Bitcoin Briefly Reclaims $119K as Ethereum Climbs Toward $4K – Best Crypto To Buy?

Bitcoin remained steady between $116,000 and $119,000 last week, while Ethereum hovered just below $4,000. As traders search for the best crypto to buy ahead of major catalysts, Bitcoin and Ethereum remain in focus with several events likely to influence short-term momentum. The biggest short-term driver is the Federal Reserve’s interest rate decision this Wednesday... The post Bitcoin Briefly Reclaims $119K as Ethereum Climbs Toward $4K – Best Crypto To Buy? appeared first on 99Bitcoins.

Bitcoin remained steady between $116,000 and $119,000 last week, while Ethereum hovered just below $4,000. As traders search for the best crypto to buy ahead of major catalysts, Bitcoin and Ethereum remain in focus with several events likely to influence short-term momentum.

The biggest short-term driver is the Federal Reserve’s interest rate decision this Wednesday. With inflation creeping higher and Trump’s proposed tariffs adding pressure, the Fed is expected to keep rates between 4.25% and 4.50%. Upcoming data, like Tuesday’s consumer confidence, Wednesday’s GDP, and Friday’s non-farm payrolls, will further shape expectations for future policy.

Meanwhile, ETF inflows continue to offer support. Spot Bitcoin ETFs saw modest $72 million inflows last week, while Ethereum ETFs added over $5.1 billion in assets. Institutional interest in both assets remains strong.

EXPLORE: Top 20 Crypto to Buy in 2025

Best Crypto to Buy Right Now? ZORA and VINE Make Headlines After Major Moves

With Bitcoin steady near $119K and Ethereum pushing toward $4,000, altcoins are back in the spotlight and two names in particular have caught traders’ attention: ZORA and VINE.

