XRP, BNB Whale Wallets Expand 20% — UNI and CRO Named Undervalued Picks by Analysts

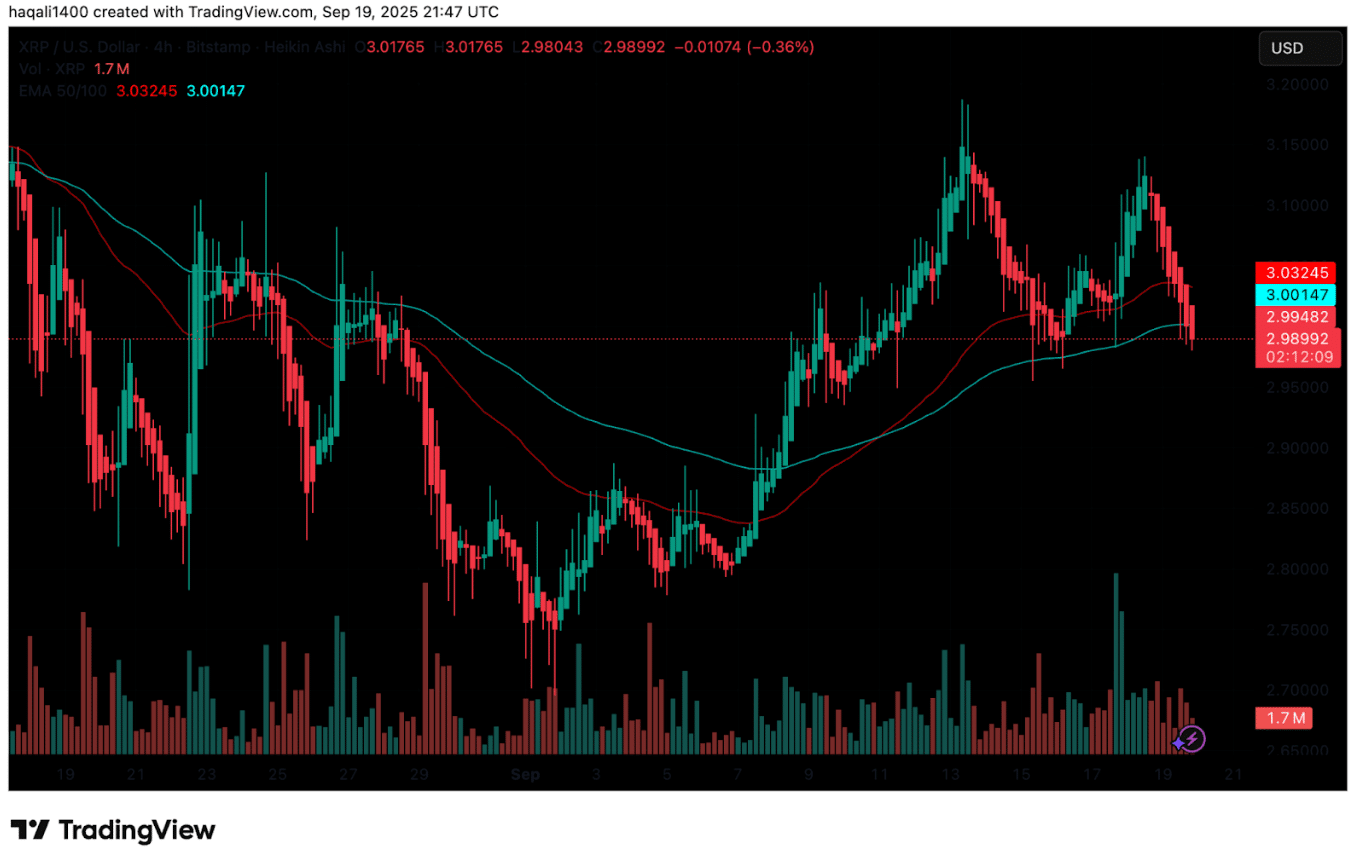

The post XRP, BNB Whale Wallets Expand 20% — UNI and CRO Named Undervalued Picks by Analysts appeared on BitcoinEthereumNews.com. Crypto News Whale wallets are accumulating XRP and BNB, while analysts call UNI and CRO undervalued plays for 2025 upside. Whale wallets holding XRP and BNB have expanded by close to 20% in recent weeks, suggesting growing confidence from large investors and institutions. On-chain data points to a notable build-up in these holdings, even as broader crypto markets cooled. At the same time, analysts have spotlighted MAGACOIN FINANCE, Uniswap (UNI) and Cronos (CRO) as three of the most undervalued tokens in the market, with these assets trading at significant discounts to their perceived fair value. XRP & BNB Whale Accumulation XRP whales have stepped up accumulation aggressively. Addresses holding between 10 million and 100 million XRP added approximately 340 million tokens in just two weeks, pushing whale-controlled supply above 7.84 billion XRP. The build-up coincides with a surge in XRP futures activity, where volumes topped $1 billion on CME. Analysts link this rise to anticipation of an exchange-traded fund, coupled with a more favorable regulatory environment around Ripple. BNB has followed a similar trajectory. Large holders were active shortly after the token set new all-time highs, with some whale wallets adding over 10,000 BNB each. Historically, such accumulation has preceded strong price trends, and market observers suggest this could point to BNB’s continued leadership into the final quarter of 2025. Combined with XRP, the whale inflows indicate institutional conviction that both tokens are preparing for their next market leg. UNI and CRO: Undervalued Picks Uniswap (UNI) remains one of the most important protocols in decentralized finance, yet its token trades under $1 — levels analysts describe as deeply undervalued. With the v4 upgrade in progress and multi-chain expansion ahead, price targets for 2025 range between $13 and $19. The sharp discount relative to projected adoption makes UNI a classic high-risk,…

The post XRP, BNB Whale Wallets Expand 20% — UNI and CRO Named Undervalued Picks by Analysts appeared on BitcoinEthereumNews.com.

Crypto News Whale wallets are accumulating XRP and BNB, while analysts call UNI and CRO undervalued plays for 2025 upside. Whale wallets holding XRP and BNB have expanded by close to 20% in recent weeks, suggesting growing confidence from large investors and institutions. On-chain data points to a notable build-up in these holdings, even as broader crypto markets cooled. At the same time, analysts have spotlighted MAGACOIN FINANCE, Uniswap (UNI) and Cronos (CRO) as three of the most undervalued tokens in the market, with these assets trading at significant discounts to their perceived fair value. XRP & BNB Whale Accumulation XRP whales have stepped up accumulation aggressively. Addresses holding between 10 million and 100 million XRP added approximately 340 million tokens in just two weeks, pushing whale-controlled supply above 7.84 billion XRP. The build-up coincides with a surge in XRP futures activity, where volumes topped $1 billion on CME. Analysts link this rise to anticipation of an exchange-traded fund, coupled with a more favorable regulatory environment around Ripple. BNB has followed a similar trajectory. Large holders were active shortly after the token set new all-time highs, with some whale wallets adding over 10,000 BNB each. Historically, such accumulation has preceded strong price trends, and market observers suggest this could point to BNB’s continued leadership into the final quarter of 2025. Combined with XRP, the whale inflows indicate institutional conviction that both tokens are preparing for their next market leg. UNI and CRO: Undervalued Picks Uniswap (UNI) remains one of the most important protocols in decentralized finance, yet its token trades under $1 — levels analysts describe as deeply undervalued. With the v4 upgrade in progress and multi-chain expansion ahead, price targets for 2025 range between $13 and $19. The sharp discount relative to projected adoption makes UNI a classic high-risk,…

What's Your Reaction?

.png?#)