Crypto News Today, September 29 – Bitcoin Price Briefly Surges Above $112K And Ethereum Reclaims $4K – Best Crypto To Buy Before “Uptober?

Bulls are tired of this September and already looking forward to Uptober, historically one of Bitcoin’s strongest months. In the past few hours, briefly pushed to $112.4K, while Ethereum reclaimed $4K, sparking some hope as we get closer to October. History isn’t on Bitcoin’s side though. In 13 years, BTC has only had four green.. The post Crypto News Today, September 29 – Bitcoin Price Briefly Surges Above $112K And Ethereum Reclaims $4K – Best Crypto To Buy Before “Uptober? appeared first on 99Bitcoins.

Bulls are tired of this September and already looking forward to Uptober, historically one of Bitcoin’s strongest months. In the past few hours, briefly pushed to $112.4K, while Ethereum reclaimed $4K, sparking some hope as we get closer to October.

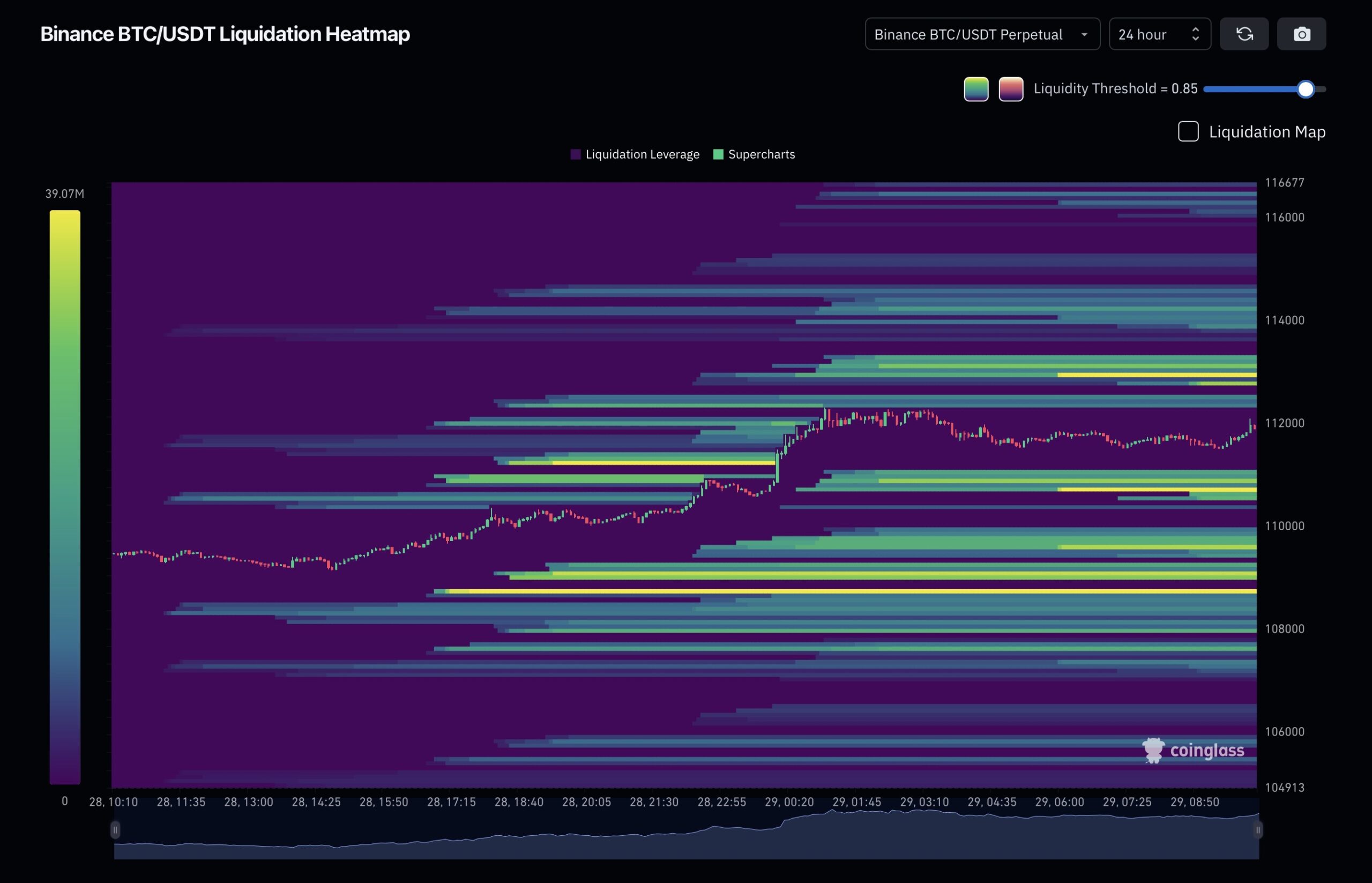

History isn’t on Bitcoin’s side though. In 13 years, BTC has only had four green Septembers, and never in a bull year. With just two days to go, Bitcoin is trading around $111,781. A clean breakout and hold above $112K could flip sentiment for bulls, but for now traders remain divided and liquidations are piling up on both sides of the book. No clear direction yet, just chop around key levels.

