Tesla’s Quarter-Life Crisis – and Why Bitcoin Looks Bullet-Proof

The post Tesla’s Quarter-Life Crisis – and Why Bitcoin Looks Bullet-Proof appeared on BitcoinEthereumNews.com. Tesla once wore the crown jewel of the car business: top-shelf tech, sky-high multiples, and customers who treated every Elon tweet as gospel. Today, that halo’s slipped. Vehicle deliveries tumbled 14 % in Q2, the worst year-on-year slide since the Model 3 ramp-up days. The safety net that kept the profit sheet green – U.S. regulatory credit sales – is about to vanish, thanks to President Trump’s freshly signed “Big Beautiful Bill.” Analysts project the loss of those credits chops as much as $2 billion out of annual earnings. Musk vs. Trump: the bromance is dead The bill torpedoes the $7,500 federal EV tax credit, scraps CAFE penalties, and pares back most renewable-energy perks. It also left nothing for Trump’s crypto supporters. Musk blasted the legislation as “an abomination” and, in true Tony-Stark-after-three-espressos style, announced plans for a third political force, the America Party. Trump responded by calling the idea “ridiculous” while dangling the threat of yanking SpaceX and Starlink contracts. An ex-Tesla executive told the FT that Musk has only just “woken up” to the scale of the political own-goal: “It’s everything together – tariffs, the $7,500 credit, manufacturing and charging incentives… talk about a day late and a dollar short.” The market agrees; Tesla stock opened 7 % lower the morning after Musk’s political party stunt. It’s not all bad news, Elon says his political party will support Bitcoin, Source: X Cash flow on life support In Q1 2025, Tesla eked out a profit only because regulatory credits jumped 35 % year-over-year to $595 million. Strip those out, and the quarter would have gone red. Now, with U.S. credits headed for the shredder, the company is scrambling to hawk carbon allowances in Europe just to paper over the hole. Wedbush analyst Dan Ives summed up the mood: shareholders…

The post Tesla’s Quarter-Life Crisis – and Why Bitcoin Looks Bullet-Proof appeared on BitcoinEthereumNews.com.

