Trump Media Reveals $2.5 Billion Raise to Buy Bitcoin

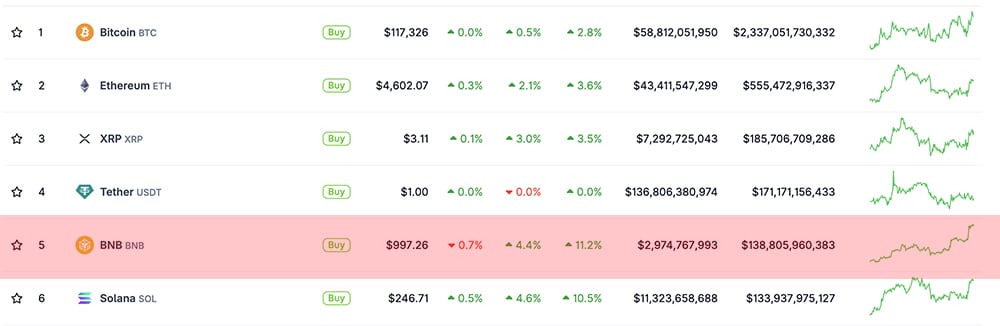

The post Trump Media Reveals $2.5 Billion Raise to Buy Bitcoin appeared on BitcoinEthereumNews.com. In brief Trump Media is raising $2.5 billion via fresh equity and convertible bond sales. The funds will be used to fuel the publicly traded firm’s Bitcoin treasury. The Trump family-owned company has made several forays into the crypto industry over the past few months. Trump Media & Technology Group is raising $2.5 billion to purchase Bitcoin for a company treasury, the publicly traded firm announced Tuesday. According to a release, Trump Media has entered subscription agreements with about 50 institutional investors, and will sell $1.5 billion worth of common stock and $1 billion worth of convertible senior secured notes. The funds will fuel Trump Media’s Bitcoin play. “We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets,” said Trump Media CEO and Chairman Devin Nunes, in a statement. “Our first acquisition of a crown jewel asset, this investment will help defend our company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms, and will create synergies for subscription payments, a utility token, and other planned transactions across Truth Social and Truth+.” Crypto.com and Anchorage Digital will custody the firm’s future Bitcoin holdings. The offering is set to close on or around Thursday, May 29. The announcement comes once day after the Financial Times first reported the plans, citing six people familiar with the matter. The FT report had pegged the fundraising target at $3 billion, however, and said that the firm intended to invest in multiple cryptocurrencies—not just Bitcoin. TMTG did not respond to Decrypt’s request for comment on Monday. In a statement to the Financial Times following publication of its story, the company seemingly denied the report: “Apparently the Financial Times has dumb writers listening to even dumber sources,” the…

The post Trump Media Reveals $2.5 Billion Raise to Buy Bitcoin appeared on BitcoinEthereumNews.com.

In brief Trump Media is raising $2.5 billion via fresh equity and convertible bond sales. The funds will be used to fuel the publicly traded firm’s Bitcoin treasury. The Trump family-owned company has made several forays into the crypto industry over the past few months. Trump Media & Technology Group is raising $2.5 billion to purchase Bitcoin for a company treasury, the publicly traded firm announced Tuesday. According to a release, Trump Media has entered subscription agreements with about 50 institutional investors, and will sell $1.5 billion worth of common stock and $1 billion worth of convertible senior secured notes. The funds will fuel Trump Media’s Bitcoin play. “We view Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets,” said Trump Media CEO and Chairman Devin Nunes, in a statement. “Our first acquisition of a crown jewel asset, this investment will help defend our company against harassment and discrimination by financial institutions, which plague many Americans and U.S. firms, and will create synergies for subscription payments, a utility token, and other planned transactions across Truth Social and Truth+.” Crypto.com and Anchorage Digital will custody the firm’s future Bitcoin holdings. The offering is set to close on or around Thursday, May 29. The announcement comes once day after the Financial Times first reported the plans, citing six people familiar with the matter. The FT report had pegged the fundraising target at $3 billion, however, and said that the firm intended to invest in multiple cryptocurrencies—not just Bitcoin. TMTG did not respond to Decrypt’s request for comment on Monday. In a statement to the Financial Times following publication of its story, the company seemingly denied the report: “Apparently the Financial Times has dumb writers listening to even dumber sources,” the…

What's Your Reaction?