Bitcoin outperforms traditional finance assets in 2023

The post Bitcoin outperforms traditional finance assets in 2023 appeared on BitcoinEthereumNews.com. Bitcoin (BTC) rallied during this week, moving from its lowest price of $26,814 on Sunday to trade for as high as $30,233 on October 20 (Friday). This move marks another uncorrelation between the leading cryptocurrency and the core stock market indexes. Notably, CryptoRank identified a major outperformance from Bitcoin related to traditional finance assets and Ethereum (ETH) year-to-date (YTD). According to a performance analysis on October 20, Bitcoin outperformed Ethereum, Gold, NASDAQ’s index, and the SPY in 2023. Accruing over 4,000 basis points (bps) more than the second-best performing asset, ETH, both cryptocurrencies. Interestingly, with 79.7% and 34.9% accumulated gains YTD, Bitcoin and Ethereum outperformed NASDAQ (+26.9%) by 5,280 bps and 800 bps, respectively. The SPY and Gold were also left behind with accumulated gains of 13.2% and 7.03% each in 2023. BTC outperforms traditional finance assets in 2023. Source: CryptoRank Bitcoin is a “flight to quality” vs. traditional finance Larry Fink, CEO of BlackRock Inc. (NYSE: BLK), gave an interview on Fox Business where he mentioned Bitcoin’s rally and a perceived trend of clients around the globe talking about “the need of crypto”, in Finks words. “I think the rally today [Monday] is about a flight to quality, with all the issues around the Israeli war now and global terrorism.” — Larry Fink BlackRock is the largest asset manager in the world and a major shareholder in 4 of the 5 largest Bitcoin miners. BLK’s price history speaks for itself, with 4,443.57% accumulated gains since its Initial Public Offering (IPO) in 1999. Moreover, Fink is not the only traditional finance giant looking at Bitcoin with bright eyes. Many institutional investors are showing growing interest in Satoshi Nakmoto’s creation, as described by Dave Weisberger, CEO of CoinRoutes, as a “literal perfect storm” brewing for BTC. Bitcoin dominance at yearly highs…

The post Bitcoin outperforms traditional finance assets in 2023 appeared on BitcoinEthereumNews.com.

