Ethereum Bears Dominate Market Orders: -$418.8M Daily Net Taker Volume Signals Trouble

The post Ethereum Bears Dominate Market Orders: -$418.8M Daily Net Taker Volume Signals Trouble appeared on BitcoinEthereumNews.com. Ethereum is trading below the $3,700 level after days of heightened volatility and mounting uncertainty. The recent price action reflects a clear struggle by bulls to defend key demand zones, as bearish momentum continues to dominate short-term trends. Despite multiple rebound attempts, Ethereum has been unable to reclaim crucial resistance levels, raising concerns of a potential deeper correction in the near term. However, strong fundamentals such as increasing institutional adoption, network growth, and broader market developments continue to support the bullish thesis for Ethereum over the coming months. These structural tailwinds suggest that the current weakness may be part of a healthy consolidation phase before the next major upward move. Top analyst Maartunn shared key insights revealing that the Ethereum Net Taker Volume (Daily) has turned sharply negative, signaling a growing dominance of sell-side pressure. This metric quantifies the difference between market buy and sell orders, providing a clear view of the current sentiment among active traders. Ethereum Net Taker Volume Signals Bearish Dominance Top analyst Maartunn shared critical insights regarding Ethereum’s current market dynamics, emphasizing that Net Taker Volume for ETH sits at -$418.8 million (Daily). This figure indicates that taker sellers have offloaded approximately 115,400 more ETH than buyers were willing to absorb through market orders. Net Taker Volume measures the difference between buying and selling volumes executed at market prices, offering a direct view of the aggressiveness of traders prioritizing immediate execution over optimal pricing. Such a significant negative Net Taker Volume reflects that market participants with a bearish outlook are dominating order books, pushing sell orders aggressively into the market. This behavior signals that sellers are not waiting for better prices, highlighting a serious short-term bearish pressure that can weigh on Ethereum’s price in the immediate term. However, this bearish signal comes after weeks of intense…

The post Ethereum Bears Dominate Market Orders: -$418.8M Daily Net Taker Volume Signals Trouble appeared on BitcoinEthereumNews.com.

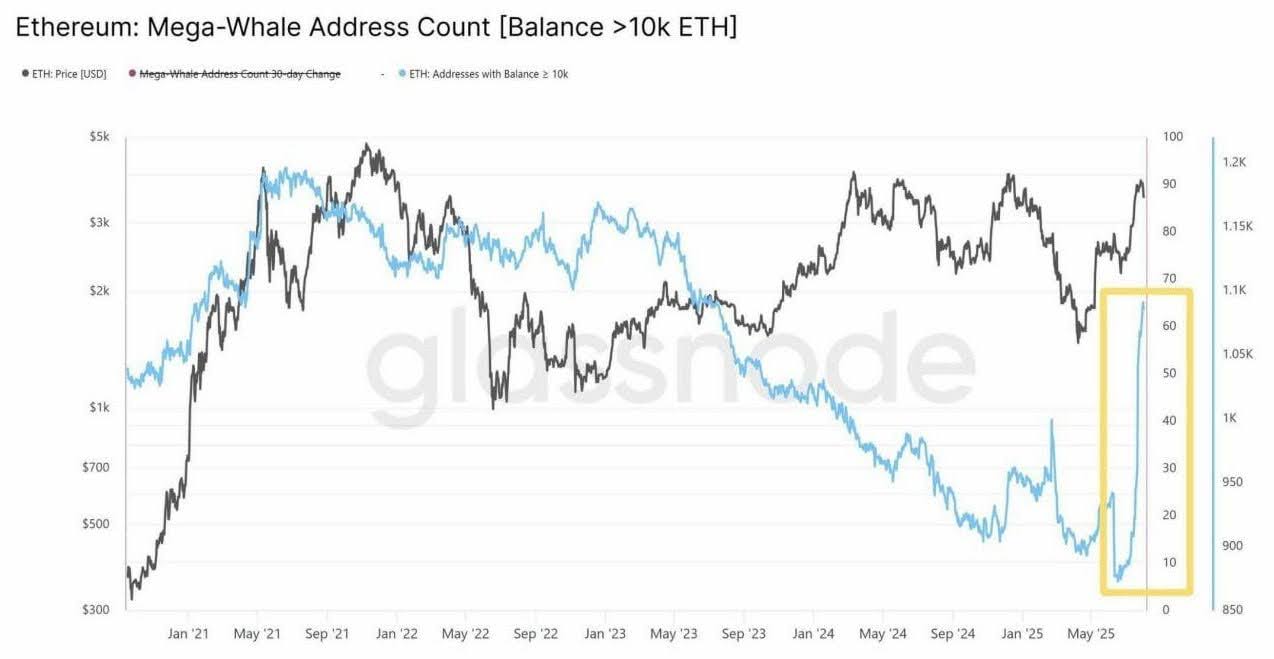

Ethereum is trading below the $3,700 level after days of heightened volatility and mounting uncertainty. The recent price action reflects a clear struggle by bulls to defend key demand zones, as bearish momentum continues to dominate short-term trends. Despite multiple rebound attempts, Ethereum has been unable to reclaim crucial resistance levels, raising concerns of a potential deeper correction in the near term. However, strong fundamentals such as increasing institutional adoption, network growth, and broader market developments continue to support the bullish thesis for Ethereum over the coming months. These structural tailwinds suggest that the current weakness may be part of a healthy consolidation phase before the next major upward move. Top analyst Maartunn shared key insights revealing that the Ethereum Net Taker Volume (Daily) has turned sharply negative, signaling a growing dominance of sell-side pressure. This metric quantifies the difference between market buy and sell orders, providing a clear view of the current sentiment among active traders. Ethereum Net Taker Volume Signals Bearish Dominance Top analyst Maartunn shared critical insights regarding Ethereum’s current market dynamics, emphasizing that Net Taker Volume for ETH sits at -$418.8 million (Daily). This figure indicates that taker sellers have offloaded approximately 115,400 more ETH than buyers were willing to absorb through market orders. Net Taker Volume measures the difference between buying and selling volumes executed at market prices, offering a direct view of the aggressiveness of traders prioritizing immediate execution over optimal pricing. Such a significant negative Net Taker Volume reflects that market participants with a bearish outlook are dominating order books, pushing sell orders aggressively into the market. This behavior signals that sellers are not waiting for better prices, highlighting a serious short-term bearish pressure that can weigh on Ethereum’s price in the immediate term. However, this bearish signal comes after weeks of intense…

What's Your Reaction?