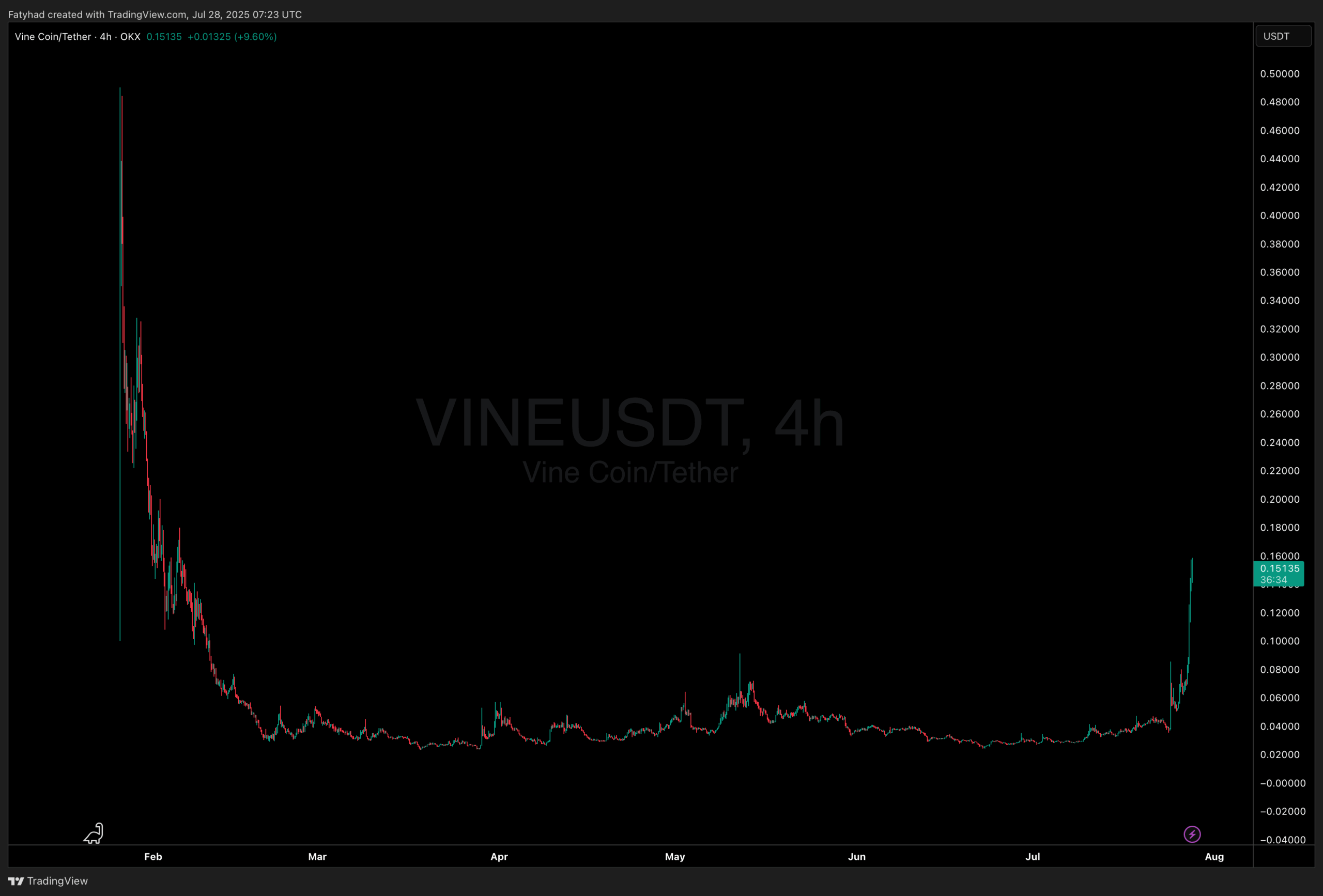

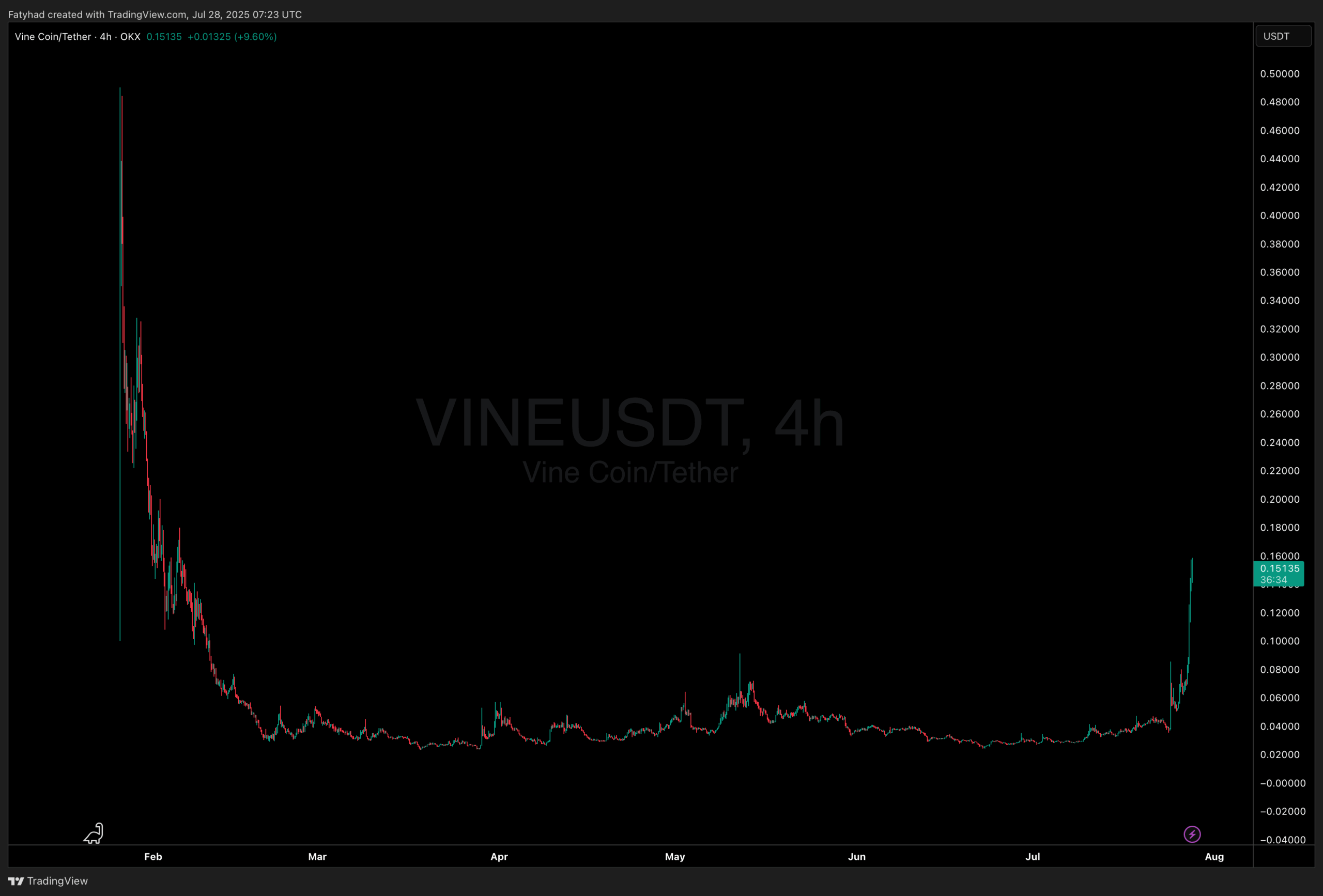

The VINE memecoin surged over 350%, $400 million volume in the last 24 hours, in just four days after Elon Musk teased the return of Vine, saying, “We’re bringing back Vine, but in AI form.”

Elon Musk in a new tweet:

“We’re bringing back Vine, but in AI form.” pic.twitter.com/TtPJYxP42R

— Pop Base (@PopBase) July 24, 2025

The post instantly went viral on X, but also drew criticism about potential “crappy AI content.” Interestingly, Rus Yusupov, Vine’s original founder, had posted about viral AI videos days before the announcement. Though he dropped a VINE token earlier this year, there’s no official link between him and Musk’s AI Vine revival. The memecoin may just be riding speculative hype.

(VINEUSDT)

Meanwhile, ZORA, a creator-focused protocol enabling tokenized content, has gained serious traction, printing over 900% gains in just a month. It’s now trading at $289 million market cap (839 million FDV).

Built on the Base chain, ZORA benefited from rising interest in dApps and a public dispute between Jesse Pollak (Base) and Jon Chabonne (DBA). Pollak’s defense of ZORA as “more than a meme coin” helped draw attention.

Still, the platform itself has received mixed feedback. Some find the UX unintuitive, sitting somewhere between SocialFi and NFT tools. It may still be a work in progress, but ZORA is clearly on traders’ radars.

