BlackRock BUIDL Fund Achieves Phenomenal $2.88B Milestone On Ethereum

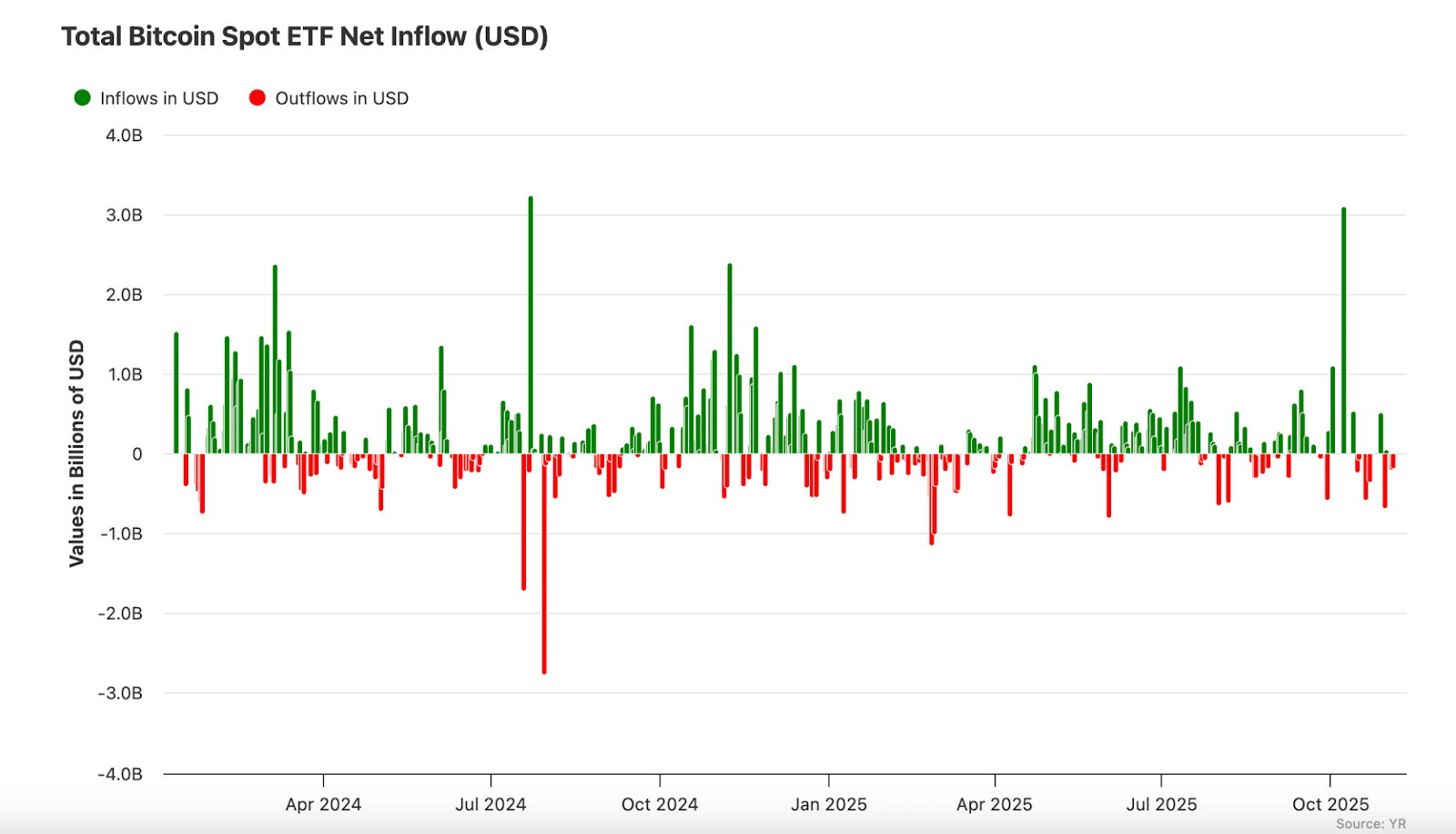

The post BlackRock BUIDL Fund Achieves Phenomenal $2.88B Milestone On Ethereum appeared on BitcoinEthereumNews.com. Get ready for some exciting news from the intersection of traditional finance and the blockchain world! BlackRock, one of the globe’s largest asset managers, has seen its tokenized fund, known as BUIDL (BlackRock USD Institutional Digital Liquidity Fund), achieve a significant milestone. As of May 18th, the BlackRock BUIDL fund now holds a staggering $2.88 billion in assets. This isn’t just a big number; it’s a powerful indicator of growing interest from major players in leveraging blockchain technology for real-world assets. Let’s dive into what makes this development so noteworthy, especially its strong ties to the Ethereum network. What is BlackRock BUIDL and Why Does it Matter? The BlackRock BUIDL fund is designed to provide institutional investors with access to U.S. dollar-denominated yields through tokenized ownership. In simpler terms, it takes traditional financial assets, like cash, and represents them as digital tokens on a blockchain. This is a prime example of the growing trend of Real World Assets (RWAs) being brought onto distributed ledgers. Why is this significant? Because BlackRock entering this space with such a substantial fund size sends a strong signal to the market. It validates the potential of tokenization for institutional use cases, moving beyond just cryptocurrencies like Bitcoin and Ether to include traditional financial instruments. The fund aims to offer benefits like: Efficiency: Potentially faster settlement times compared to traditional systems. Transparency: Transactions recorded on a public or permissioned ledger. Accessibility: Enabling fractional ownership and broader access (for eligible investors). The success and growth of BlackRock BUIDL demonstrate that major financial institutions are not just observing the blockchain space; they are actively participating and building products within it. Exploring the Dominance of Ethereum RWA in BUIDL Perhaps the most striking data point from RWA.xyz is the network distribution of the BUIDL fund’s assets. Out of the…

