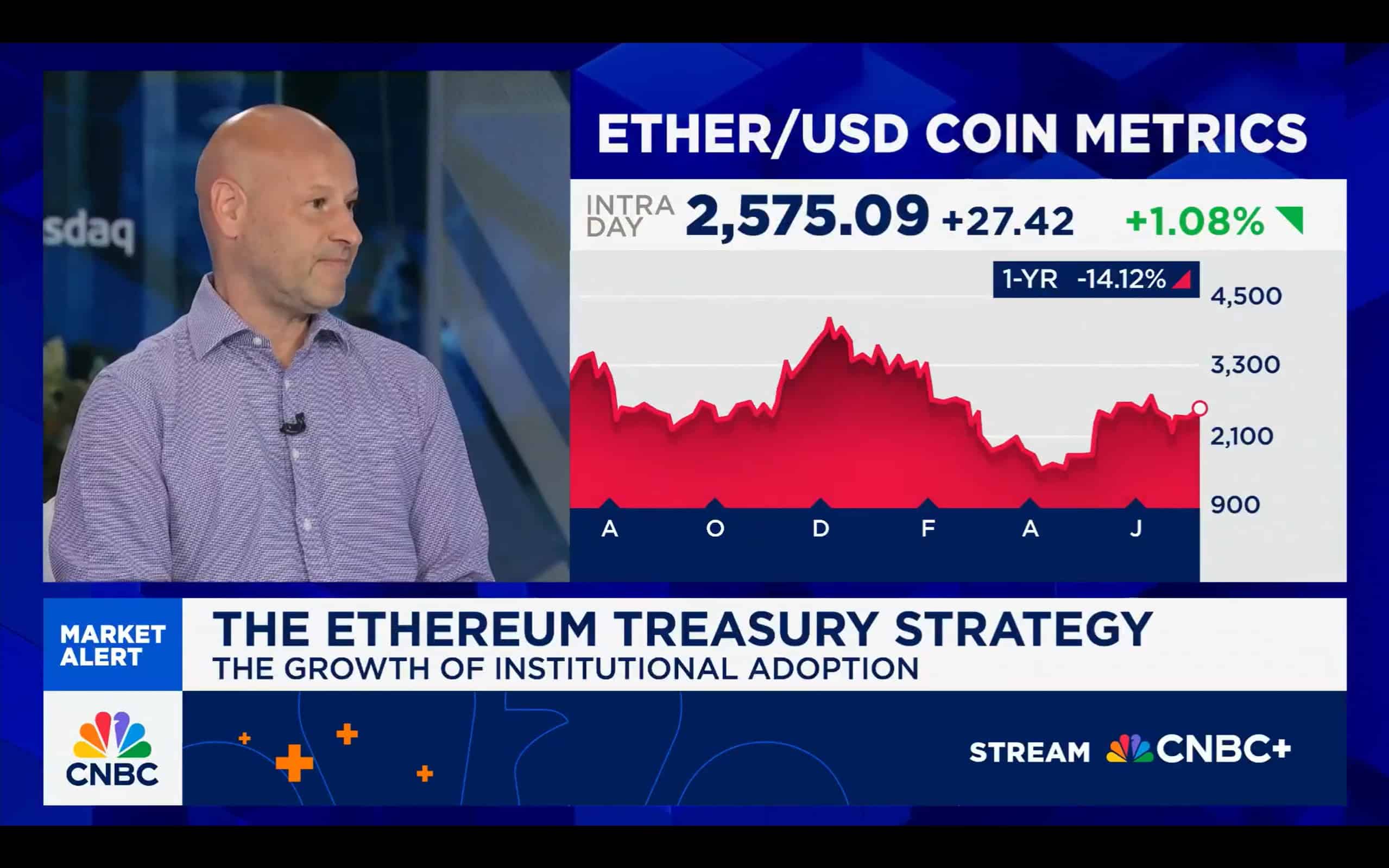

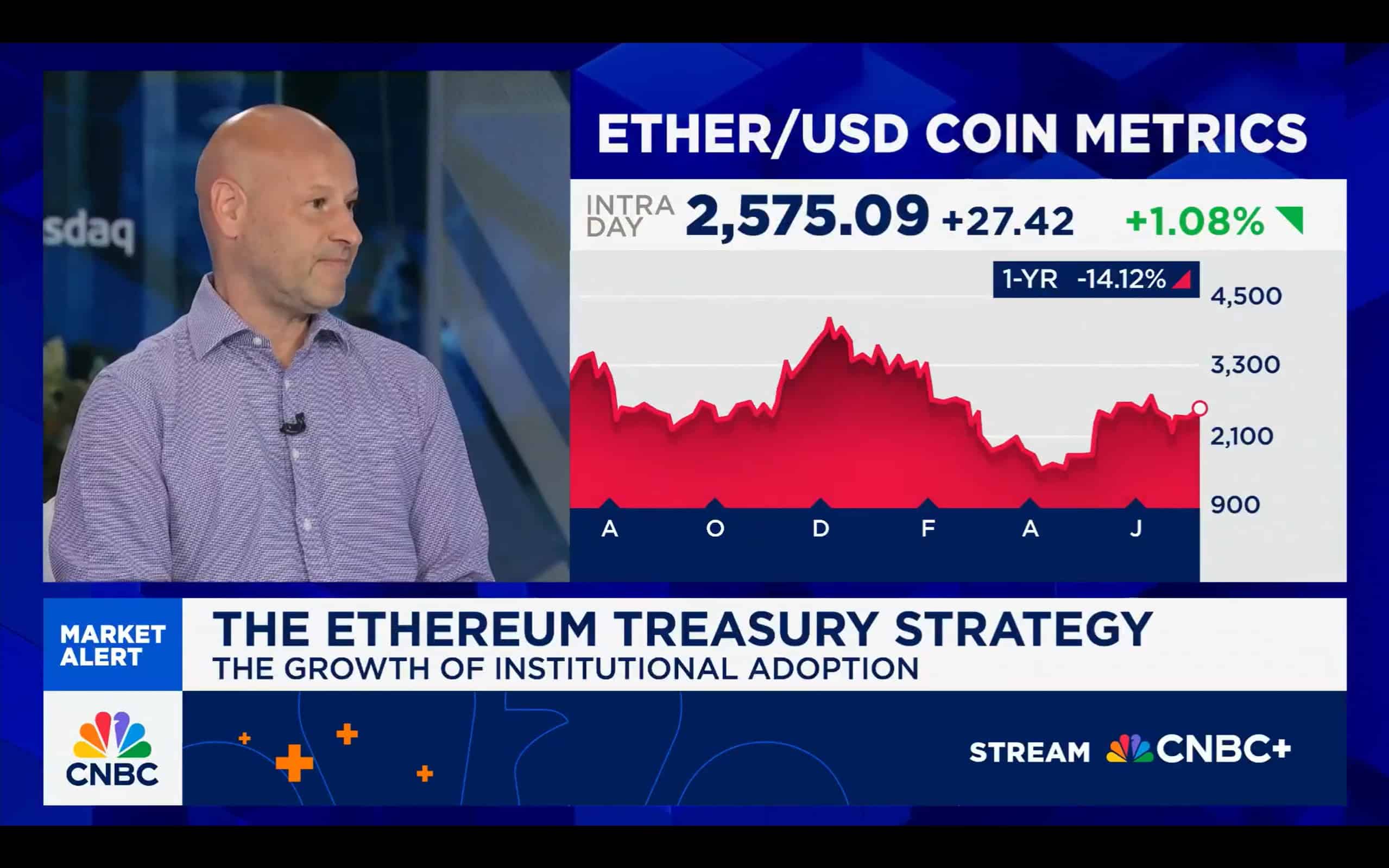

Joe Lubin Predicts Ethereum Treasury Moves Will Shift Wall Street Attitudes

Ethereum co-founder and ConsenSys CEO Joe Lubin believes that Ethereum is starting to gain real ground in how traditional finance thinks about digital assets. He sees a growing number of companies holding ETH in their treasuries as a strategic choice that could influence how Wall Street treats crypto as a whole. Joe Lubin says the.. The post Joe Lubin Predicts Ethereum Treasury Moves Will Shift Wall Street Attitudes appeared first on 99Bitcoins.

Ethereum co-founder and ConsenSys CEO Joe Lubin believes that Ethereum is starting to gain real ground in how traditional finance thinks about digital assets. He sees a growing number of companies holding ETH in their treasuries as a strategic choice that could influence how Wall Street treats crypto as a whole. Joe Lubin says the Ethereum treasury trend is gaining traction as more companies treat ETH as a real working asset, not just a headline grab.

Treasuries as the New Gateway

Lubin’s view is that Ethereum is beginning to play a role similar to what cash or even gold once did for corporate treasuries. It is not just about buying crypto to sit on a balance sheet. He makes the case for ETH as a functional part of the financial stack. Lubin points to Bitcoin’s entry into corporate treasuries as the early spark but says Ethereum takes it further because of what it can do.

Joe Lubin: 'Ethereum treasury strategy just makes sense' pic.twitter.com/Ewodk53txw

— Altcoin Daily (@AltcoinDaily) July 8, 2025

Unlike Bitcoin, Ethereum has built-in yield through staking and utility through smart contracts. Lubin argues that this gives companies more tools to manage their assets, earn passive income, and stay involved in a network that keeps evolving.

Ethereum as a Financial Backbone

Ethereum’s flexibility is what makes it different from other cryptocurrencies since it is not only a store of value. Lubin explains the fact that ETH can be deployed programmatically for yield, risk management, or even service payments within decentralized systems.

