EigenLayer Dominates Trends Despite DeFi Sell-Off: What’s Going On?

EIGEN is trending, and bulls are confident despite the sell-off. As the EigenLayer TVL expands, adding 41% in one month, will EIGENUSDT break $5 in the coming months? The total crypto market cap is down nearly 5% to $3.44 trillion. Although Bitcoin remains the most dominant, controlling over 60% of the market share, it has.. The post EigenLayer Dominates Trends Despite DeFi Sell-Off: What’s Going On? appeared first on 99Bitcoins.

EIGEN is trending, and bulls are confident despite the sell-off. As the EigenLayer TVL expands, adding 41% in one month, will EIGENUSDT break $5 in the coming months?

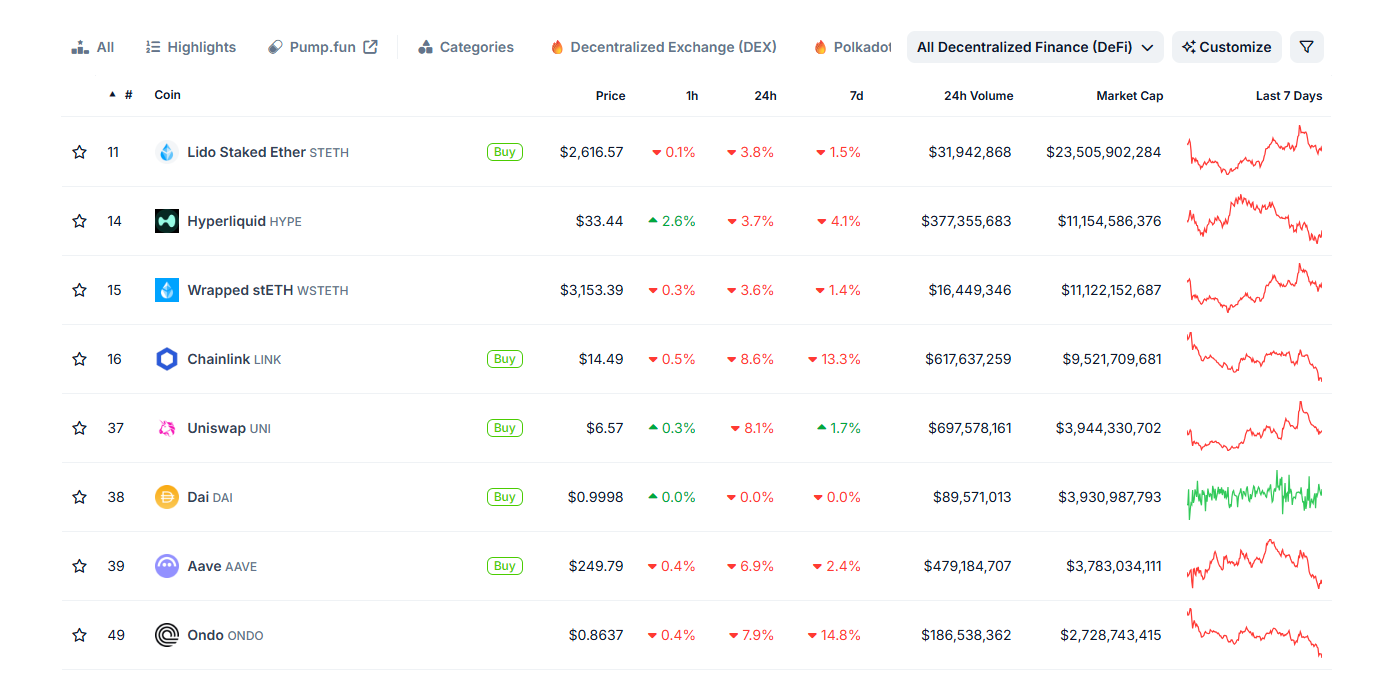

The total crypto market cap is down nearly 5% to $3.44 trillion. Although Bitcoin remains the most dominant, controlling over 60% of the market share, it has trended lower, trading below $106,000 at spot rates.

This drop means the most valuable coin is down 5% in the past week but still outperforms XRP and Dogecoin (DOGE), down 10% and 16%, respectively.

Despite this firmness and potential weakness that could trickle down the market, EigenLayer, the liquidity restaking platform, is among the best cryptos to consider buying, after dominating trends in the past 24 hours.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

EIGEN Jumps 15% Before Dropping

Data from Coingecko reveals that EIGEN, the native token, surged 15%, breaking above a key liquidation level before dropping.

By breaking higher, EIGEN not only stretched gains against Ethereum and Bitcoin but also cemented its role in DeFi.

However, this spike was short-lived as prices tanked after bears stepped up earlier today. Most DeFi tokens also sold off.

(Source)

As of May 30, EigenLayer manages over $11.15 billion in assets, predominantly on Ethereum, and is the third-largest DeFi protocol, trailing only Aave and Lido.

In the last month alone, its TVL grew by over 41%, according to DeFiLlama data.

(Source)

EigenLayer Trending: What’s Going On?

While this is impressive, EigenLayer is trending and helping improve sentiment and interest in some of the best new cryptocurrencies to invest in 2025.

Yesterday, the founder of EigenLayer, Sreeram Kannan, confirmed changes in how slashing penalties will be handled.

This announcement will likely unlock a new class of financial applications, which may further propel EIGEN to Q4 2024 highs.

Slashing officially went live on EigenLayer on April 17, and immediately after, Infura and LayerZero integrated slashing for their Actively Validated Services (AVSs).

The release of the slashing feature officially made EigenLayer “complete,” allowing the protocol to automatically enforce accountability for operators and stakers.

Validators and key EigenLayer operators who fail to perform as required, for example, by not maintaining high node reliability, are penalized for poor performance.

Moreover, validators and operators engaged in malicious behavior are subject to slashing.

While attractive, slashing includes an opt-in feature, meaning stakers and other key players must choose to participate in slashable conditions.

A “unique stake allocation” feature was also introduced to isolate slashing risks to specific AVSs, reducing overall systemic risks.

DISCOVER: 20+ Next Crypto to Explode in 2025

A New Era of Supercharged Growth? Will EIGENUSDT Retest $5?

Following the May 28 announcement, EigenLayer plans to distribute slashed funds to AVSs complaints on top of the protocol rather than burn them.

Burning, as seen in Ethereum and BNB Chain, could reduce inflation. In EigenLayer’s case, the distribution could fuel growth, boosting demand for EIGEN.

It remains to be seen how quickly developers and AVSs will build new financial dApps on the platform. However, when they do, they will be secured by ETH locked on the mainnet.

For now, EIGEN is trading above $1.5. Any surge confirming the breakout on May 29 could trigger a lift to $2 and later $5 in a buy trend continuation formation.

Partnerships with Lombard Capital, bringing Bitcoin restaking to EigenLayer, and new products leveraging the restaking liquidity layer will likely fuel growth.

DISCOVER: 7 High-Risk High-Reward Cryptos for 2025

EigenLayer EIGEN Trending After Key Slashing Announcement

- EIGEN trending, holds firm above $1.5

- EigenLayer cements its place as a top DeFi protocol with over $11.15 billion in TVL

- DeFi protocol to begin distributing slashing funds

- Will EIGENUSDT soar to $5 and retest 2024 highs?

The post EigenLayer Dominates Trends Despite DeFi Sell-Off: What’s Going On? appeared first on 99Bitcoins.

What's Your Reaction?