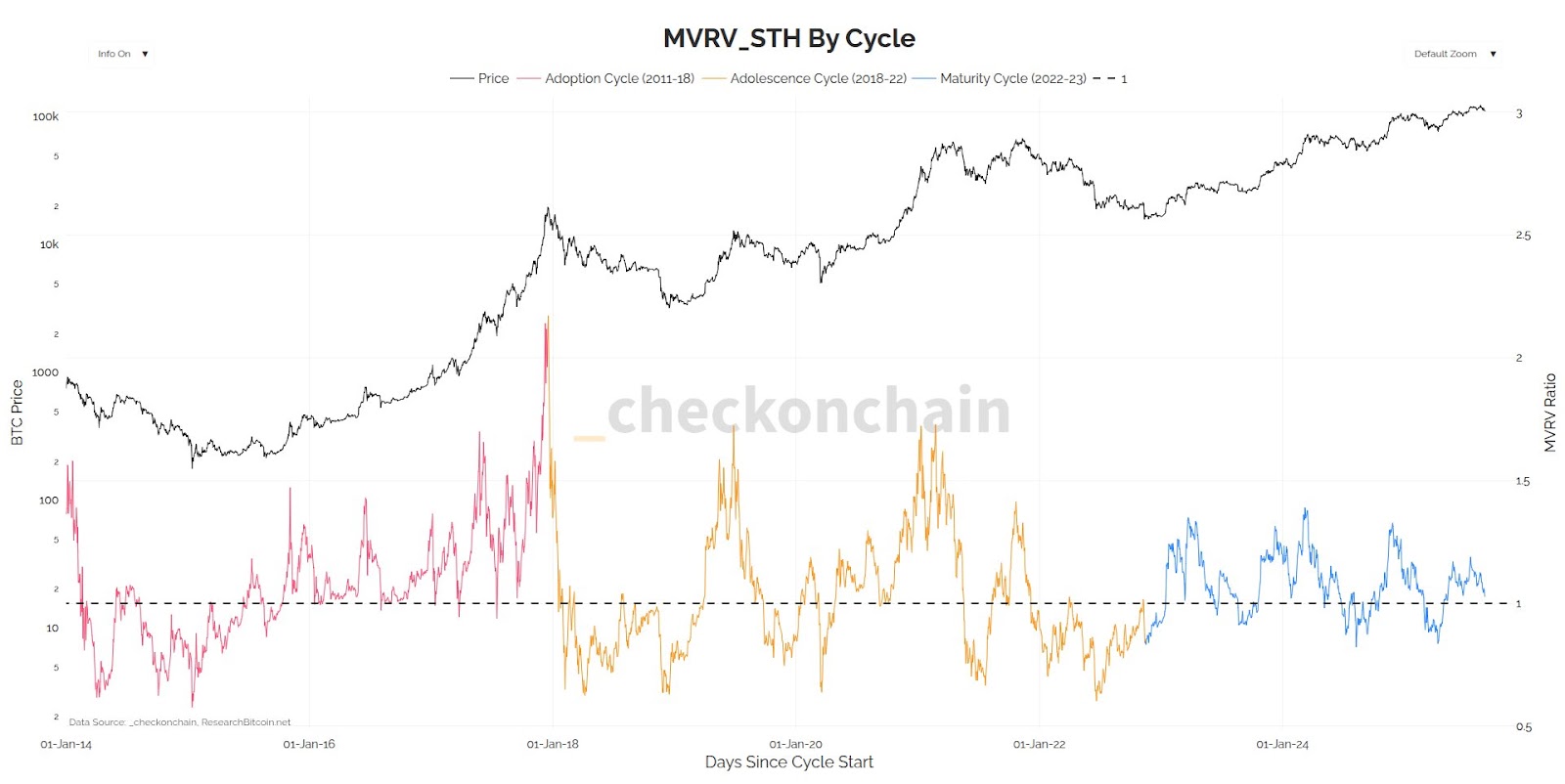

The post Analyst James Check Argues Bitcoin Cycles May Track Adoption Trends Rather Than Halving Events appeared on BitcoinEthereumNews.com. Bitcoin market cycles are driven primarily by adoption trends, market structure and liquidity dynamics rather than strictly by halving events. Analyst James Check identifies three cycles—adoption, adolescence, maturity—where retail activity, leverage and institutional inflows set bull and bear phases. Three adoption-driven cycles: adoption, adolescence, maturity Halvings influence supply but liquidity and institutional flows often determine cycle timing. Glassnode and market analysts signal a late-phase cycle with elevated selling pressure and profit taking. Bitcoin market cycles explained: adoption, leverage, and institutional maturity drive trends more than halvings — read expert analysis, charts, and key takeaways now. What are Bitcoin market cycles? Bitcoin market cycles are multi-year phases of market expansion and contraction defined by adoption, leverage dynamics and liquidity conditions. These cycles describe transitions from retail-driven booms to leveraged corrections and then to institutional maturity, shaping price peaks and troughs more than the date of halvings. How do halving events affect Bitcoin cycles? Halving events reduce miner rewards and can create supply-side constraints, often coinciding with bullish momentum. Historically, major price peaks followed halvings (price peaks in 2013, 2017, 2021), but analyst James Check argues the core drivers are adoption trends and market structure, not the halving clock alone. ‘, ‘

The post Analyst James Check Argues Bitcoin Cycles May Track Adoption Trends Rather Than Halving Events appeared on BitcoinEthereumNews.com.

Bitcoin market cycles are driven primarily by adoption trends, market structure and liquidity dynamics rather than strictly by halving events. Analyst James Check identifies three cycles—adoption, adolescence, maturity—where retail activity, leverage and institutional inflows set bull and bear phases. Three adoption-driven cycles: adoption, adolescence, maturity Halvings influence supply but liquidity and institutional flows often determine cycle timing. Glassnode and market analysts signal a late-phase cycle with elevated selling pressure and profit taking. Bitcoin market cycles explained: adoption, leverage, and institutional maturity drive trends more than halvings — read expert analysis, charts, and key takeaways now. What are Bitcoin market cycles? Bitcoin market cycles are multi-year phases of market expansion and contraction defined by adoption, leverage dynamics and liquidity conditions. These cycles describe transitions from retail-driven booms to leveraged corrections and then to institutional maturity, shaping price peaks and troughs more than the date of halvings. How do halving events affect Bitcoin cycles? Halving events reduce miner rewards and can create supply-side constraints, often coinciding with bullish momentum. Historically, major price peaks followed halvings (price peaks in 2013, 2017, 2021), but analyst James Check argues the core drivers are adoption trends and market structure, not the halving clock alone. ‘, ‘

What's Your Reaction?