One example comes from SharpLink, a publicly traded company that recently moved a chunk of its treasury into Ether. The company is not just holding ETH, they’re staking it, using it to generate yield, and folding it into their long-term planning. That, according to Lubin, could become the new playbook for other firms.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Why This Matters

Lubin is also making the case that if companies treat ETH like any other working financial asset, the perception around it will shift. This could have ripple effects throughout traditional finance, especially in how investors and regulators classify crypto assets.

It also hints at the idea that crypto is maturing in the eyes of people who typically operate outside the space. Lubin thinks Ethereum is positioned well to become a bridge between tech innovation and mainstream financial strategy. It is no longer just about holding a token, it is about what the token can actually do when put to work.

DISCOVER: 20+ Next Crypto to Explode in 2025

The Road Ahead

Lubin believes that a growing focus on Ethereum treasury moves could lead to more serious attention from traditional finance. If more companies begin holding and using ETH as part of their treasury operations, it could change the way Wall Street evaluates digital assets. Lubin sees this as a turning point. It is not just the value of Ethereum that matters now, it is the structure it offers for financial tools, investment strategies, and future products.

As more firms explore staking, on-chain finance, and DeFi integration, Ethereum’s role in the global financial system could expand significantly. Lubin believes that the future may already be taking shape.

Whether or not Wall Street fully catches on this year, Ethereum’s push into corporate treasuries is gaining attention. And for now, Joe Lubin is betting that ETH has more to offer than just price action. It may be laying the groundwork for a more dynamic and programmable financial future.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

The post Joe Lubin Predicts Ethereum Treasury Moves Will Shift Wall Street Attitudes appeared first on 99Bitcoins.

What's Your Reaction?