Amidst Legal Battle, Binance to Exit Russia

While fighting a legal battle with the SEC, troubled crypto exchange Binance has sold off their entire business in Russia to a possible shell company.

The below is a piece from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Binance, one of the world’s largest cryptocurrency exchanges, has seen several difficult months of various legal challenges, and recently sold all assets of their Russian branch to a company only founded days earlier.

The trouble began for this major exchange in June, when the Securities and Exchange Commission (SEC) sued Binance for alleged violation of securities law. Citing the “unregistered offers and sales of securities” and lying to potential investors “regarding surveillance and controls over manipulative trading,” the SEC put this company in the crosshairs of a major investigation. The Commission later chastised Binance in September about their lack of cooperation with federal regulators, and further action to unseal Binance’s record was carried out soon after.

Although Binance and its defenders have continued to assert that this lawsuit is an unfair attack in part of a federal “crypto crackdown,” new difficulties have been appearing in its fight since the legal battle escalated. A shockwave went through the Bitcoin community as Brian Shroder, CEO of Binance’s US branch, resigned on September 12 alongside a series of layoffs that eliminated approximately one third of the branch’s staff. American customers already are required to go through the Binance.us site to comply with regulators, and US dollars are no longer accepted by the platform. With these existing difficulties, the added trouble of layoffs and new management have put the future of Binance’s access to the entire American market at risk.

However, although the American operation of Binance has seen difficulties, it is still at least somewhat functional and nominally open for crypto transactions. These setbacks, in other words, truly pale in comparison to the announcement on September 27 that Binance was selling off all exchange services and business operations in the Russian Federation, denying any plans to have ongoing revenue sharing or stock buybacks. And the kicker? CommEX, the buyer of all these assets, is a company that first came into existence one day before the sale.

A move this dramatic certainly came with a large deal of speculation from the international Bitcoin community, with analyst Adam Cochrane identifying not only some telltale Binance fingerprints on CommEX’s online presence and a possible usage of the platform by Russian mercenaries in Nigeria and Ukraine. Although Binance’s press release claims that this move is prompted in part by a Department of Justice investigation into sanctions violations, CEO Changpeng “CZ” Zhao has denied that he is the owner of CommEX. Many former Binance employees will continue their functions at CommEX, however, and he assured that “all assets of existing Russian users are safe and securely protected.”

For a major international company already involved in a months-long legal battle with the federal government, these developments are exceptionally shady. Russia has long been one of the international crypto scene’s leading nations, with high levels of interest in purchasing Bitcoin and active development in crypto and blockchain technology. So, for Binance to abruptly and completely withdraw from this major market implies a serious disruption with their normal activities and a desperate state of operations. And what if the Justice Department continues this probe, suspecting that CommEX merely is a shell company created to avoid charges? Could a lawsuit for violating sanctions join the accusations of financial impropriety?

Binance has seen some good news in the days following this announcement, but also further setbacks. On September 30, two influential players in the cryptocurrency industry, stablecoin issuer Circle Internet Financial Ltd. and crypto investment fund Paradigm Operations filed amicus briefs in support of Binance’s attempt to dismiss the lawsuit against them. Although it is surely heartening to see support from companies with no financial stake in Binance — Circle is even partially owned by Binance’s competitor Coinbase — it is unclear whether the actions of these other firms will deter the SEC’s offensive.

Worse, it is no longer only the federal government targeting Binance through the SEC and Department of Justice. On October 3, Nir Lahav filed a class-action civil suit against Binance and several subsidiaries, specifically mentioning CEO Changpeng Zhao by name. Although this suit alleges that Binance has indeed violated SEC regulations, the goal of this lawsuit is for private entities to win compensation for damage to their businesses. In essence, Lahav and the plaintiffs have accused Binance of triggering the collapse of FTX, allowing Binance to secure more of the market.

These charges seem somewhat flimsy, especially considering that they allege foul play against a firm whose CEO is currently on trial for fraud and money laundering charges. Still, even if this lawsuit is dismissed in short order, it still is a very telling snapshot of the general attitude towards Binance: there is blood in the water. Perhaps these plaintiffs are primarily aiming to force Binance to settle with them, or perhaps they plan to pursue this fight as long as possible. Regardless, actions like this are rarely taken against multibillion dollar businesses with a stable footing.

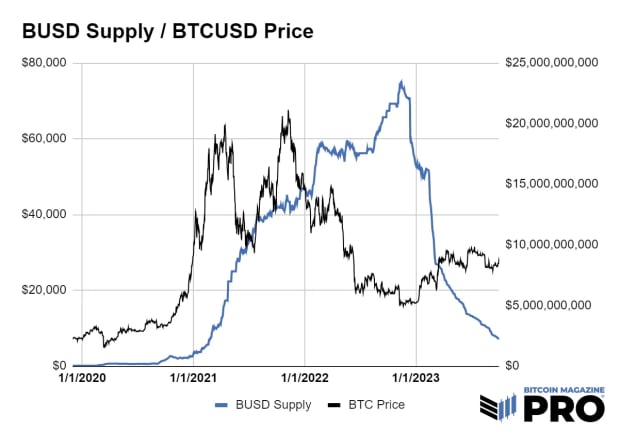

Even if this lawsuit flops without much impact to Binance’s underlying business, there are other warning signs that seem even more dire. There has been a dramatic fall from grace for Binance’s stablecoin, BUSD, as the firm announced on October 3rd that they would cease all borrowing and lending in BUSD before the end of the month. In August, Binance announced a gradual closure of the BUSD asset, albeit with a vague timeline of some time in 2024. To have such a major aspect of the token shuttered in such short order is typical of much smaller stablecoin operations. BUSD, however, had a peak market capitalization of $23 billion in November 2022, and has cratered dramatically in less than a year to barely over $2 billion. Evidently, something has gone deeply wrong with this previously-successful product, now that it is being abandoned entirely.

It’s anyone’s guess as to what happens to Binance from here, whether it ends up completely ceasing to exist a year from now or flourishing beyond its former prominence. In any event, the value of Bitcoin itself seems untangled from these proceedings. Although the entire crypto industry took a massive and sustained hit when FTX collapsed suddenly, the compounding difficulties for another giant crypto exchange have coincided with a solid performance by the biggest cryptocurrency. Perhaps Bitcoin has learned some lessons from previous setbacks, and will be more resilient to future setbacks. After all, if there’s one thing that these developments can demonstrate, it’s that the world of Bitcoin is a global business with multifarious connections. It’s far bigger than even the largest crypto exchange.

What's Your Reaction?