EXPLORE: 10+ Next Crypto to 100X In 2025

Best Crypto to Buy Now – Perps Meta Still Running Strong With ASTER and APEX

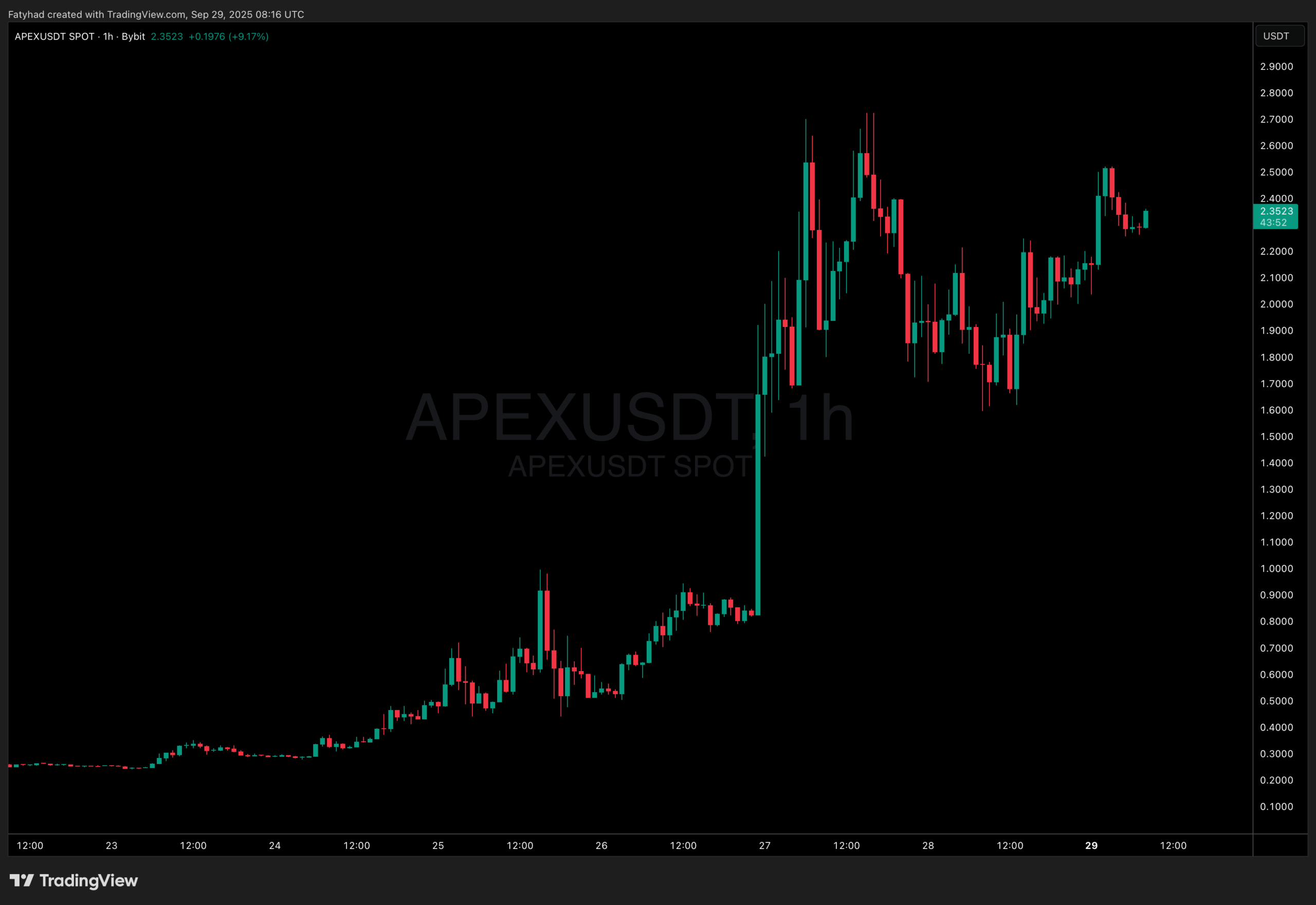

Beyond BTC and ETH, the story right now is still perp DEX tokens. After Aster’s run, attention has shifted to ApeX Protocol (APEX), which just pulled off a crazy move — more than 160% in a single day after its XP token conversion event. The campaign dropped 25M APEX to users, and trading volumes shot to $361M.

(Source: Coingecko)

ApeX is a decentralized hub for perpetuals trading with leverage, deep liquidity, and low fees, backed by products like ApeX Pro (a Layer-2 powered DEX). There’s also $12M set aside for buybacks from past revenue, and support from Bybit should boost both usage and revenue going forward.

At the moment, APEX sits at a $304M market cap, way below Aster’s $3.22B. That gap is where the rotation trade could come in. Aster is still holding strong around $1.94, but fresh money may flow into APEX as traders chase the next perp play.

If momentum carries into Uptober, with Bitcoin price reclaiming $112K, APEX could run into double digits faster than most expect, making it one of the best cryptos to buy before October kicks off.

DISCOVER: Crypto Calm as Uptober Looms: Best New Crypto to Buy in October?

Crypto ETFs saw heavy outflows on September 29. Bitcoin products recorded a net withdrawal of 4,083 BTC worth about $466 million. Fidelity led the sell-off, shedding 2,747 BTC valued at $313.6 million, though it still holds over 200,699 BTC ($22.9B).

