Forget Memecoins: This Crypto Playbook Built a Fortune

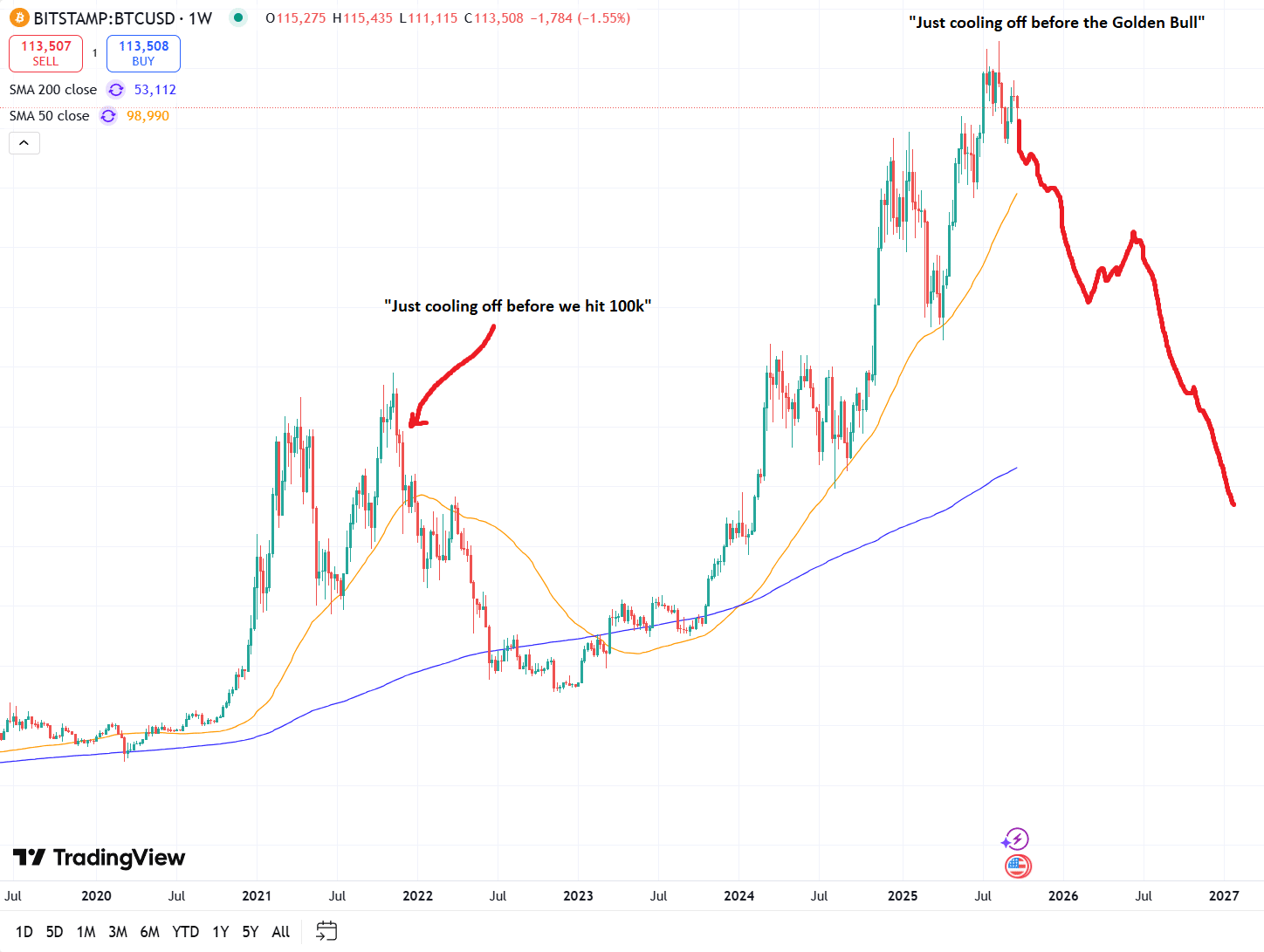

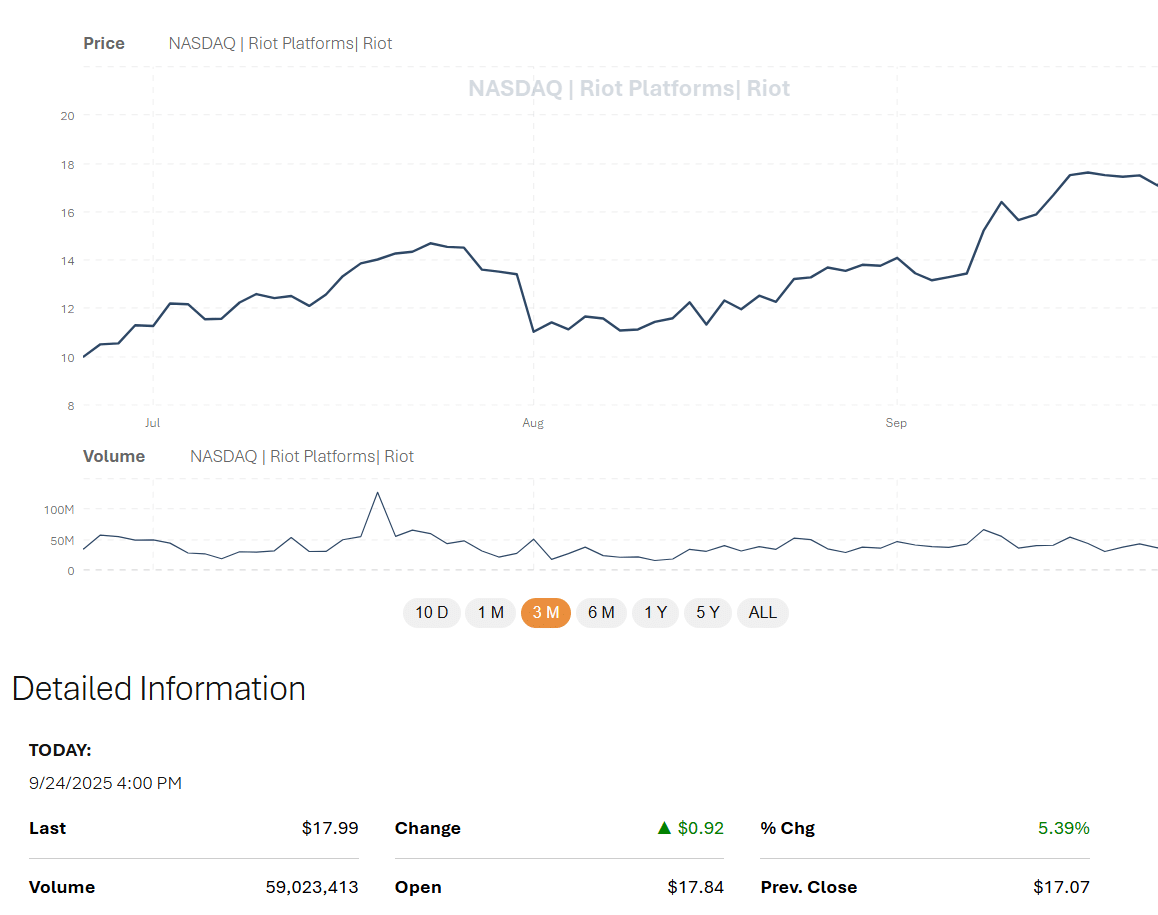

The post Forget Memecoins: This Crypto Playbook Built a Fortune appeared on BitcoinEthereumNews.com. He never bought a memecoin Not because he missed the trend. But because he was focused on something else entirely, vision. Seventeen years ago, Karnika E. Yashwant, known as Mr. KEY to those in the world of Web3, dropped out of school at age 14. Today, he’s an ultra-high-net-worth entrepreneur, founder of multiple Web3 ventures, and a strategic advisor to projects across the blockchain industry. He runs companies with over 150 people and operates from Dubai, a city he calls the future capital of digital freedom. Unlike many who chase cycles, Mr. KEY’s strategy was never about catching the next moonshot. It was about conviction. And it started with one principle: understanding what you’re actually buying. “When I invest,” he says, “I don’t care what the price is tomorrow. I care what the value will be ten years from now.” Vision over volatility During a recent conversation, Mr. KEY broke down how he thinks about the market—and why most people get it wrong. His approach is deceptively simple: block out the noise, focus on fundamentals, and invest like an institution would, not like a headline-chaser. He bought Ethereum when it was $100, again at $3,500. Still holds it today. He’s seen it dip below $1,000 and didn’t blink. Why? “I believe Ethereum is undervalued—always has been. Bitcoin, in my view, is a million-dollar asset. It just hasn’t been priced like one yet.” His strategy isn’t dictated by market conditions. It’s rooted in frameworks. When retail investors obsess over whether Bitcoin will hit $75,000 or fall back to $45,000, Mr. KEY is already thinking five steps ahead. “You make money when you buy, not when you sell,” he says, echoing Kiyosaki. “If you bought something because you understood its future value, you’ve already made the return. The price just…