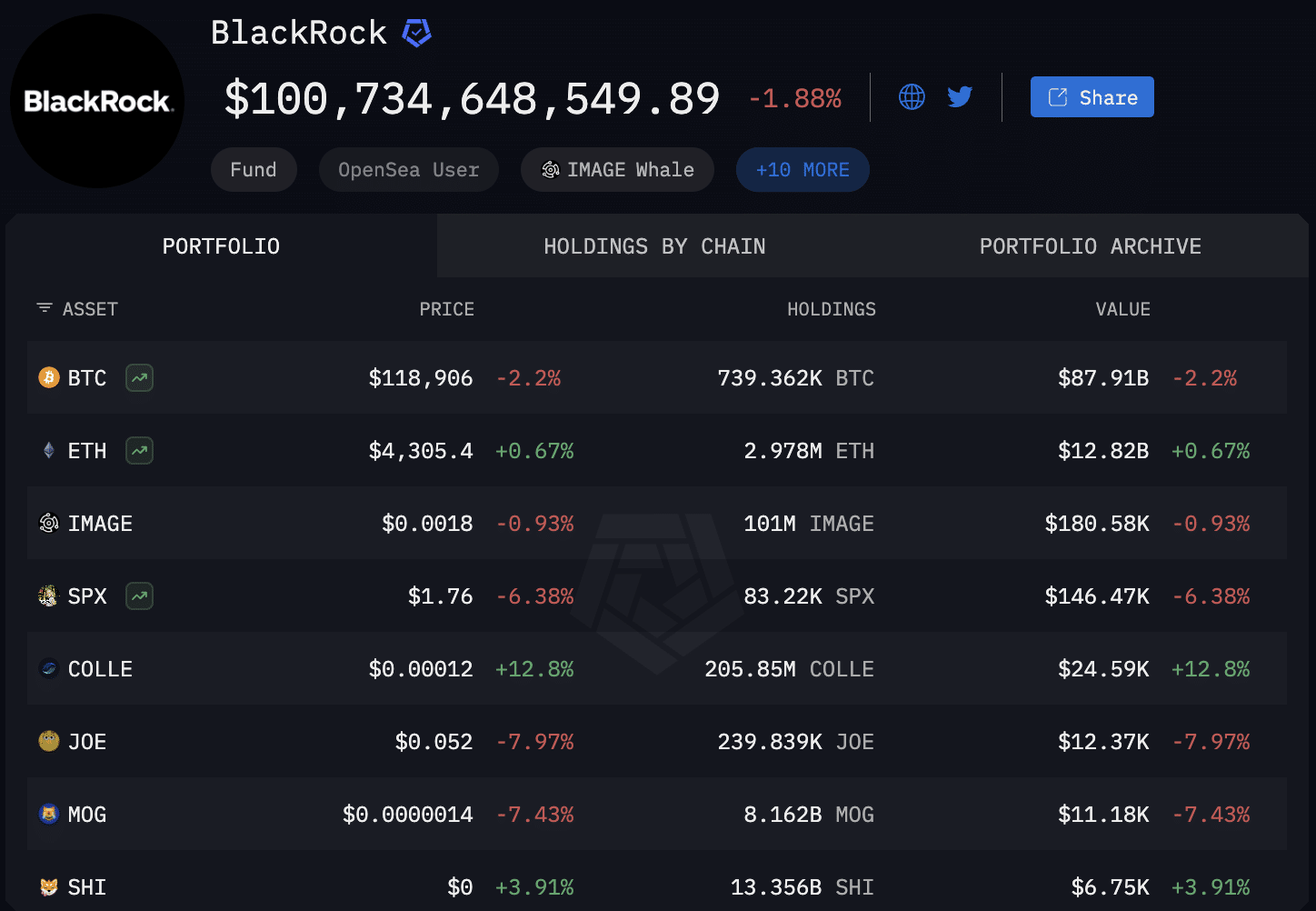

Bitcoin (BTC) rallied during this week, moving from its lowest price of $26,814 on Sunday to trade for as high as $30,233 on October 20 (Friday). This move marks another uncorrelation between the leading cryptocurrency and the core stock market indexes. Notably, CryptoRank identified a major outperformance from Bitcoin related to traditional finance assets and Ethereum (ETH) year-to-date (YTD). According to a performance analysis on October 20, Bitcoin outperformed Ethereum, Gold, NASDAQ’s index, and the SPY in 2023. Accruing over 4,000 basis points (bps) more than the second-best performing asset, ETH, both cryptocurrencies. Interestingly, with 79.7% and 34.9% accumulated gains YTD, Bitcoin and Ethereum outperformed NASDAQ (+26.9%) by 5,280 bps and 800 bps, respectively. The SPY and Gold were also left behind with accumulated gains of 13.2% and 7.03% each in 2023. BTC outperforms traditional finance assets in 2023. Source: CryptoRank Bitcoin is a “flight to quality” vs. traditional finance Larry Fink, CEO of BlackRock Inc. (NYSE: BLK), gave an interview on Fox Business where he mentioned Bitcoin’s rally and a perceived trend of clients around the globe talking about “the need of crypto”, in Finks words. “I think the rally today [Monday] is about a flight to quality, with all the issues around the Israeli war now and global terrorism.” — Larry Fink BlackRock is the largest asset manager in the world and a major shareholder in 4 of the 5 largest Bitcoin miners. BLK’s price history speaks for itself, with 4,443.57% accumulated gains since its Initial Public Offering (IPO) in 1999. Moreover, Fink is not the only traditional finance giant looking at Bitcoin with bright eyes. Many institutional investors are showing growing interest in Satoshi Nakmoto’s creation, as described by Dave Weisberger, CEO of CoinRoutes, as a “literal perfect storm” brewing for BTC. Bitcoin dominance at yearly highs…

What's Your Reaction?