Jim Chanos takes opposing bets on Bitcoin and Strategy

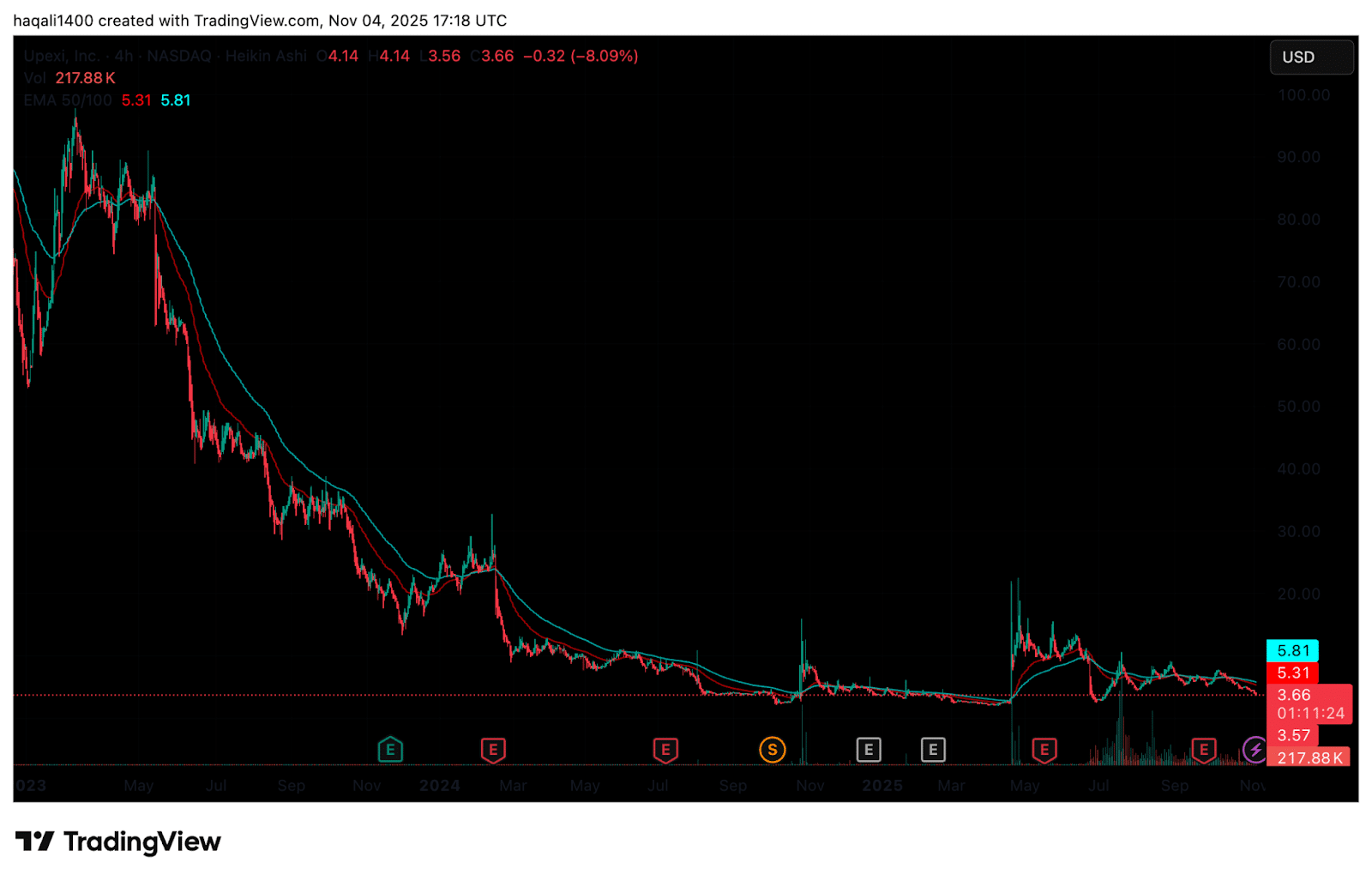

The post Jim Chanos takes opposing bets on Bitcoin and Strategy appeared on BitcoinEthereumNews.com. Prominent short-seller Jim Chanos, once a vocal critic of Bitcoin and cryptocurrencies, revealed a new trading play that involves shorting shares of Strategy (formerly MicroStrategy) and buying Bitcoin. At the Sohn Investment Conference in New York, Chanos told CNBC he’s “selling MicroStrategy stock and buying Bitcoin.” The investor described the move as buying something for $1 and selling something for $2.50, referring to what he sees as a significant price mismatch. Chanos argued that Strategy is selling the idea of buying Bitcoin (BTC) in a corporate structure, and that other companies are following suit in hopes of receiving a similar market premium. Chanos said this was “ridiculous.” He described his trade as “a good barometer of not only just the arbitrage itself, but I think of retail speculation.” Selling Strategy stock to buy Bitcoin Chanos’ recent move assumes investors overpay for Bitcoin exposure through corporate wrappers like Strategy and other firms that follow its Bitcoin accumulation blueprint. The investor’s move reflects a stance that purchasing Bitcoin directly would be better than purchasing Strategy’s stocks for indirect Bitcoin exposure. Chanos’ move suggests that holding Bitcoin through companies reflects excessive speculation and risk mispricing. It assumes that retail investors’ idea of having Bitcoin indirectly through corporate wrappers can inflate the company’s stock valuations. While shorting Strategy may seem like a good idea, investors have already lost billions shorting Saylor’s company. In 2024, investors who bet against the firm lost about $3.3 billion as the stock rose. As of May 2025, Strategy holds about 568,840 Bitcoin, valued at around $59 billion. Since the company started accumulating Bitcoin in 2020, its stock price has surged by 1,500%, outperforming the S&P 500’s gains during the same period. In a recently released documentary from the Financial Times, Strategy analyst Jeff Walton said that the company’s Bitcoin…

