Fundamental Global Files $5 Billion Plan to Become Largest Corporate Ethereum Holder

The post Fundamental Global Files $5 Billion Plan to Become Largest Corporate Ethereum Holder appeared on BitcoinEthereumNews.com. A publicly traded company has filed paperwork with the SEC to raise up to $5 billion, mostly to buy Ethereum. Fundamental Global Inc. (Nasdaq: FGF) wants to own 10% of all Ethereum tokens in circulation. The Charlotte-based company announced the shelf registration on August 8, 2025. This filing gives them permission to sell stock and raise money over time when market conditions are good. Company Transformation and New Leadership Fundamental Global is changing its name to FG Nexus Inc. The company brought in heavy hitters from Wall Street to lead this new direction. Joe Moglia, who used to run TD Ameritrade, joined as an advisor. Maja Vujinovic, who helped bring blockchain technology to General Electric years ago, now leads their digital asset business. “This marks a pivotal moment in our evolution,” said Kyle Cerminara, the company’s CEO. “FG Nexus will leverage our deep capabilities in merchant banking, reinsurance, and capital markets to unlock the full potential of Ethereum as a reserve asset.” The company already raised $200 million in August from big crypto investors like Galaxy Digital, Kraken, and Digital Currency Group. Ambitious 10% Network Target The company wants to own 10% of all Ethereum tokens. This would make them the biggest corporate holder of Ethereum by far. Right now, other companies like SharpLink Gaming own about $2.2 billion worth of Ethereum. BitMine holds around $3.5 billion. If Fundamental Global spends their full $5 billion on Ethereum, they would dwarf these holdings. Source: @FGNexusio “We believe this framework will enable us to capitalize on ETH accumulation opportunities and support our target of a 10% stake in the Ethereum Network,” Cerminara explained. The total value of all Ethereum tokens is around $473 billion. Owning 10% would mean controlling roughly $47 billion worth of the cryptocurrency. Following the Corporate Crypto Trend Fundamental…

The post Fundamental Global Files $5 Billion Plan to Become Largest Corporate Ethereum Holder appeared on BitcoinEthereumNews.com.

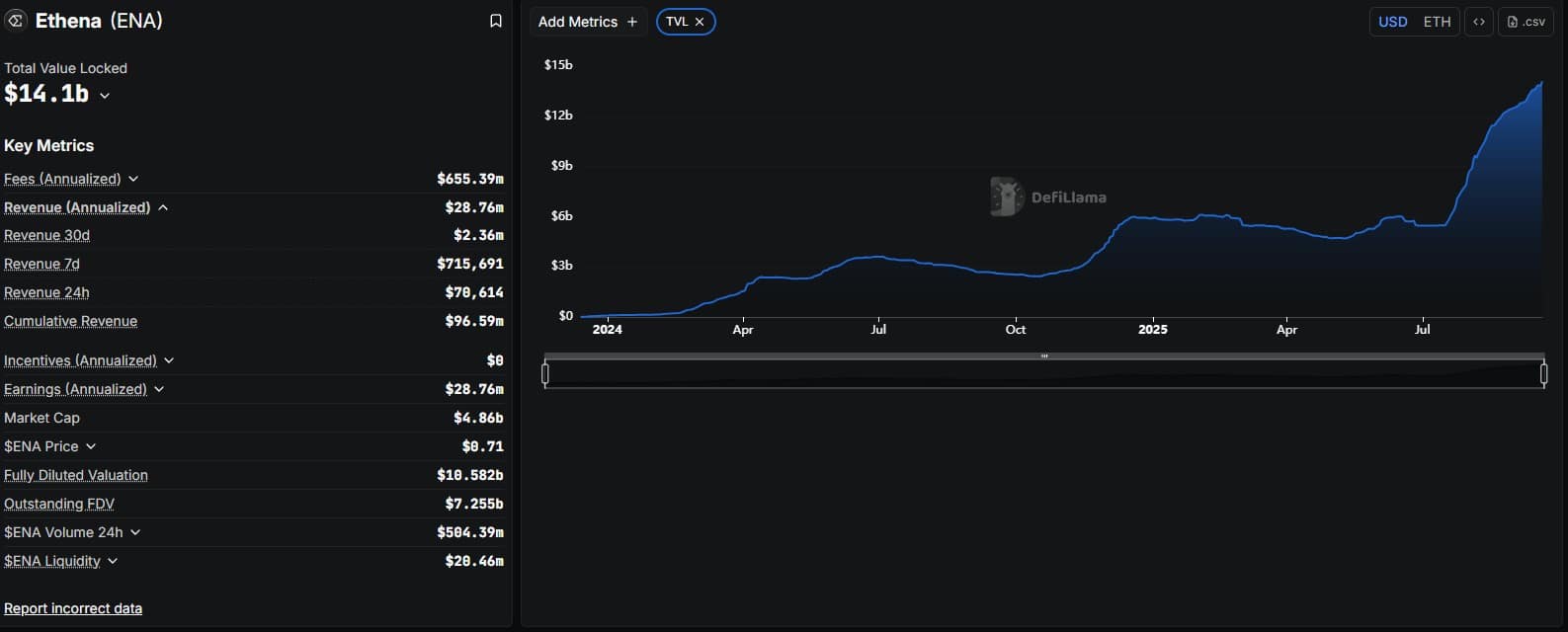

A publicly traded company has filed paperwork with the SEC to raise up to $5 billion, mostly to buy Ethereum. Fundamental Global Inc. (Nasdaq: FGF) wants to own 10% of all Ethereum tokens in circulation. The Charlotte-based company announced the shelf registration on August 8, 2025. This filing gives them permission to sell stock and raise money over time when market conditions are good. Company Transformation and New Leadership Fundamental Global is changing its name to FG Nexus Inc. The company brought in heavy hitters from Wall Street to lead this new direction. Joe Moglia, who used to run TD Ameritrade, joined as an advisor. Maja Vujinovic, who helped bring blockchain technology to General Electric years ago, now leads their digital asset business. “This marks a pivotal moment in our evolution,” said Kyle Cerminara, the company’s CEO. “FG Nexus will leverage our deep capabilities in merchant banking, reinsurance, and capital markets to unlock the full potential of Ethereum as a reserve asset.” The company already raised $200 million in August from big crypto investors like Galaxy Digital, Kraken, and Digital Currency Group. Ambitious 10% Network Target The company wants to own 10% of all Ethereum tokens. This would make them the biggest corporate holder of Ethereum by far. Right now, other companies like SharpLink Gaming own about $2.2 billion worth of Ethereum. BitMine holds around $3.5 billion. If Fundamental Global spends their full $5 billion on Ethereum, they would dwarf these holdings. Source: @FGNexusio “We believe this framework will enable us to capitalize on ETH accumulation opportunities and support our target of a 10% stake in the Ethereum Network,” Cerminara explained. The total value of all Ethereum tokens is around $473 billion. Owning 10% would mean controlling roughly $47 billion worth of the cryptocurrency. Following the Corporate Crypto Trend Fundamental…

What's Your Reaction?