Bitcoin ETFs Notch $1B Weekly Inflow, Extending 10-Week Streak

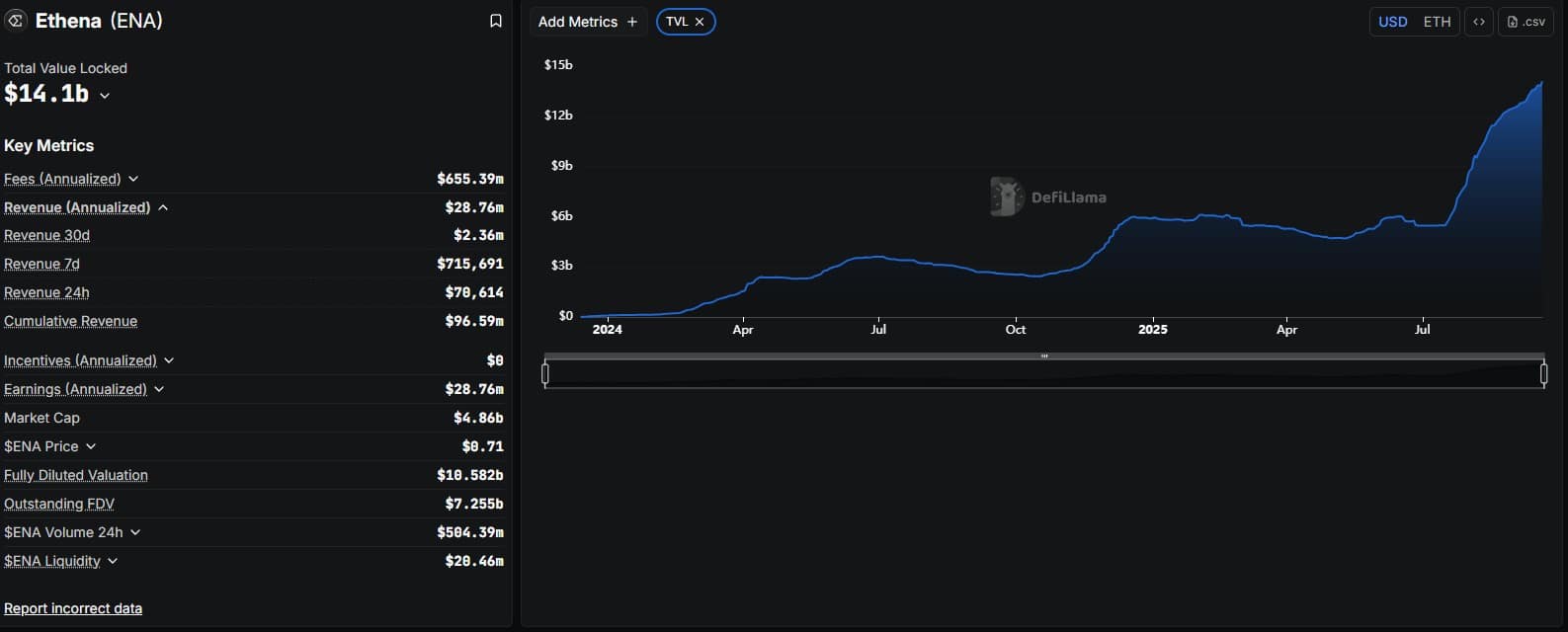

The post Bitcoin ETFs Notch $1B Weekly Inflow, Extending 10-Week Streak appeared on BitcoinEthereumNews.com. BlackRock’s IBIT dominated with a $1.23 billion inflow, while Bitwise’s BITB saw $29.85 million, Grayscale’s Bitcoin Mini Trust $14.93 million, and Hashdex’s DEFI fund $1.17 million. Positive Market Sentiment Amid Easing Geopolitical Tensions Having witnessed a 10‑day streak of ETF inflows, Bitcoin has been able to record this bullish run thanks to easing geopolitical uncertainty with the Iran-Israel ceasefire taking center stage. Source: Crypto King BlackRock’s IBIT dominance cannot go unnoticed because its inflows since early June have surpassed $2.6 billion, securing 9-concecutive days of inflows. Therefore, the $1.02 billion net inflow reflects sustained institutional conviction, supply-driven bullish dynamics, and geopolitical stability with Bitcoin ETFs already cementing their place as a mainstream investment vehicles. Source: Sosovalue Meanwhile, Bitcoin and crypto funds have raked in inflows for 10 consecutive weeks, adding $1.24 billion recently and pushing year-to-date totals to $15 billion. Despite holiday lulls and global jitters, investors are seizing the pullback as a buying opportunity—not a sell signal. Bitcoin attracted $1.11 billion in weekly capital inflows, boosting its monthly total to $2.37 billion and year-to-date haul to $12.7 billion—backed by nearly $152 billion in assets under management, according to CoinShares data. Therefore, these metrics paint a bullish Bitcoin picture as more institutional and retail investors continue jumping on the BTC bandwagon. Bitcoin’s Illiquid Supply Ballons Bitcoin’s illiquid supply—the portion of coins held in wallets that rarely move—is now 14.37 million BTC, up from roughly 13.9 million BTC at the start of the year, reflecting a rise of 470,000 BTC YTD. Source: Glassnode This means over 72 percent of the circulating Bitcoin supply—approximately 19.8 million BTC—is now effectively “off‑market,” held by long‑term investors and cold wallets. That’s a historic peak in illiquid supply, driven by two reinforcing trends: What’s Driving the Surge? Record Accumulation in Recent Months Over the past 30 days, around 180,000 BTC moved into illiquid wallets—the strongest…