If you’re hunting for the best crypto to buy right now, ZORA and VINE offer contrasting bets: one on speculative hype, the other on creator-driven infrastructure.

Institutional interest in crypto is rising fast, with Bitcoin and Ethereum ETFs seeing major inflows on July 28. Ten Bitcoin ETFs added a net 1,497 BTC ($177.5M), led by BlackRock’s iShares, which now holds over 738,000 BTC worth $87.5 billion. Ethereum ETFs also saw heavy inflows, 126,429 ETH ($486.5M), signaling growing confidence in the market’s long-term direction.

These inflows do more than boost price sentiment. They strengthen the Bitcoin ecosystem as a whole by reinforcing institutional trust and deepening market liquidity. As capital flows into spot ETFs, more investors begin to explore on-chain Bitcoin utility: a frontier still largely underdeveloped compared to Ethereum.

That’s where Bitcoin Hyper comes in. As a Bitcoin Layer-2 that integrates the Solana Virtual Machine (SVM), Bitcoin Hyper allows BTC holders to participate in DeFi, gaming, and staking: features that the traditional Bitcoin infrastructure lacks.

With over $5.4 million raised in its presale and a 188% APY staking reward, HYPER is positioning itself as the go-to solution for unlocking BTC’s on-chain potential. It acts as a bridge between institutional BTC demand and next-gen crypto use cases.

