Shiba Inu Price Prediction for June 08, 2025

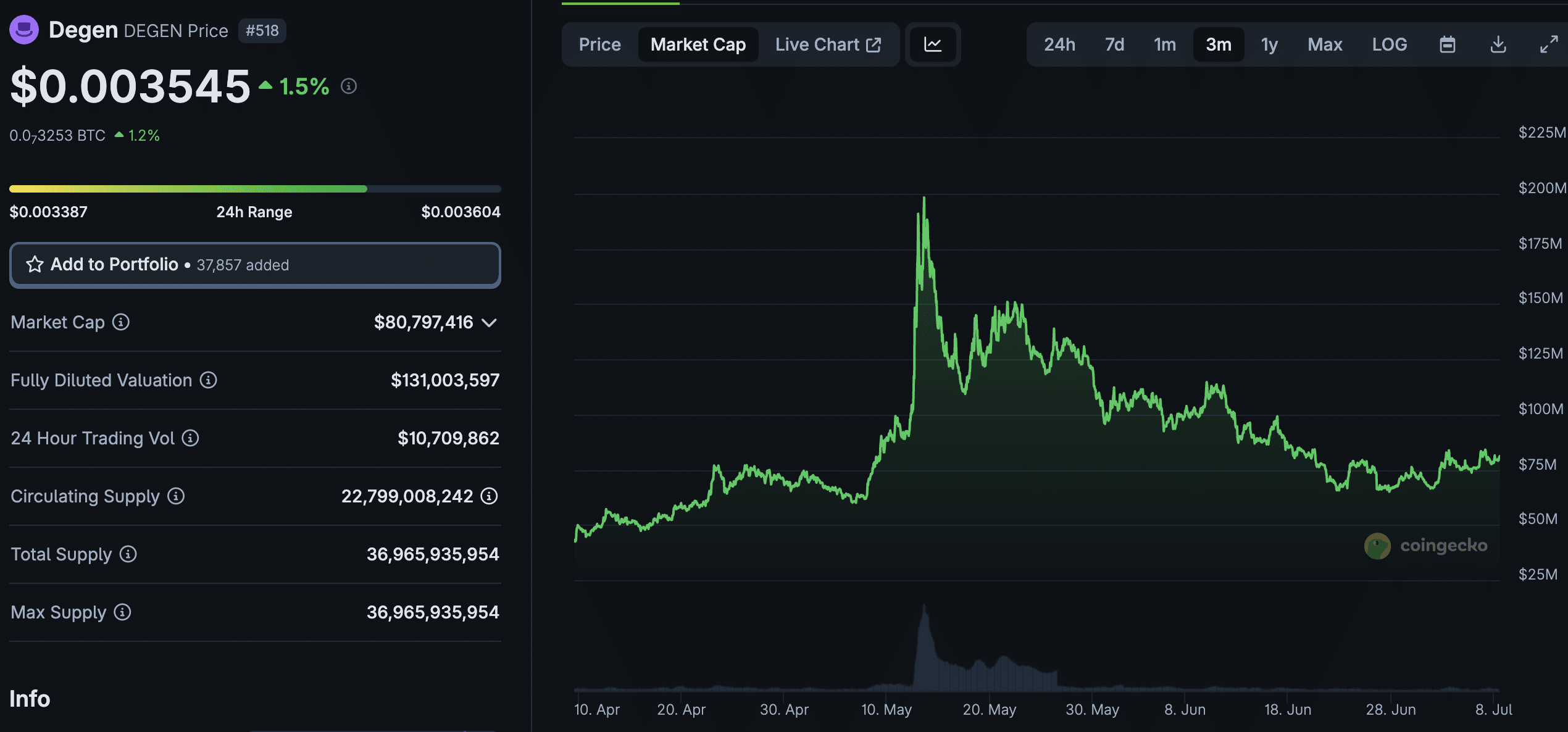

The post Shiba Inu Price Prediction for June 08, 2025 appeared on BitcoinEthereumNews.com. The Shiba Inu price today is trading near $0.00001281, reflecting a moderate intraday gain of 3.1% as the token attempts to recover from recent lows. After bouncing from a demand zone near $0.000012, SHIB has reclaimed key intraday levels and is now testing the lower boundary of a descending trendline. With multiple indicators flashing early recovery signals, traders are closely monitoring whether this bounce can evolve into a sustainable upside move. What’s Happening With Shiba Inu’s Price? Over the last 48 hours, Shiba Inu price action has shown signs of a potential bottoming structure on lower time frames. A sharp rebound from the $0.000012–$0.0000122 support region marked a temporary halt to the broader downtrend that dominated late May and early June. The 4-hour chart reveals a symmetrical breakout attempt from a falling wedge pattern. SHIB is now pressing against immediate resistance near $0.00001288, which aligns with the 100-EMA and a previously broken trendline. The token must close above this cluster to shift momentum further in favor of bulls. The current structure also includes multiple short-bodied candles with higher lows, suggesting a gradual return of buyer confidence. However, a decisive close above the wedge resistance remains key to invalidating the recent bearish structure. RSI and MACD Signal Strengthening Bullish Momentum Momentum indicators support the possibility of short-term continuation. The 30-minute RSI has surged above 69, reflecting bullish strength but nearing overbought territory. Meanwhile, the MACD histogram has flipped positive, with both signal lines crossing above the baseline for the first time this week. This convergence hints at improving upside momentum and a potential revisit of the $0.000013–$0.00001325 range if follow-through volume builds. However, the daily RSI remains neutral, currently hovering in the mid-40s. This keeps longer-term sentiment cautious despite the intraday recovery. Traders should be alert for any bearish divergences on…

The post Shiba Inu Price Prediction for June 08, 2025 appeared on BitcoinEthereumNews.com.

The Shiba Inu price today is trading near $0.00001281, reflecting a moderate intraday gain of 3.1% as the token attempts to recover from recent lows. After bouncing from a demand zone near $0.000012, SHIB has reclaimed key intraday levels and is now testing the lower boundary of a descending trendline. With multiple indicators flashing early recovery signals, traders are closely monitoring whether this bounce can evolve into a sustainable upside move. What’s Happening With Shiba Inu’s Price? Over the last 48 hours, Shiba Inu price action has shown signs of a potential bottoming structure on lower time frames. A sharp rebound from the $0.000012–$0.0000122 support region marked a temporary halt to the broader downtrend that dominated late May and early June. The 4-hour chart reveals a symmetrical breakout attempt from a falling wedge pattern. SHIB is now pressing against immediate resistance near $0.00001288, which aligns with the 100-EMA and a previously broken trendline. The token must close above this cluster to shift momentum further in favor of bulls. The current structure also includes multiple short-bodied candles with higher lows, suggesting a gradual return of buyer confidence. However, a decisive close above the wedge resistance remains key to invalidating the recent bearish structure. RSI and MACD Signal Strengthening Bullish Momentum Momentum indicators support the possibility of short-term continuation. The 30-minute RSI has surged above 69, reflecting bullish strength but nearing overbought territory. Meanwhile, the MACD histogram has flipped positive, with both signal lines crossing above the baseline for the first time this week. This convergence hints at improving upside momentum and a potential revisit of the $0.000013–$0.00001325 range if follow-through volume builds. However, the daily RSI remains neutral, currently hovering in the mid-40s. This keeps longer-term sentiment cautious despite the intraday recovery. Traders should be alert for any bearish divergences on…

What's Your Reaction?