The post Forget Memecoins: This Crypto Playbook Built a Fortune appeared on BitcoinEthereumNews.com.

He never bought a memecoin Not because he missed the trend. But because he was focused on something else entirely, vision. Seventeen years ago, Karnika E. Yashwant, known as Mr. KEY to those in the world of Web3, dropped out of school at age 14. Today, he’s an ultra-high-net-worth entrepreneur, founder of multiple Web3 ventures, and a strategic advisor to projects across the blockchain industry. He runs companies with over 150 people and operates from Dubai, a city he calls the future capital of digital freedom. Unlike many who chase cycles, Mr. KEY’s strategy was never about catching the next moonshot. It was about conviction. And it started with one principle: understanding what you’re actually buying. “When I invest,” he says, “I don’t care what the price is tomorrow. I care what the value will be ten years from now.” Vision over volatility During a recent conversation, Mr. KEY broke down how he thinks about the market—and why most people get it wrong. His approach is deceptively simple: block out the noise, focus on fundamentals, and invest like an institution would, not like a headline-chaser. He bought Ethereum when it was $100, again at $3,500. Still holds it today. He’s seen it dip below $1,000 and didn’t blink. Why? “I believe Ethereum is undervalued—always has been. Bitcoin, in my view, is a million-dollar asset. It just hasn’t been priced like one yet.” His strategy isn’t dictated by market conditions. It’s rooted in frameworks. When retail investors obsess over whether Bitcoin will hit $75,000 or fall back to $45,000, Mr. KEY is already thinking five steps ahead. “You make money when you buy, not when you sell,” he says, echoing Kiyosaki. “If you bought something because you understood its future value, you’ve already made the return. The price just…

What's Your Reaction?