As ETF-driven demand surges, Bitcoin Hyper stands to benefit by offering yield and utility to an asset historically seen only as digital gold.

Visit HYPER Here

BNB crypto, the token that powers both the BNB Smart Chain and Binance, has just reached a new all-time high of $858 after more than a year of sideways trading. BNB surged 6% overnight, reaching its highest price point since its launch in 2017.

Its 30%+ July rally has catapulted BNB back into the crypto top five by market cap, overtaking Solana after weeks of jostling, according to CoinGecko. BNB is now valued at $117 billion, just behind Tether (USDT) in fourth with $163 billion.

Crypto valuations, especially ETH, surged on Sunday, tacking on over $82 billion and lifting the market to $3.87 trillion. However, beneath the euphoria, trading volume plummeted, down 25.98% in 24 hours, reaching $165.52 billion.

The big picture is that BTC and ETH are becoming black holes for value. They’re siphoning value from other assets until they are sucked completely dry. Meanwhile, a new crypto presale is set to MOON this week if favorable trade deels are made between Trump and the EU.

SharpLink Gaming has expanded its Ethereum holdings with a new $295 million purchase of 77,210 ETH over the weekend, bringing its total to 438,017 ETH (worth approximately $1.69 billion), according to Lookonchain.

The company plans to stake the newly acquired ETH, highlighting Ethereum’s 24/7 operational advantage over traditional banking hours. On-chain data shows SharpLink transferred $145 million in USDC to Galaxy Digital ahead of the buy. Galaxy later withdrew 38,600 ETH from Binance and transferred it to SharpLink.

Analysts believe this completes the purchase, which follows SharpLink’s earlier acquisition of 360,807 ETH last week. Over 95% of the holdings are now staked or used in liquid staking.

This aggressive accumulation has pushed SharpLink ahead of Bitmine and Coinbase in ETH reserves.

As Ethereum pushes toward $4,000, excitement around a full-blown altcoin season is building. Meme coins like SPX6900 and BONK surged in the past days hitting new ATHs, and investors are now eyeing low-cap gems with 100x potential: like TOKEN6900 (T6900).

After missing SPX6900’s legendary 10,000x run, traders are rushing into the T6900 presale, betting on a repeat. With over $1.3 million raised toward a $5 million hard cap, TOKEN6900’s no-utility, meme-only approach is resonating with crypto’s meme-hungry crowd.

Staking is available at 63% APY, and community hype is surging across socials. Discover more about TOKEN6900 in their website.

Visit T6900 Here

Trump Media & Technology Group (TMTG), the parent of Truth Social, has invested $300 million in options tied to Bitcoin-related securities, according to Bloomberg. The strategy aims to profit from crypto price swings without holding Bitcoin directly. These options, linked to ETFs, crypto firm shares, or notes from companies like MicroStrategy, offer high upside but carry significant risk if the strike price isn’t met.

While TMTG hasn’t commented, the move reflects a wider trading approach as the firm deepens its exposure to the crypto sector. Trump’s posts have historically moved digital asset prices, and the company already holds an estimated $2 billion in Bitcoin-linked assets.

Critics warn the financial strategy could blur lines between Trump’s political influence and personal investments. With crypto holdings making up a sizable chunk of Trump’s estimated $6.6 billion fortune, the overlap is raising concerns about potential conflicts of interest.

Bitcoin And ETH ETF Inflows Surge – Layer-2 Projects Like Bitcoin Hyper Poised to Benefit

BNB Crypto Hits A New All-Time High Of $858, Making Binance Co-Founder One Of The World’s Richest Men

Four Trilion Crypto Market Cap: Bullrun not Stoping, Not Yet

SharpLink Gaming Buys $295M in Ethereum, Now Holds $1.69B in ETH

Altcoin Season Heats Up as TOKEN6900 Presale Gains Traction Amid Ethereum Rally

Trump Media Bets $300M on Bitcoin-Linked Options to Capitalise on Crypto Volatility

The post Bitcoin Briefly Reclaims $119K as Ethereum Climbs Toward $4K – Best Crypto To Buy? appeared first on 99Bitcoins.

What's Your Reaction?