Nasdaq-Listed Giant GDC Buys Into Bitcoin and TRUMP Token With $300M Splash

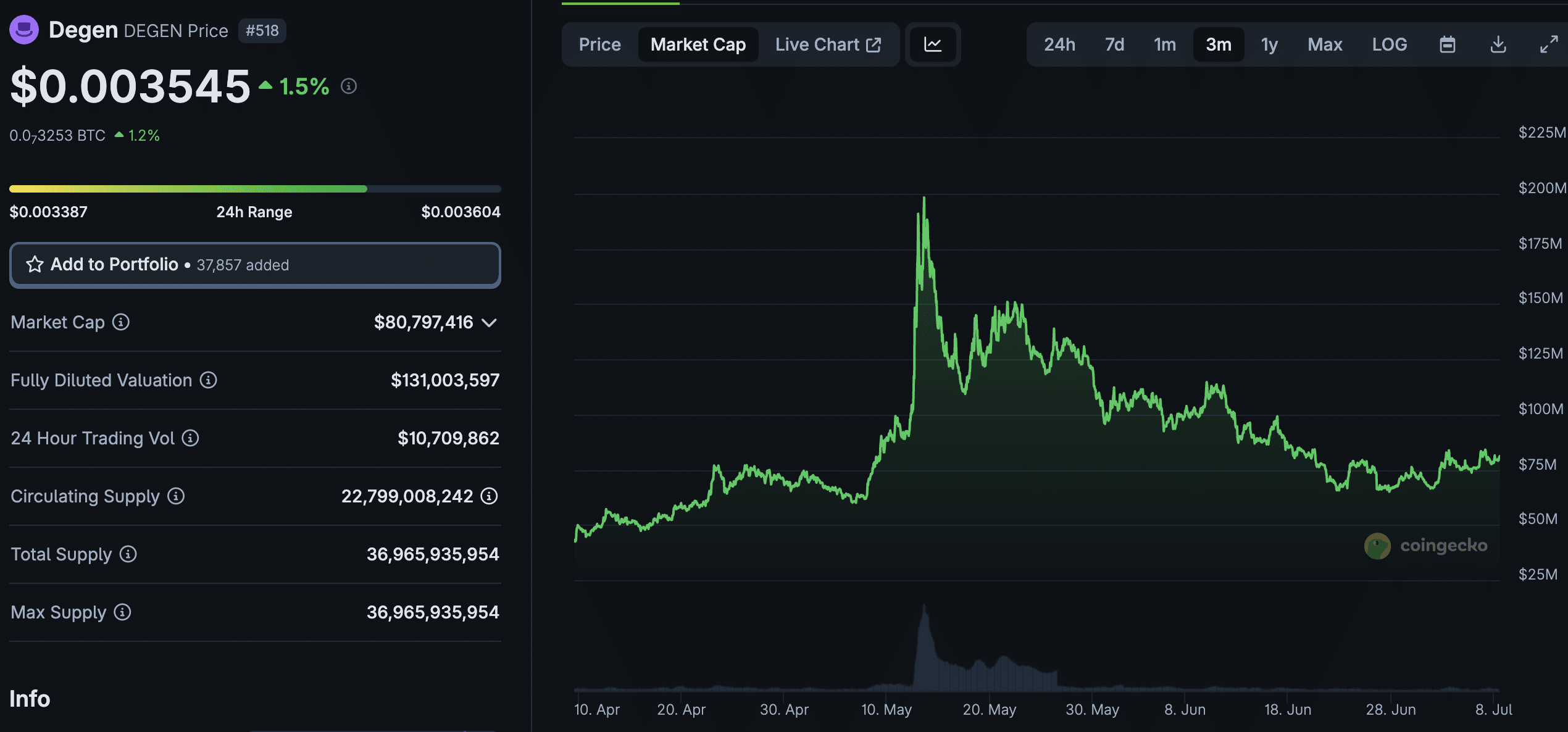

The post Nasdaq-Listed Giant GDC Buys Into Bitcoin and TRUMP Token With $300M Splash appeared on BitcoinEthereumNews.com. Bitcoin and TRUMP will serve as long-term treasury reserves, marking the company’s entry into the growing trend of public firms holding cryptocurrency on their balance sheets. The inclusion of the politically themed TRUMP token has drawn criticism, with analysts questioning its volatility as a treasury asset. Nasdaq-listed GD Culture Group (GDC) has made a big move into the crypto market game with up to $300 million allocated to Bitcoin and the Donald Trump-inspired TRUMP (TRUMP) token. The move is part of a stock purchase agreement in line with an investor in the British Virgin Islands. GDC plans to keep both assets in its treasury as long-term reserves and, thus, places itself on a list of public companies that incorporate crypto into their balance sheets. GDC Group Adds Bitcoin & Trump Meme Coin To Balance Sheet The company’s crypto acquisition is expected to further enhance its position in terms of a closer affiliation with blockchain and decentralized finance (DeFi). GDC is also expanding its digital push via its subsidiary AI Catalysis, which is playing in live streaming e-commerce. The company purports that this strategy is a major turnaround in its operations. Chairman and CEO Xiaojian Wang described the decision as a forward-looking move that is strongly aimed at leveraging current market trends. “We’re confident this will drive long-term value for our shareholders,” Wang said. He went ahead to explain the move as a calculated step with the aim of placing the company in the future framework of finance. As such, despite this aggressive crypto entry, GDC is facing several hurdles, including financial losses. The firm incurred a net loss of $14.1 million in 2024 fiscal year, better than the $14.3 million loss last year. As well, Nasdaq has flagged the company for failing to maintain the minimum $ 2.5 million in stockholders’…

The post Nasdaq-Listed Giant GDC Buys Into Bitcoin and TRUMP Token With $300M Splash appeared on BitcoinEthereumNews.com.

Bitcoin and TRUMP will serve as long-term treasury reserves, marking the company’s entry into the growing trend of public firms holding cryptocurrency on their balance sheets. The inclusion of the politically themed TRUMP token has drawn criticism, with analysts questioning its volatility as a treasury asset. Nasdaq-listed GD Culture Group (GDC) has made a big move into the crypto market game with up to $300 million allocated to Bitcoin and the Donald Trump-inspired TRUMP (TRUMP) token. The move is part of a stock purchase agreement in line with an investor in the British Virgin Islands. GDC plans to keep both assets in its treasury as long-term reserves and, thus, places itself on a list of public companies that incorporate crypto into their balance sheets. GDC Group Adds Bitcoin & Trump Meme Coin To Balance Sheet The company’s crypto acquisition is expected to further enhance its position in terms of a closer affiliation with blockchain and decentralized finance (DeFi). GDC is also expanding its digital push via its subsidiary AI Catalysis, which is playing in live streaming e-commerce. The company purports that this strategy is a major turnaround in its operations. Chairman and CEO Xiaojian Wang described the decision as a forward-looking move that is strongly aimed at leveraging current market trends. “We’re confident this will drive long-term value for our shareholders,” Wang said. He went ahead to explain the move as a calculated step with the aim of placing the company in the future framework of finance. As such, despite this aggressive crypto entry, GDC is facing several hurdles, including financial losses. The firm incurred a net loss of $14.1 million in 2024 fiscal year, better than the $14.3 million loss last year. As well, Nasdaq has flagged the company for failing to maintain the minimum $ 2.5 million in stockholders’…

What's Your Reaction?