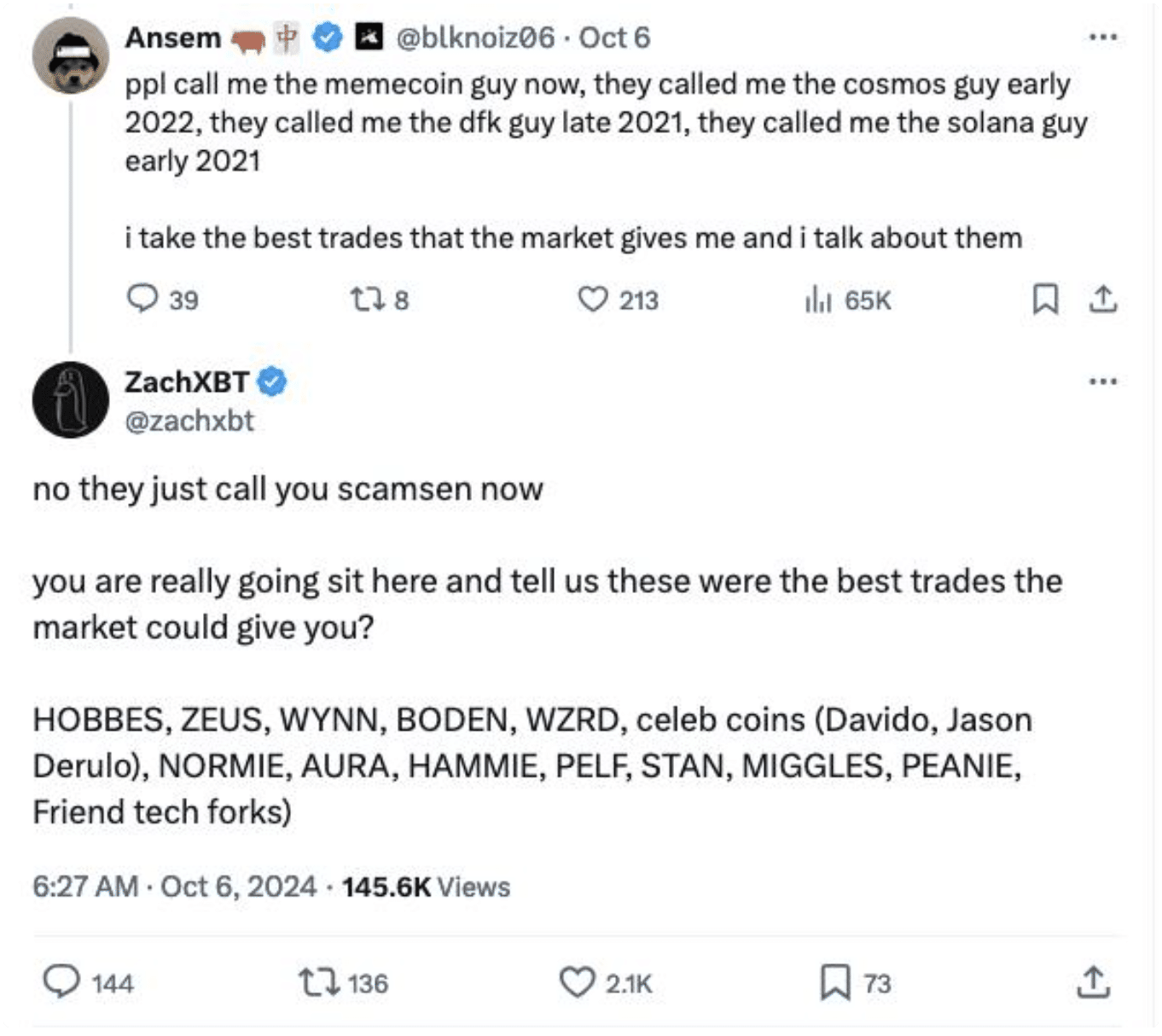

Tesla once wore the crown jewel of the car business: top-shelf tech, sky-high multiples, and customers who treated every Elon tweet as gospel. Today, that halo’s slipped. Vehicle deliveries tumbled 14 % in Q2, the worst year-on-year slide since the Model 3 ramp-up days. The safety net that kept the profit sheet green – U.S. regulatory credit sales – is about to vanish, thanks to President Trump’s freshly signed “Big Beautiful Bill.” Analysts project the loss of those credits chops as much as $2 billion out of annual earnings. Musk vs. Trump: the bromance is dead The bill torpedoes the $7,500 federal EV tax credit, scraps CAFE penalties, and pares back most renewable-energy perks. It also left nothing for Trump’s crypto supporters. Musk blasted the legislation as “an abomination” and, in true Tony-Stark-after-three-espressos style, announced plans for a third political force, the America Party. Trump responded by calling the idea “ridiculous” while dangling the threat of yanking SpaceX and Starlink contracts. An ex-Tesla executive told the FT that Musk has only just “woken up” to the scale of the political own-goal: “It’s everything together – tariffs, the $7,500 credit, manufacturing and charging incentives… talk about a day late and a dollar short.” The market agrees; Tesla stock opened 7 % lower the morning after Musk’s political party stunt. It’s not all bad news, Elon says his political party will support Bitcoin, Source: X Cash flow on life support In Q1 2025, Tesla eked out a profit only because regulatory credits jumped 35 % year-over-year to $595 million. Strip those out, and the quarter would have gone red. Now, with U.S. credits headed for the shredder, the company is scrambling to hawk carbon allowances in Europe just to paper over the hole. Wedbush analyst Dan Ives summed up the mood: shareholders…

What's Your Reaction?

![[LIVE] Latest Crypto News, August 7 – Mixed Signals From The Market As BTC Hovers Around $115K Is There a Best Crypto to Buy Right Now?](https://99bitcoins.com/wp-content/uploads/2025/08/IMG_0827.jpeg?#)