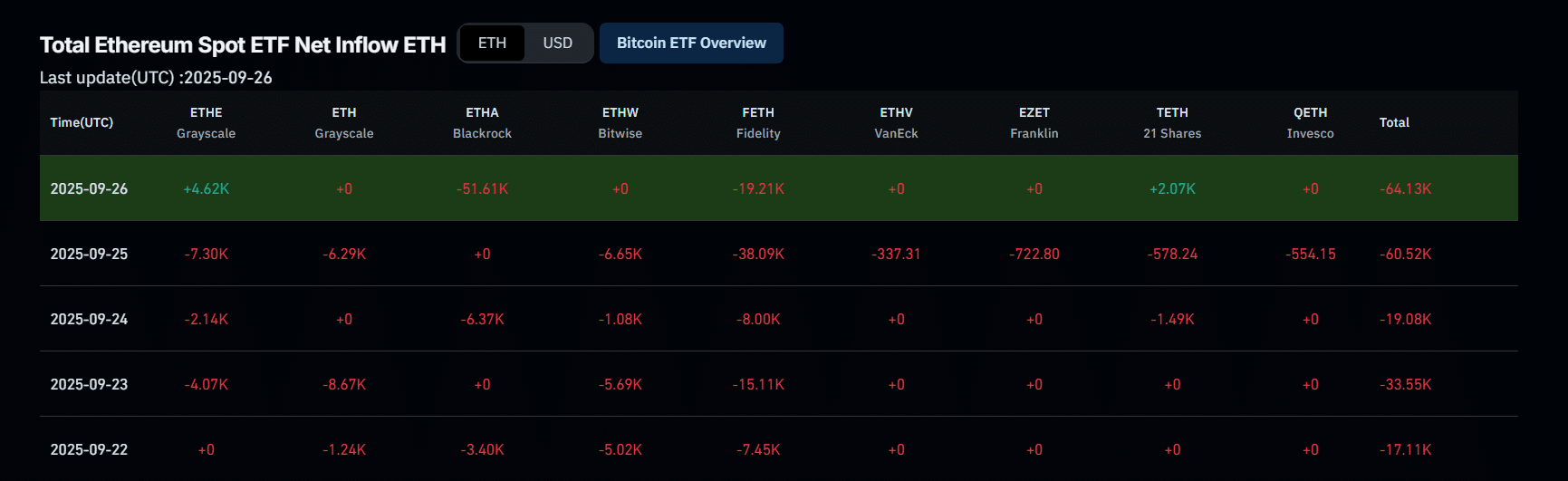

Ethereum ETFs were hit even harder, with net outflows of 81,358 ETH (around $341.7M). BlackRock topped the list, offloading 49,608 ETH worth $208.3M, leaving it with 3.77M ETH ($15.9B).

The scale of these moves highlights continued investor caution across both major crypto ETF markets.

Strategy (formerly MicroStrategy) has continued its aggressive Bitcoin accumulation, purchasing 196 BTC for $22.1 million at an average price of $113,048 per coin. The firm now holds 640,031 BTC, acquired for a total of roughly $47.35 billion at an average cost of $73,983 per Bitcoin.

Meanwhile, Bitmine (@BitMNR) has been scaling its Ethereum reserves. The company bought 234,846 ETH worth $96.5 million last week, bringing its total holdings to 2.65 million ETH, currently valued at $10.89 billion.

How does it feel that the above picture is the only reason the Ethereum price is trading above $2000?

Ethereum ETFs just suffered their worst week on record. According to Farside Investors, spot ETH funds saw $795.6M in outflows last week, narrowly beating the previous $787.7M record set earlier this month.

ETF flows mirror investor hesitation — high volumes, but cautious allocations,” one Farside analyst said.

The Fidelity Ethereum Fund (FETH) led the exodus with $362M withdrawn, while BlackRock’s ETHA lost over $200M despite managing more than $15B in assets. Grayscale’s ETHE also reported heavy withdrawals, underscoring that this wasn’t isolated selling but a broader wave of investor caution.

So, will we see a new Ethereum ATH this year or not?

