Did The SEC Just Kill Liquid Staking? Market Reaction on Satoshi Street

When Ethereum decided to go green, it chose a proof-of-stake system, which allowed for liquid staking. The result has been magical. Liquid staking platforms like Lido Finance and Rocket Pool now command billions in total value locked (TVL). But new moves by the SEC are spooking everything. Lido Finance is among the largest DeFi protocols,.. The post Did The SEC Just Kill Liquid Staking? Market Reaction on Satoshi Street appeared first on 99Bitcoins.

When Ethereum decided to go green, it chose a proof-of-stake system, which allowed for liquid staking. The result has been magical. Liquid staking platforms like Lido Finance and Rocket Pool now command billions in total value locked (TVL). But new moves by the SEC are spooking everything.

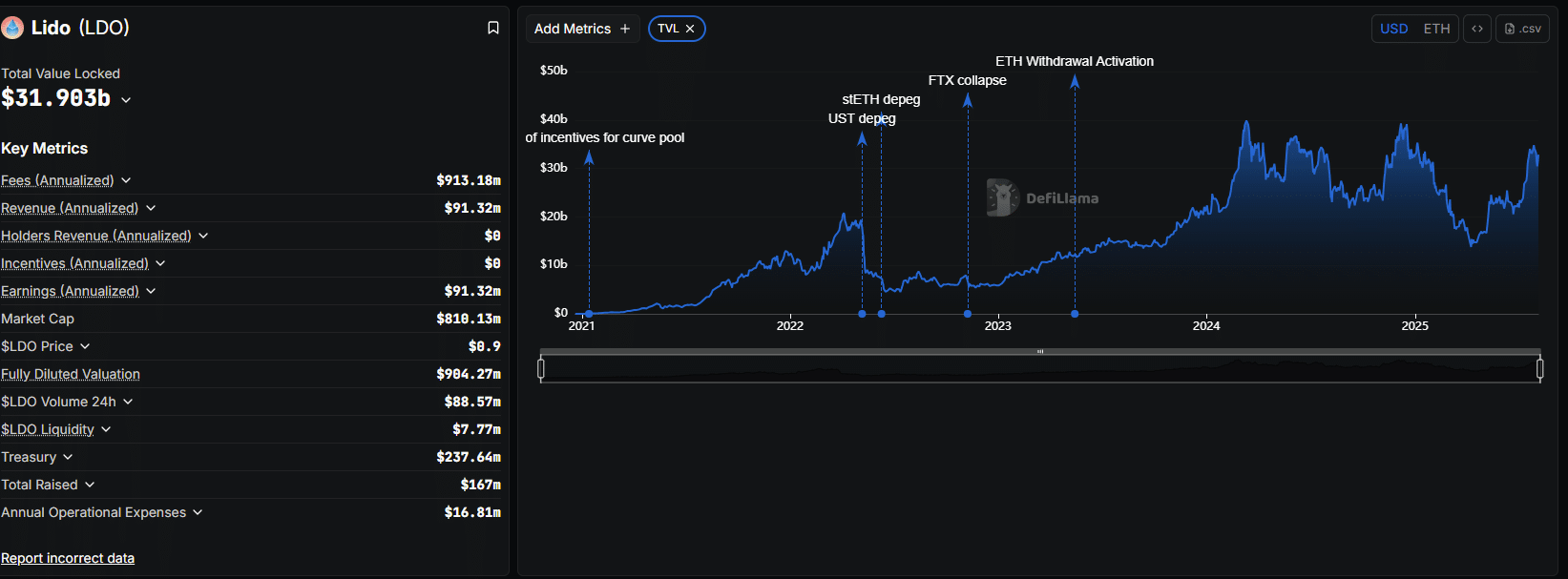

Lido Finance is among the largest DeFi protocols, per DefiLlama. As of August 6, managed over $31 billion worth of assets and is the second-largest DeFi protocol, only after the high-flying Aave, which has a TVL of over $34 billion.

SEC’s Guidance on Liquid Staking

Liquid staking platforms are just beginning to gain traction, and more assets are expected to flow to them as platforms choose to move away from energy-intensive mining to greener and more energy-efficient systems.

Aware that this industry will only grow, yesterday, on August 5, the United States Securities and Exchange Commission (SEC) issued a staff statement clarifying that, in their assessment, certain liquid staking activities and associated tokens do not constitute securities offerings under the Securities Act of 1933 and the Securities Exchange Act of 1934.

Notably, the regulator defined liquid staking as a process of staking digital assets via a protocol in return for a “liquid staking receipt token (LST).” Some of these tokens include staked Ether (stETH) offered by Lido Finance or JITOSOL by Jito on Solana. These LSTs are proof of ownership, and all accrue staking rewards, making them among the best cryptos to buy.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

DeFi Tokens To Explode?

According to the SEC, depending on the facts and circumstances, protocols issuing these tokens are not offering and selling securities since they don’t bear any characteristics of an investment contract under the Howey Test.

Paul Atkins, the chair of the SEC, said the guidance is a “significant step forward in clarifying the staff’s view about crypto asset activities that do not fall within the SEC’s jurisdiction.”

Atkins added that the agency is further committed to providing clear guidance on “the application of the federal securities laws to emerging technologies and financial activities.”

Far from killing liquid staking, this guidance is seen as a massive step toward providing regulatory clarity in DeFi and for Liquid staking platforms like Rocket Pool, Jito on Solana, and many other similar protocols.

The regulator now permits issuers and persons involved in the secondary market offering and selling LSTs to engage freely. They won’t have to register those transactions with the Commission.

“Liquid Staking Providers involved in the process of minting, issuing and redeeming Staking Receipt Tokens, as well as persons involved in secondary market offers and sales of Staking Receipt Tokens, do not need to register those transactions with the Commission under the Securities Act.”

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Market Reaction on Satoshi Street

The guidance is a game-changer for liquid staking platforms on Ethereum and Solana, including Lido Finance and Jito.

Specifically, it will reduce and even eliminate the risk of enforcement actions from the agency. This is a specter that haunted DeFi during Gary Gensler’s regime. There is also a high possibility that institutions will now be eager to take part. Their move will unlock billions and boost quality tokens, including top Solana meme coins.

On X, Sei Network said this guidance will lead to better products and stronger networks.

Meanwhile, Nate Geraci, an ETF commentator, said this statement is the last hurdle for the agency to approve staking in spot Ethereum ETFs eventually.

SEC says certain liquid staking tokens are NOT securities…

Think last hurdle in order for SEC to approve staking in spot eth ETFs.

The reason?

Liquid staking tokens will be used to help manage liquidity w/in spot eth ETFs, something that was a concern for SEC. pic.twitter.com/tKJbEoQVNp

— Nate Geraci (@NateGeraci) August 5, 2025

Once approved, Geraci said LSTs will help manage liquidity within spot Ethereum ETFs, a previous concern for the agency.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

SEC Guidance on Liquid Staking Platform: Game Changer?

- Ethereum, Solana, and proof-of-stake tokens are reliant on liquid staking platforms

- SEC provides guidance on liquid staking

- Will this boost DeFi?

- Time for the regulator to approve staking for spot Ethereum ETF issuers?

The post Did The SEC Just Kill Liquid Staking? Market Reaction on Satoshi Street appeared first on 99Bitcoins.

What's Your Reaction?