The post Bitcoin ETFs Notch $1B Weekly Inflow, Extending 10-Week Streak appeared on BitcoinEthereumNews.com.

BlackRock’s IBIT dominated with a $1.23 billion inflow, while Bitwise’s BITB saw $29.85 million, Grayscale’s Bitcoin Mini Trust $14.93 million, and Hashdex’s DEFI fund $1.17 million. Positive Market Sentiment Amid Easing Geopolitical Tensions Having witnessed a 10‑day streak of ETF inflows, Bitcoin has been able to record this bullish run thanks to easing geopolitical uncertainty with the Iran-Israel ceasefire taking center stage. Source: Crypto King BlackRock’s IBIT dominance cannot go unnoticed because its inflows since early June have surpassed $2.6 billion, securing 9-concecutive days of inflows. Therefore, the $1.02 billion net inflow reflects sustained institutional conviction, supply-driven bullish dynamics, and geopolitical stability with Bitcoin ETFs already cementing their place as a mainstream investment vehicles. Source: Sosovalue Meanwhile, Bitcoin and crypto funds have raked in inflows for 10 consecutive weeks, adding $1.24 billion recently and pushing year-to-date totals to $15 billion. Despite holiday lulls and global jitters, investors are seizing the pullback as a buying opportunity—not a sell signal. Bitcoin attracted $1.11 billion in weekly capital inflows, boosting its monthly total to $2.37 billion and year-to-date haul to $12.7 billion—backed by nearly $152 billion in assets under management, according to CoinShares data. Therefore, these metrics paint a bullish Bitcoin picture as more institutional and retail investors continue jumping on the BTC bandwagon. Bitcoin’s Illiquid Supply Ballons Bitcoin’s illiquid supply—the portion of coins held in wallets that rarely move—is now 14.37 million BTC, up from roughly 13.9 million BTC at the start of the year, reflecting a rise of 470,000 BTC YTD. Source: Glassnode This means over 72 percent of the circulating Bitcoin supply—approximately 19.8 million BTC—is now effectively “off‑market,” held by long‑term investors and cold wallets. That’s a historic peak in illiquid supply, driven by two reinforcing trends: What’s Driving the Surge? Record Accumulation in Recent Months Over the past 30 days, around 180,000 BTC moved into illiquid wallets—the strongest…

What's Your Reaction?