Institutional Influence Grows in Crypto Landscape as Bitcoin Faces New Regulatory Dynamics

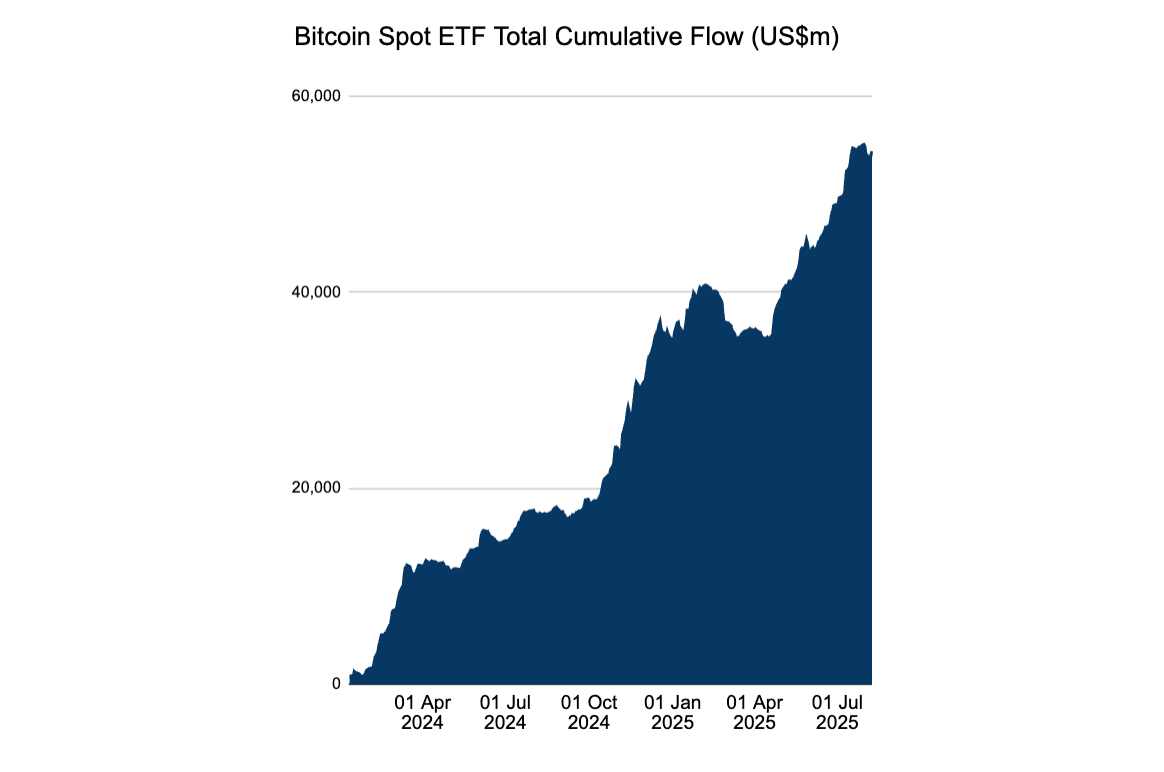

The post Institutional Influence Grows in Crypto Landscape as Bitcoin Faces New Regulatory Dynamics appeared on BitcoinEthereumNews.com. Institution Action Impact Big Banks Launch stablecoins Increased market participation What is Driving the Institutionalization of Crypto? The increasing presence of institutional investors in the crypto market is reshaping its landscape. According to Arthur Azizov, founder of B2 Ventures, this market cycle is dominated by investment vehicles like ETFs, governments, and stablecoin issuers. How Are Governments Influencing Crypto Regulation? Governments are motivated to regulate crypto to attract technology companies and fintech startups. Azizov notes that this trend is evident in the Asia-Pacific region and Europe, where AML and KYC regulations are already in place. Frequently Asked Questions What are the main trends in crypto regulation? Governments are focusing on AML and KYC regulations to integrate crypto into the traditional financial system, which contrasts with the decentralized ethos of crypto. Why are banks interested in launching stablecoins? Banks have a loyal customer base and can easily implement crypto solutions once they receive regulatory clarity, which is expected soon. Key Takeaways Institutional Influence: Institutional investors are reshaping crypto narratives. Regulatory Focus: Governments are pushing for stricter regulations. Future Outlook: Expect banks to launch stablecoins soon. Conclusion In summary, the crypto landscape is being transformed by institutional investors and regulatory pressures. As banks and governments push for integration, the future of crypto may diverge significantly from its decentralized roots. The cypherpunk ethos is retreating from the limelight, as institutions and centralized players take center stage, driving new narratives. Traditional financial institutions are increasingly shaping the narratives in the crypto sector, and are poised to benefit the most from the current trends, according to Arthur Azizov, founder of B2 Ventures, a private “alliance” of crypto services and financial tech companies. Azizov told Cointelegraph that this market cycle has been dominated by institutional investors, investment vehicles like exchange-traded funds (ETFs), governments, and stablecoin issuers. The…

The post Institutional Influence Grows in Crypto Landscape as Bitcoin Faces New Regulatory Dynamics appeared on BitcoinEthereumNews.com.

Institution Action Impact Big Banks Launch stablecoins Increased market participation What is Driving the Institutionalization of Crypto? The increasing presence of institutional investors in the crypto market is reshaping its landscape. According to Arthur Azizov, founder of B2 Ventures, this market cycle is dominated by investment vehicles like ETFs, governments, and stablecoin issuers. How Are Governments Influencing Crypto Regulation? Governments are motivated to regulate crypto to attract technology companies and fintech startups. Azizov notes that this trend is evident in the Asia-Pacific region and Europe, where AML and KYC regulations are already in place. Frequently Asked Questions What are the main trends in crypto regulation? Governments are focusing on AML and KYC regulations to integrate crypto into the traditional financial system, which contrasts with the decentralized ethos of crypto. Why are banks interested in launching stablecoins? Banks have a loyal customer base and can easily implement crypto solutions once they receive regulatory clarity, which is expected soon. Key Takeaways Institutional Influence: Institutional investors are reshaping crypto narratives. Regulatory Focus: Governments are pushing for stricter regulations. Future Outlook: Expect banks to launch stablecoins soon. Conclusion In summary, the crypto landscape is being transformed by institutional investors and regulatory pressures. As banks and governments push for integration, the future of crypto may diverge significantly from its decentralized roots. The cypherpunk ethos is retreating from the limelight, as institutions and centralized players take center stage, driving new narratives. Traditional financial institutions are increasingly shaping the narratives in the crypto sector, and are poised to benefit the most from the current trends, according to Arthur Azizov, founder of B2 Ventures, a private “alliance” of crypto services and financial tech companies. Azizov told Cointelegraph that this market cycle has been dominated by institutional investors, investment vehicles like exchange-traded funds (ETFs), governments, and stablecoin issuers. The…

What's Your Reaction?