Bitcoin Passes $118K For First Time in History as Shorts Vaporize $1B

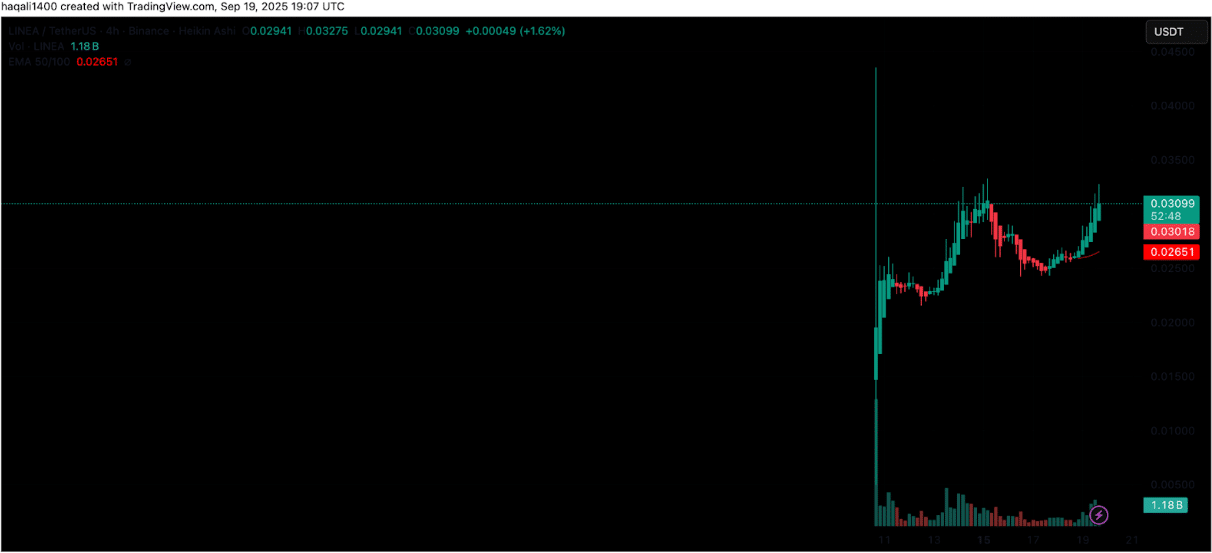

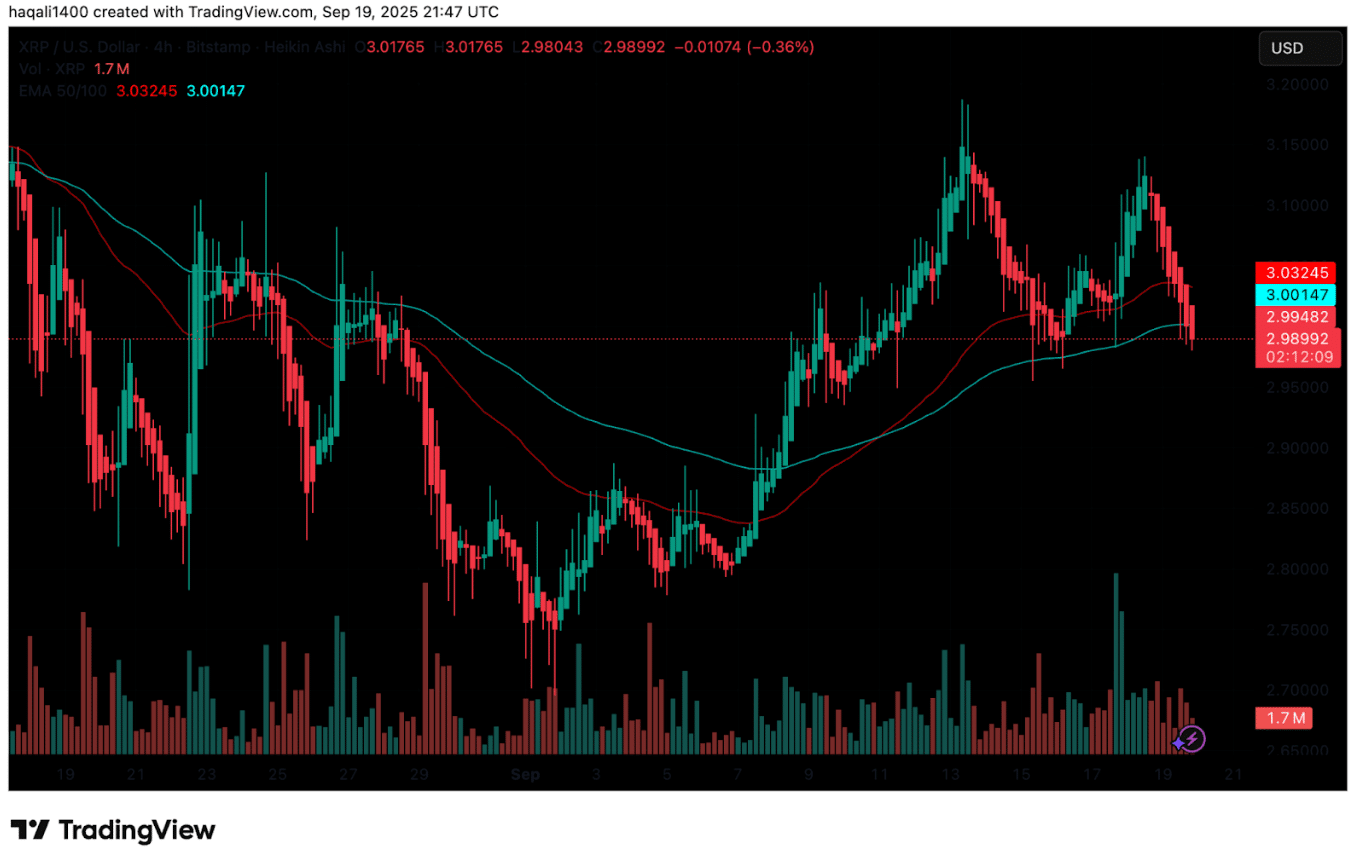

The post Bitcoin Passes $118K For First Time in History as Shorts Vaporize $1B appeared on BitcoinEthereumNews.com. Bitcoin hits $118K and vaporizes $1B in shorts. US debt fuels rally, can coins like $HYPER surge? The crypto market is on fire. Bitcoin has smashed past $118K, which is a massive 60% jump since April. And it’s not just $BTC; Ether hit $3K and XRP surged 5% to nearly $2.60. Source: CoinMarketCap The rally isn’t random; it’s happening as the U.S. Dollar takes a beating, dropping nearly 11% in six months, its worst start to a year since 1973. Plus, tech stocks are soaring, with Nvidia’s market cap hitting a mind-blowing $4T. Source: TradingView Bitcoin’s explosive surge didn’t just grab headlines, it also wiped out over $1 billion in short positions across the crypto market in just 24 hours. Traders betting against the rally were caught off guard as prices soared, triggering a wave of forced liquidations. When shorts get liquidated, it adds buying pressure to the market, fueling the rally even further in a classic short squeeze spiral. Source: Coinglass Bitcoin shorts accounted for over $678M of the liquidations, indicating a highly leveraged, futures-driven rally. Source: Coinglass The timing of Bitcoin’s climb caught the market off guard. It bottomed out in early April when worries about a global trade war eased up. But something deeper is fuelling this rebound: growing concerns about U.S. debt and messy fiscal policies. The U.S. government’s debt ceiling is currently sitting at around $36T as of July 3rd, and people are already expecting it to max out again in under three years. That kind of financial anxiety is clearly pushing investors towards decentralized assets. Macroeconomic Tailwinds and Crypto’s Rise Adding to the bigger picture, Elon Musk’s public exit from the Department of Government Efficiency (DOGE) felt like a big sign that Washington’s financial picture was even worse than expected, despite his positive X…

