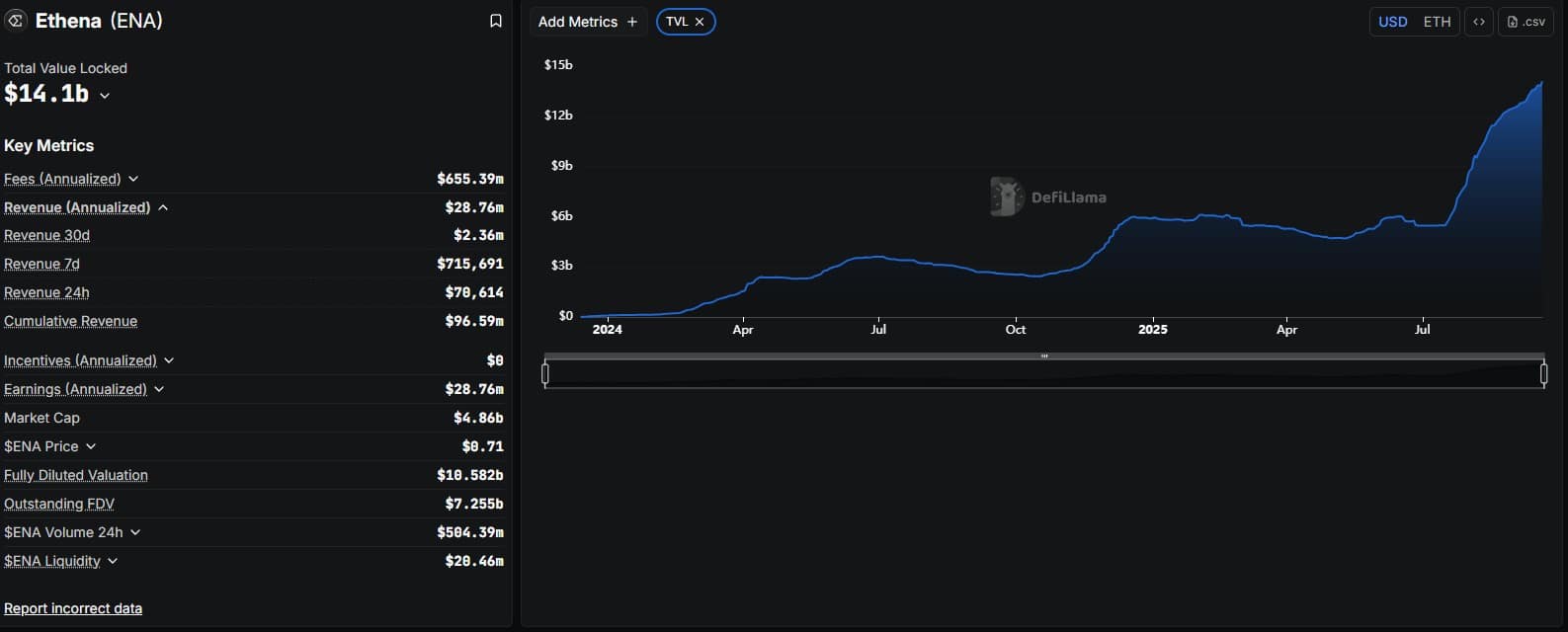

Federal Reserve’s Shift May Encourage Bank Participation in Crypto Services and Digital Asset Markets

The post Federal Reserve’s Shift May Encourage Bank Participation in Crypto Services and Digital Asset Markets appeared on BitcoinEthereumNews.com. The Federal Reserve has reintegrated crypto supervision into traditional banking regulations as of August 15, 2025, reducing institutional burdens and encouraging banks to offer crypto services more freely. Crypto oversight is now part of standard banking regulations. Institutions can now offer services like stablecoins without pre-approval. Analysts anticipate increased capital inflows due to relaxed regulations. The Federal Reserve has integrated crypto oversight into traditional banking regulations to ease institutional burdens and improve access to crypto services. What is the recent Federal Reserve regulation change regarding crypto? The Federal Reserve has ended its special crypto bank oversight program as of August 15, 2025. This regulatory change fully incorporates crypto supervision into existing banking regulations, allowing banks to offer various crypto services, akin to traditional banking products. How does this impact crypto banking operations? This shift allows banks to evaluate risks independently while handling crypto-assets and removes previous pre-approval requirements for crypto activities. It is expected to foster greater participation in the digital asset market and innovation within the industry. ‘, ‘

The post Federal Reserve’s Shift May Encourage Bank Participation in Crypto Services and Digital Asset Markets appeared on BitcoinEthereumNews.com.

The Federal Reserve has reintegrated crypto supervision into traditional banking regulations as of August 15, 2025, reducing institutional burdens and encouraging banks to offer crypto services more freely. Crypto oversight is now part of standard banking regulations. Institutions can now offer services like stablecoins without pre-approval. Analysts anticipate increased capital inflows due to relaxed regulations. The Federal Reserve has integrated crypto oversight into traditional banking regulations to ease institutional burdens and improve access to crypto services. What is the recent Federal Reserve regulation change regarding crypto? The Federal Reserve has ended its special crypto bank oversight program as of August 15, 2025. This regulatory change fully incorporates crypto supervision into existing banking regulations, allowing banks to offer various crypto services, akin to traditional banking products. How does this impact crypto banking operations? This shift allows banks to evaluate risks independently while handling crypto-assets and removes previous pre-approval requirements for crypto activities. It is expected to foster greater participation in the digital asset market and innovation within the industry. ‘, ‘

What's Your Reaction?