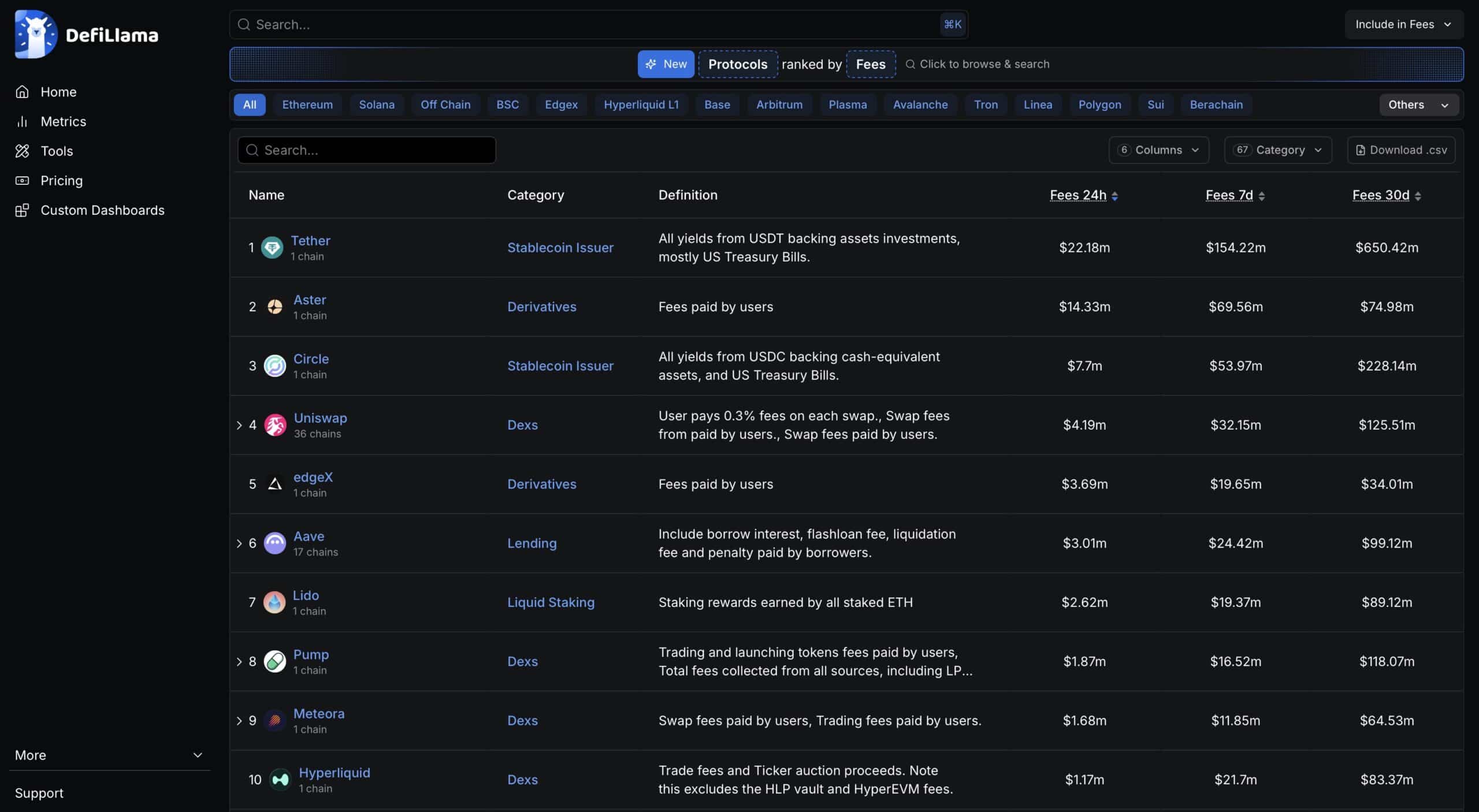

DeFiLlama shows Aster pulled in $14.33 million in fees over the past 24 hours, making it the world’s second-highest fee-generating protocol. Only Tether ($22.18 million) collected more. Aster’s performance outpaced Circle and Uniswap, highlighting how derivatives/perp activity is stealing market share from traditional venues.

Aster’s fee intake is roughly ten times that of Hyperliquid.

Sept 29 ETF Update: Bitcoin and Ethereum Outflows Deepen

Strategy Adds More Bitcoin as Bitmine Expands Ethereum Holdings

Now That Ethereum ETFs Are Dead, What’s Next For ETH Price? (Record $796M Outflows)

Aster Surges to Second Place in Global Fee Rankings, Outpacing Circle and Uniswap

The post Crypto News Today, September 29 – Bitcoin Price Briefly Surges Above $112K And Ethereum Reclaims $4K – Best Crypto To Buy Before “Uptober? appeared first on 99Bitcoins.

What's Your Reaction?