CTAS) Made Double Top, Will CTAS Retest $500?

The post CTAS) Made Double Top, Will CTAS Retest $500? appeared on BitcoinEthereumNews.com. Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets. Latest posts by Pratik Chadhokar (see all) Cintas Corporation (NASDAQ: CTAS) CTAS stock made a double top pattern near the resistance mark of $525. It is retracing toward the 20 day EMA. Moreover, the price action shows that buyers started unwinding their long positions and is losing momentum which suggests that CTAS stock may retest the round mark of $500 in the coming sessions. However, the CTAS stock is in an uptrend and is gaining steadily. Cintas stock price is above the significant moving averages and was in a strong uptrend and has given positive returns among its peer stocks. Moreover, CTAS stock persisted in driving performance showcasing the bulls’ dominance. However, profit booking is essentially due to the broad market selling among the sectors which led to a slide from the resistance mark of $525. However, the immediate support zone is near the 20 day EMA, from ca pullback is anticipated and that the stock will retain the swing highs in the coming sessions. CTAS stock per the options chain shows that, at the strike price of $510, a massive open interest of 132 hundred shares on the put side, whereas 99 hundred shares on the call side shows that long buildup and stock will resume the up move soon. At press time, CTAS stock price was $508.19. An intraday drop of 1.18% suggests neutrality. Moreover, the trading volume rose by 0.56% to 254.89K and…

The post CTAS) Made Double Top, Will CTAS Retest $500? appeared on BitcoinEthereumNews.com.

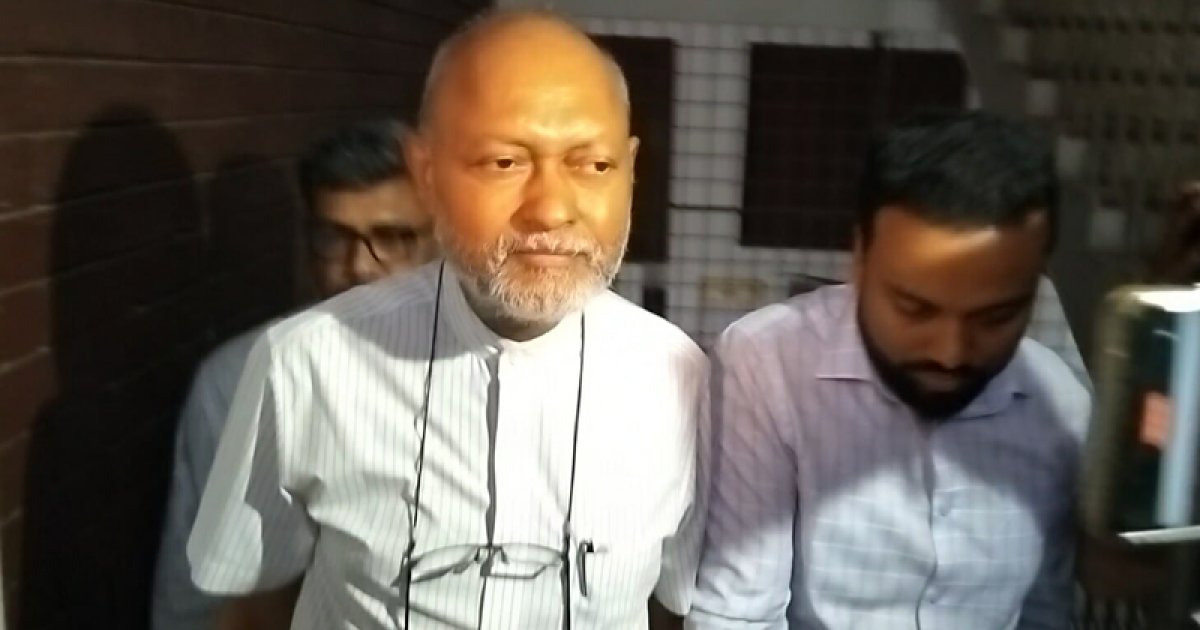

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets. Latest posts by Pratik Chadhokar (see all) Cintas Corporation (NASDAQ: CTAS) CTAS stock made a double top pattern near the resistance mark of $525. It is retracing toward the 20 day EMA. Moreover, the price action shows that buyers started unwinding their long positions and is losing momentum which suggests that CTAS stock may retest the round mark of $500 in the coming sessions. However, the CTAS stock is in an uptrend and is gaining steadily. Cintas stock price is above the significant moving averages and was in a strong uptrend and has given positive returns among its peer stocks. Moreover, CTAS stock persisted in driving performance showcasing the bulls’ dominance. However, profit booking is essentially due to the broad market selling among the sectors which led to a slide from the resistance mark of $525. However, the immediate support zone is near the 20 day EMA, from ca pullback is anticipated and that the stock will retain the swing highs in the coming sessions. CTAS stock per the options chain shows that, at the strike price of $510, a massive open interest of 132 hundred shares on the put side, whereas 99 hundred shares on the call side shows that long buildup and stock will resume the up move soon. At press time, CTAS stock price was $508.19. An intraday drop of 1.18% suggests neutrality. Moreover, the trading volume rose by 0.56% to 254.89K and…

What's Your Reaction?