BitMine Boosts ETH Treasury to $4.96B as Ethereum Open Interest Nears $60B

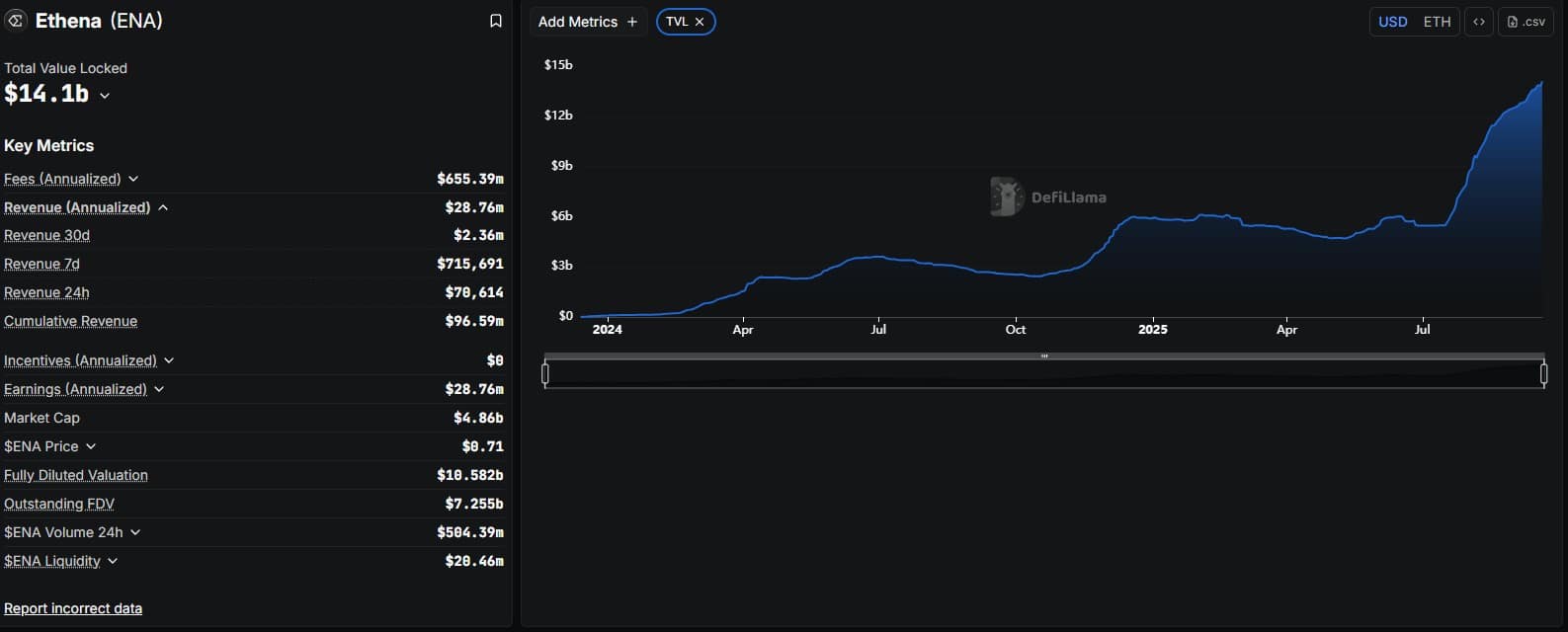

The post BitMine Boosts ETH Treasury to $4.96B as Ethereum Open Interest Nears $60B appeared on BitcoinEthereumNews.com. Key Notes BitMine increased ETH holdings to 1.15 million tokens within one week, boosting treasury value to $4.96 billion total. Fundamental Global purchased 47,331 ETH tokens as part of ambitious $5 billion acquisition fund targeting market dominance. Technical indicators show bullish momentum with potential targets at $5,000, though record open interest creates liquidation risks. Ethereum ETH $4 245 24h volatility: 0.6% Market cap: $511.80 B Vol. 24h: $41.80 B price crossed the $4,360 mark on Monday, August 11, setting a higher daily peak for the fifth consecutive session. The latest surge is primarily driven by BitMine’s aggressive treasury expansion, as the Nasdaq-listed company disclosed a massive ETH accumulation spree that added over 316,000 tokens to its holdings within just one week. BitMine Immersion increased its ETH holdings from 833,137 tokens to 1.15 million, boosting its treasury valuation by $2 billion to reach $4.96 billion total. This corporate buying pressure has coincided with derivatives market activity reaching unprecedented levels, as ETH open interest climbed to nearly $60 billion, signaling intensified institutional and retail interest in Ethereum’s price trajectory. “We are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” Thomas Lee, Fundstrat Chairman and BitMine Board Director said. According to Yahoo Finance, BitMine stock (NASDAQ:IMMR) ranks among the 25 most actively traded US equities, with a $2.2 billion five-day average daily dollar volume, surpassing JPMorgan and Micron Technology. Meanwhile, Fundamental Global (Nasdaq: FGNX) also announced its first ETH purchase of 47,331 tokens, just days after launching a $5 billion acquisition fund targeting 10% of Ethereum’s total supply. The company aims to become one of the largest ETH treasury holders globally. In the derivatives market, ETH open interest rose 1.25% to $59.47 billion, its highest level yet, while…

The post BitMine Boosts ETH Treasury to $4.96B as Ethereum Open Interest Nears $60B appeared on BitcoinEthereumNews.com.

Key Notes BitMine increased ETH holdings to 1.15 million tokens within one week, boosting treasury value to $4.96 billion total. Fundamental Global purchased 47,331 ETH tokens as part of ambitious $5 billion acquisition fund targeting market dominance. Technical indicators show bullish momentum with potential targets at $5,000, though record open interest creates liquidation risks. Ethereum ETH $4 245 24h volatility: 0.6% Market cap: $511.80 B Vol. 24h: $41.80 B price crossed the $4,360 mark on Monday, August 11, setting a higher daily peak for the fifth consecutive session. The latest surge is primarily driven by BitMine’s aggressive treasury expansion, as the Nasdaq-listed company disclosed a massive ETH accumulation spree that added over 316,000 tokens to its holdings within just one week. BitMine Immersion increased its ETH holdings from 833,137 tokens to 1.15 million, boosting its treasury valuation by $2 billion to reach $4.96 billion total. This corporate buying pressure has coincided with derivatives market activity reaching unprecedented levels, as ETH open interest climbed to nearly $60 billion, signaling intensified institutional and retail interest in Ethereum’s price trajectory. “We are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” Thomas Lee, Fundstrat Chairman and BitMine Board Director said. According to Yahoo Finance, BitMine stock (NASDAQ:IMMR) ranks among the 25 most actively traded US equities, with a $2.2 billion five-day average daily dollar volume, surpassing JPMorgan and Micron Technology. Meanwhile, Fundamental Global (Nasdaq: FGNX) also announced its first ETH purchase of 47,331 tokens, just days after launching a $5 billion acquisition fund targeting 10% of Ethereum’s total supply. The company aims to become one of the largest ETH treasury holders globally. In the derivatives market, ETH open interest rose 1.25% to $59.47 billion, its highest level yet, while…

What's Your Reaction?