Wait For Bitcoin At $20,000? This Analyst Says No

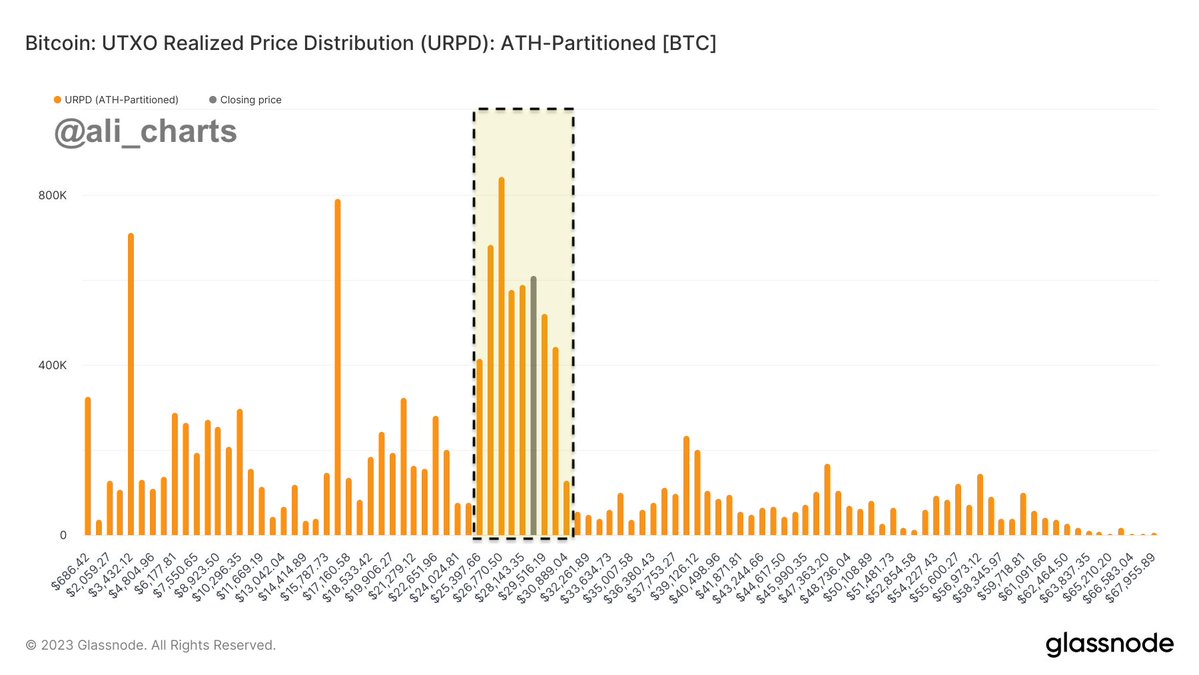

The post Wait For Bitcoin At $20,000? This Analyst Says No appeared on BitcoinEthereumNews.com. An analyst has explained using on-chain data that Bitcoin has a major demand bucket at the current price levels, so it won’t hit $20,000 anytime soon. Huge Bitcoin Buying Occurred Inside The $25,000 To $30,000 Range In a new post on X, analyst Ali has explained that some large entities accumulated at the $25,000 to $30,000 range. The indicator of interest here is the “UTXO Realized Price Distribution” (URPD), which, in short, tells us about the amount of Bitcoin that was acquired at the different price levels of the cryptocurrency. Here is a chart that shows how the URPD of the current Bitcoin market looks like: The data for the distribution of the supply over the different price levels | Source: @ali_charts on X Notice that the URPD here is “ATH-partitioned.” What this means is that the price ranges here have been defined by creating 100 equally spaced partitions between zero and the all-time high (ATH) of the cryptocurrency. From the graph of the Bitcoin URPD, it’s visible that the price levels between $25,000 and $30,000 are host to the cost basis of a particularly large amount of the supply. Ali notes that most people, including major institutional investors like Michael Saylor’s Microstrategy and Elon Musk’s Tesla, purchased a significant number of coins between these levels. The levels being so dense with supply isn’t only significant because of the fact that these large entities believe those prices were worthy buys, but also due to how investor psychology tends to work out. Generally, whenever the price retests the cost basis of a holder, they may become more probable to show some reaction. How they would react depends on their sentiment and profit/loss status prior to the retest. If they had been i9n profits before the price declined towards their cost basis,…

The post Wait For Bitcoin At $20,000? This Analyst Says No appeared on BitcoinEthereumNews.com.

An analyst has explained using on-chain data that Bitcoin has a major demand bucket at the current price levels, so it won’t hit $20,000 anytime soon. Huge Bitcoin Buying Occurred Inside The $25,000 To $30,000 Range In a new post on X, analyst Ali has explained that some large entities accumulated at the $25,000 to $30,000 range. The indicator of interest here is the “UTXO Realized Price Distribution” (URPD), which, in short, tells us about the amount of Bitcoin that was acquired at the different price levels of the cryptocurrency. Here is a chart that shows how the URPD of the current Bitcoin market looks like: The data for the distribution of the supply over the different price levels | Source: @ali_charts on X Notice that the URPD here is “ATH-partitioned.” What this means is that the price ranges here have been defined by creating 100 equally spaced partitions between zero and the all-time high (ATH) of the cryptocurrency. From the graph of the Bitcoin URPD, it’s visible that the price levels between $25,000 and $30,000 are host to the cost basis of a particularly large amount of the supply. Ali notes that most people, including major institutional investors like Michael Saylor’s Microstrategy and Elon Musk’s Tesla, purchased a significant number of coins between these levels. The levels being so dense with supply isn’t only significant because of the fact that these large entities believe those prices were worthy buys, but also due to how investor psychology tends to work out. Generally, whenever the price retests the cost basis of a holder, they may become more probable to show some reaction. How they would react depends on their sentiment and profit/loss status prior to the retest. If they had been i9n profits before the price declined towards their cost basis,…

What's Your Reaction?