XRP Supply On Coinbase Crashes 90%, Major Ripple Rally Ahead?

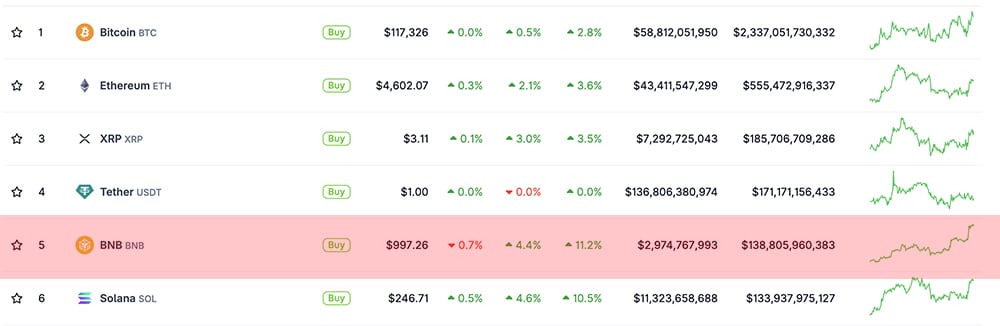

The post XRP Supply On Coinbase Crashes 90%, Major Ripple Rally Ahead? appeared on BitcoinEthereumNews.com. Ripple’s native cryptocurrency XRP is facing a major supply crunch, thereby raising analysts’ expectations for a major rally ahead. Latest reports suggest that the XRP supply on the Coinbase crypto exchange tanked 90% over the last three months. This comes as the Ripple treasury demand is on the rise, with analysts predicting an XRP rally to $5 soon. Coinbase’s XRP Supply Tanks 90% In Just Three Months On-chain data from XRPWallets shows a dramatic reduction in Coinbase’s visible XRP cold storage holdings. The cryptocurrency exchange’s XRP reserves dropped from approximately 970 million tokens held across 52 wallets in early June 2025 to just 99 million XRP distributed across 6 wallets by mid-September 2025. This shows a substantial 89.79% decline in cold wallet holdings over the three months. This sharp drop in Coinbase’s XRP reserves has raised questions about the underlying factors behind this change. Moreover, the consolidation from 52 wallets to just 6 wallets suggests a major restructuring of how the exchange manages its XRP holdings. Despite having a massive 100 billion supply, market analysts believe that the XRP supply shock is coming, amid massive Treasury demand, ETF developments, etc. Eight companies have now established XRP-based treasury strategies, signaling growing institutional confidence in the altcoin. The top holders of the treasury are Trident Digital Tech Holdings’, VivoPower International, Wedbush International, with each holding over $100 million of the Ripple cryptocurrency. On the other hand, a total of 11 spot XRP ETF applications await SEC approval from major asset managers, including Bitwise, Grayscale, Fidelity, VanEck, Franklin Templeton, and ARK Invest. The Rex-Osprey XRP ETF goes live this week under the ’40 Act structure, which could further raise institutional demand. This would further raise institutional demand, driving the XRP supply lower. Beyond corporate treasuries and ETFs, XRP faces growing utility demand across…

The post XRP Supply On Coinbase Crashes 90%, Major Ripple Rally Ahead? appeared on BitcoinEthereumNews.com.

Ripple’s native cryptocurrency XRP is facing a major supply crunch, thereby raising analysts’ expectations for a major rally ahead. Latest reports suggest that the XRP supply on the Coinbase crypto exchange tanked 90% over the last three months. This comes as the Ripple treasury demand is on the rise, with analysts predicting an XRP rally to $5 soon. Coinbase’s XRP Supply Tanks 90% In Just Three Months On-chain data from XRPWallets shows a dramatic reduction in Coinbase’s visible XRP cold storage holdings. The cryptocurrency exchange’s XRP reserves dropped from approximately 970 million tokens held across 52 wallets in early June 2025 to just 99 million XRP distributed across 6 wallets by mid-September 2025. This shows a substantial 89.79% decline in cold wallet holdings over the three months. This sharp drop in Coinbase’s XRP reserves has raised questions about the underlying factors behind this change. Moreover, the consolidation from 52 wallets to just 6 wallets suggests a major restructuring of how the exchange manages its XRP holdings. Despite having a massive 100 billion supply, market analysts believe that the XRP supply shock is coming, amid massive Treasury demand, ETF developments, etc. Eight companies have now established XRP-based treasury strategies, signaling growing institutional confidence in the altcoin. The top holders of the treasury are Trident Digital Tech Holdings’, VivoPower International, Wedbush International, with each holding over $100 million of the Ripple cryptocurrency. On the other hand, a total of 11 spot XRP ETF applications await SEC approval from major asset managers, including Bitwise, Grayscale, Fidelity, VanEck, Franklin Templeton, and ARK Invest. The Rex-Osprey XRP ETF goes live this week under the ’40 Act structure, which could further raise institutional demand. This would further raise institutional demand, driving the XRP supply lower. Beyond corporate treasuries and ETFs, XRP faces growing utility demand across…

What's Your Reaction?