The post Jim Chanos takes opposing bets on Bitcoin and Strategy appeared on BitcoinEthereumNews.com.

Prominent short-seller Jim Chanos, once a vocal critic of Bitcoin and cryptocurrencies, revealed a new trading play that involves shorting shares of Strategy (formerly MicroStrategy) and buying Bitcoin. At the Sohn Investment Conference in New York, Chanos told CNBC he’s “selling MicroStrategy stock and buying Bitcoin.” The investor described the move as buying something for $1 and selling something for $2.50, referring to what he sees as a significant price mismatch. Chanos argued that Strategy is selling the idea of buying Bitcoin (BTC) in a corporate structure, and that other companies are following suit in hopes of receiving a similar market premium. Chanos said this was “ridiculous.” He described his trade as “a good barometer of not only just the arbitrage itself, but I think of retail speculation.” Selling Strategy stock to buy Bitcoin Chanos’ recent move assumes investors overpay for Bitcoin exposure through corporate wrappers like Strategy and other firms that follow its Bitcoin accumulation blueprint. The investor’s move reflects a stance that purchasing Bitcoin directly would be better than purchasing Strategy’s stocks for indirect Bitcoin exposure. Chanos’ move suggests that holding Bitcoin through companies reflects excessive speculation and risk mispricing. It assumes that retail investors’ idea of having Bitcoin indirectly through corporate wrappers can inflate the company’s stock valuations. While shorting Strategy may seem like a good idea, investors have already lost billions shorting Saylor’s company. In 2024, investors who bet against the firm lost about $3.3 billion as the stock rose. As of May 2025, Strategy holds about 568,840 Bitcoin, valued at around $59 billion. Since the company started accumulating Bitcoin in 2020, its stock price has surged by 1,500%, outperforming the S&P 500’s gains during the same period. In a recently released documentary from the Financial Times, Strategy analyst Jeff Walton said that the company’s Bitcoin…

What's Your Reaction?