More Merchants Add Credit Surcharges

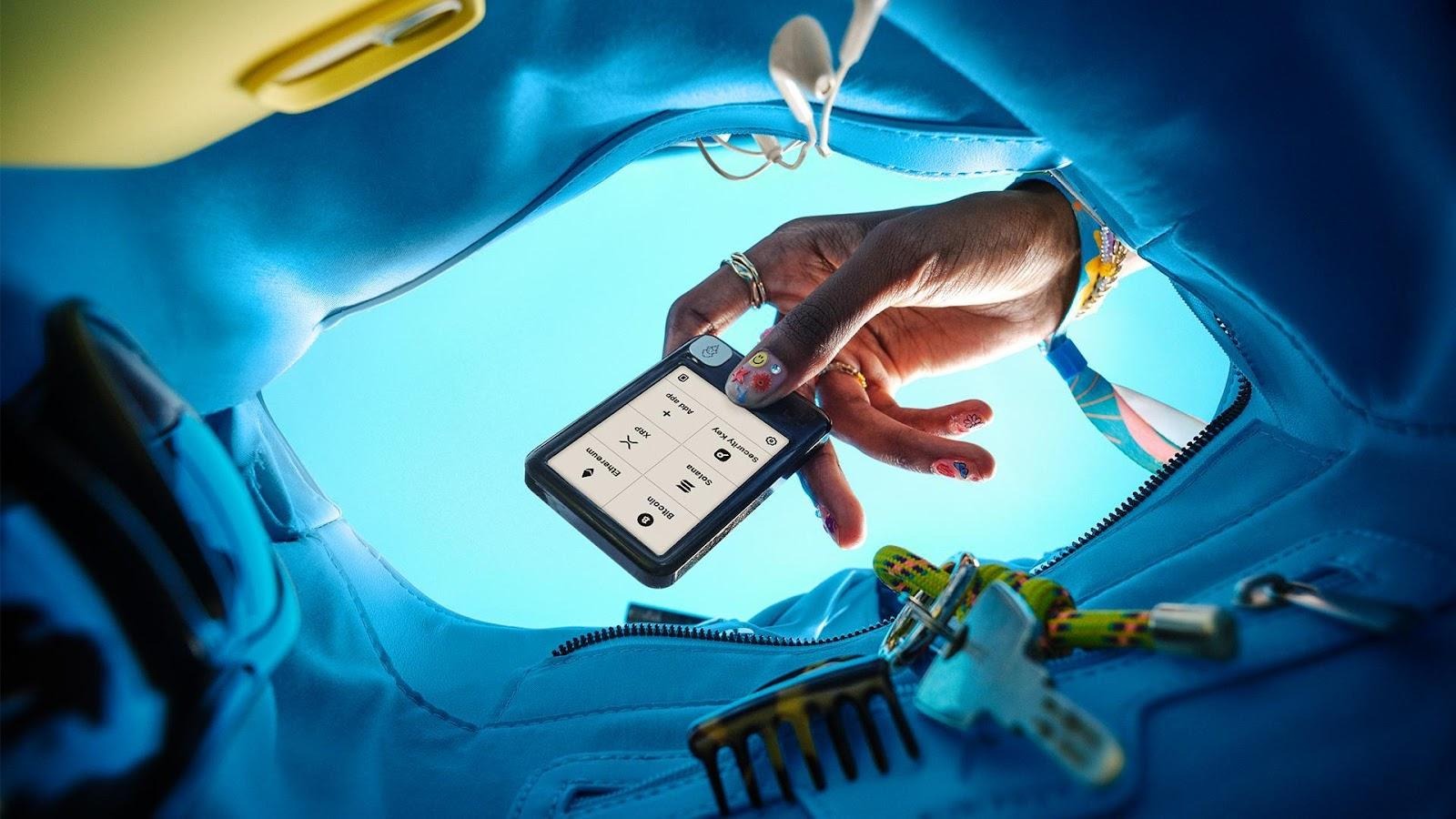

The post More Merchants Add Credit Surcharges appeared on BitcoinEthereumNews.com. Fed to Propose Lowering Debit Card Swipe Fees The Federal Reserve is preparing a proposal that would lower the fees merchants pay to many banks when consumers shop with debit cards. Today, merchants pay large card issuers 21 cents plus 0.05% of the transaction amount, the level set by the Fed in 2011. The Fed can lower the cap if it determines the costs for processing debit-card payments are declining, but it has never done so. The Fed said it would hold a meeting next week to vote on a proposal about revising the fee cap, without being more specific. The proposal would lower the cap, according to people familiar with the matter. The Fed would then start a public-comment period that would likely include heavy lobbying from card issuers and merchants and congressional discussion. It would require a final vote by the central bank’s governors to be implemented. [The Wall Street Journal] More merchants are adding a surcharge or convenience fee on purchases made with plastic Getty Images Credit Cards: Surcharges Surge as U.S. Businesses Pass Costs on to Customers Last year, U.S. merchants paid a record $160 billion in processing fees to accept $10.6 trillion in card payments, according to the Nilson Report. The bulk of those fees, about 79%, was from credit cards. Many companies’ profits margins are narrowing as they get squeezed by higher inflation. That has prompted a growing number of businesses to attempt to pass higher costs on to their customers. They are adding a surcharge or a convenience fee on those who want to swipe their plastic. Payment consultancy TSG reckons between 5-10% of 8 million card-accepting small businesses in the US now charge fees for credit card usage. That is up from 2% five years ago. Underscoring the growing trend, TSG said…

The post More Merchants Add Credit Surcharges appeared on BitcoinEthereumNews.com.

Fed to Propose Lowering Debit Card Swipe Fees The Federal Reserve is preparing a proposal that would lower the fees merchants pay to many banks when consumers shop with debit cards. Today, merchants pay large card issuers 21 cents plus 0.05% of the transaction amount, the level set by the Fed in 2011. The Fed can lower the cap if it determines the costs for processing debit-card payments are declining, but it has never done so. The Fed said it would hold a meeting next week to vote on a proposal about revising the fee cap, without being more specific. The proposal would lower the cap, according to people familiar with the matter. The Fed would then start a public-comment period that would likely include heavy lobbying from card issuers and merchants and congressional discussion. It would require a final vote by the central bank’s governors to be implemented. [The Wall Street Journal] More merchants are adding a surcharge or convenience fee on purchases made with plastic Getty Images Credit Cards: Surcharges Surge as U.S. Businesses Pass Costs on to Customers Last year, U.S. merchants paid a record $160 billion in processing fees to accept $10.6 trillion in card payments, according to the Nilson Report. The bulk of those fees, about 79%, was from credit cards. Many companies’ profits margins are narrowing as they get squeezed by higher inflation. That has prompted a growing number of businesses to attempt to pass higher costs on to their customers. They are adding a surcharge or a convenience fee on those who want to swipe their plastic. Payment consultancy TSG reckons between 5-10% of 8 million card-accepting small businesses in the US now charge fees for credit card usage. That is up from 2% five years ago. Underscoring the growing trend, TSG said…

What's Your Reaction?