The post Bitcoin Passes $118K For First Time in History as Shorts Vaporize $1B appeared on BitcoinEthereumNews.com.

Bitcoin hits $118K and vaporizes $1B in shorts. US debt fuels rally, can coins like $HYPER surge? The crypto market is on fire. Bitcoin has smashed past $118K, which is a massive 60% jump since April. And it’s not just $BTC; Ether hit $3K and XRP surged 5% to nearly $2.60. Source: CoinMarketCap The rally isn’t random; it’s happening as the U.S. Dollar takes a beating, dropping nearly 11% in six months, its worst start to a year since 1973. Plus, tech stocks are soaring, with Nvidia’s market cap hitting a mind-blowing $4T. Source: TradingView Bitcoin’s explosive surge didn’t just grab headlines, it also wiped out over $1 billion in short positions across the crypto market in just 24 hours. Traders betting against the rally were caught off guard as prices soared, triggering a wave of forced liquidations. When shorts get liquidated, it adds buying pressure to the market, fueling the rally even further in a classic short squeeze spiral. Source: Coinglass Bitcoin shorts accounted for over $678M of the liquidations, indicating a highly leveraged, futures-driven rally. Source: Coinglass The timing of Bitcoin’s climb caught the market off guard. It bottomed out in early April when worries about a global trade war eased up. But something deeper is fuelling this rebound: growing concerns about U.S. debt and messy fiscal policies. The U.S. government’s debt ceiling is currently sitting at around $36T as of July 3rd, and people are already expecting it to max out again in under three years. That kind of financial anxiety is clearly pushing investors towards decentralized assets. Macroeconomic Tailwinds and Crypto’s Rise Adding to the bigger picture, Elon Musk’s public exit from the Department of Government Efficiency (DOGE) felt like a big sign that Washington’s financial picture was even worse than expected, despite his positive X…

What's Your Reaction?

.png?#)

![Analyzing if Litecoin [LTC] can breach $137 and trigger a squeeze](https://i1.wp.com/ambcrypto.com/wp-content/uploads/2025/08/Kelvin-_80_-1000x600.webp?#)