The post BlackRock BUIDL Fund Achieves Phenomenal $2.88B Milestone On Ethereum appeared on BitcoinEthereumNews.com.

Get ready for some exciting news from the intersection of traditional finance and the blockchain world! BlackRock, one of the globe’s largest asset managers, has seen its tokenized fund, known as BUIDL (BlackRock USD Institutional Digital Liquidity Fund), achieve a significant milestone. As of May 18th, the BlackRock BUIDL fund now holds a staggering $2.88 billion in assets. This isn’t just a big number; it’s a powerful indicator of growing interest from major players in leveraging blockchain technology for real-world assets. Let’s dive into what makes this development so noteworthy, especially its strong ties to the Ethereum network. What is BlackRock BUIDL and Why Does it Matter? The BlackRock BUIDL fund is designed to provide institutional investors with access to U.S. dollar-denominated yields through tokenized ownership. In simpler terms, it takes traditional financial assets, like cash, and represents them as digital tokens on a blockchain. This is a prime example of the growing trend of Real World Assets (RWAs) being brought onto distributed ledgers. Why is this significant? Because BlackRock entering this space with such a substantial fund size sends a strong signal to the market. It validates the potential of tokenization for institutional use cases, moving beyond just cryptocurrencies like Bitcoin and Ether to include traditional financial instruments. The fund aims to offer benefits like: Efficiency: Potentially faster settlement times compared to traditional systems. Transparency: Transactions recorded on a public or permissioned ledger. Accessibility: Enabling fractional ownership and broader access (for eligible investors). The success and growth of BlackRock BUIDL demonstrate that major financial institutions are not just observing the blockchain space; they are actively participating and building products within it. Exploring the Dominance of Ethereum RWA in BUIDL Perhaps the most striking data point from RWA.xyz is the network distribution of the BUIDL fund’s assets. Out of the…

What's Your Reaction?