Australian Dollar falls as US considers military action against Iran

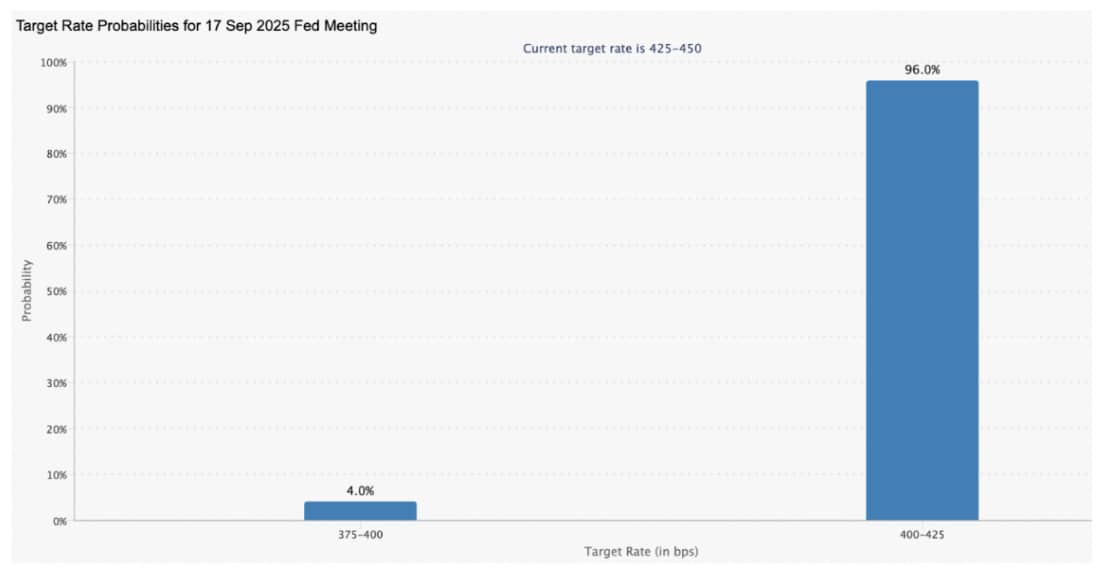

The post Australian Dollar falls as US considers military action against Iran appeared on BitcoinEthereumNews.com. The Australian Dollar remains subdued after mixed employment figures were released on Thursday. Australia’s Employment Change surprisingly declined by 2.5K in May, while Unemployment Rate steadied at 4.1% as expected. The Federal Reserve kept its interest rates on hold at 4.5% in June, as expected. The Australian Dollar (AUD) depreciated against the US Dollar (USD) on Thursday, retracing its recent gains registered in the previous session. The AUD/USD pair holds losses following the employment data release from Australia. The risk-sensitive pair also struggles due to dampened risk sentiment amid escalating Middle East tensions. Australia’s Employment Change fell by 2.5K in May against a 87.6K increase in April (revised from 89K) and the consensus forecast of a 25K rise. Furthermore, the Unemployment Rate steadied at 4.1% in May, as expected. Bloomberg cited unnamed sources on Thursday, reporting that “US officials prepare for possible strike on Iran in coming days.” “The US plans for any attack on Iran continue to evolve.” Moreover, the Wall Street Journal cited individuals familiar with discussions, saying that US President Trump said late Tuesday that he approved of attack plans for Iran, but held it to see if Tehran would abandon its nuclear program. Australian Dollar declines as US Dollar appreciates amid increased risk aversion The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading higher at around 99.00 at the time of writing. The US Federal Reserve (Fed) decided to keep the interest rate steady at 4.5% in June as widely expected. The Federal Open Market Committee (FOMC) still sees around 50 basis points of interest rate cuts through the end of 2025. Fed Chair Jerome Powell warned that ongoing policy uncertainty will keep the Fed in a rate-hold stance, and any rate cuts will be contingent…

The post Australian Dollar falls as US considers military action against Iran appeared on BitcoinEthereumNews.com.

The Australian Dollar remains subdued after mixed employment figures were released on Thursday. Australia’s Employment Change surprisingly declined by 2.5K in May, while Unemployment Rate steadied at 4.1% as expected. The Federal Reserve kept its interest rates on hold at 4.5% in June, as expected. The Australian Dollar (AUD) depreciated against the US Dollar (USD) on Thursday, retracing its recent gains registered in the previous session. The AUD/USD pair holds losses following the employment data release from Australia. The risk-sensitive pair also struggles due to dampened risk sentiment amid escalating Middle East tensions. Australia’s Employment Change fell by 2.5K in May against a 87.6K increase in April (revised from 89K) and the consensus forecast of a 25K rise. Furthermore, the Unemployment Rate steadied at 4.1% in May, as expected. Bloomberg cited unnamed sources on Thursday, reporting that “US officials prepare for possible strike on Iran in coming days.” “The US plans for any attack on Iran continue to evolve.” Moreover, the Wall Street Journal cited individuals familiar with discussions, saying that US President Trump said late Tuesday that he approved of attack plans for Iran, but held it to see if Tehran would abandon its nuclear program. Australian Dollar declines as US Dollar appreciates amid increased risk aversion The US Dollar Index (DXY), which measures the value of the US Dollar against six major currencies, is trading higher at around 99.00 at the time of writing. The US Federal Reserve (Fed) decided to keep the interest rate steady at 4.5% in June as widely expected. The Federal Open Market Committee (FOMC) still sees around 50 basis points of interest rate cuts through the end of 2025. Fed Chair Jerome Powell warned that ongoing policy uncertainty will keep the Fed in a rate-hold stance, and any rate cuts will be contingent…

What's Your Reaction?