Beyond Bitcoin: How a Weakening Dollar Could Redraw the Crypto Landscape

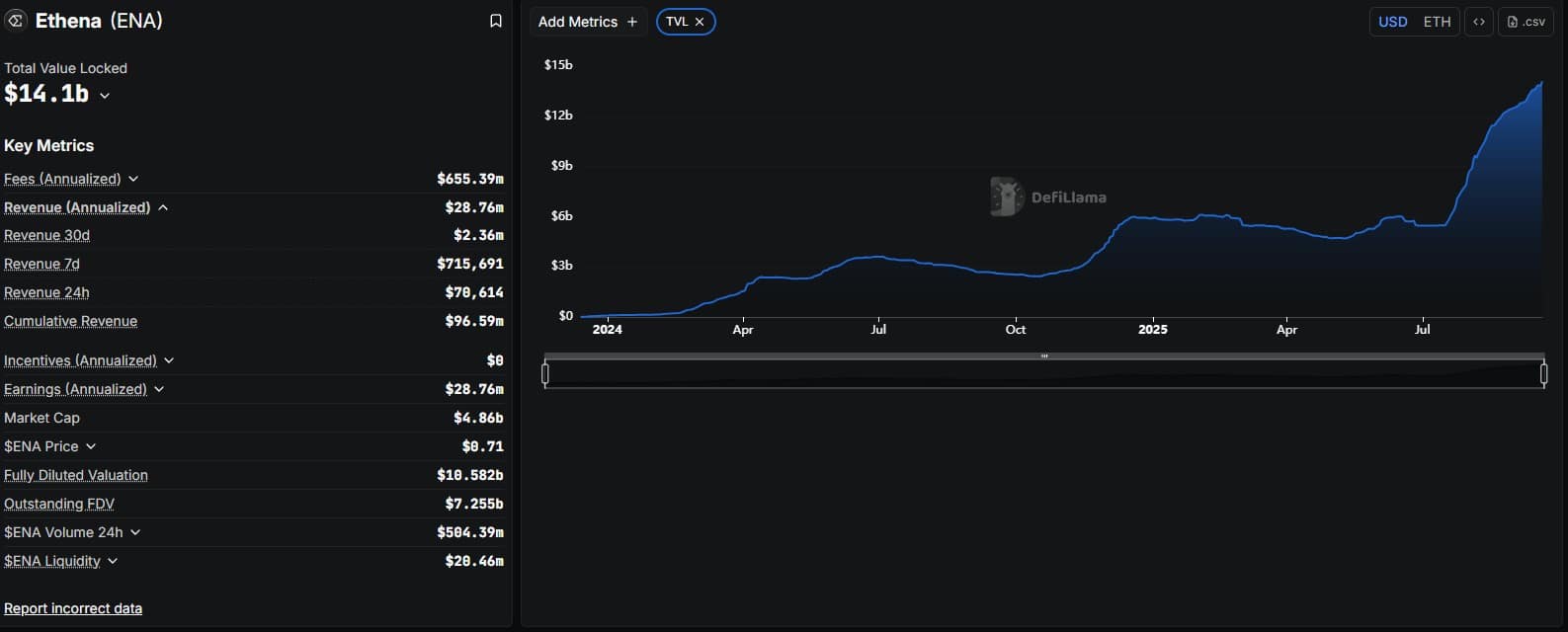

The post Beyond Bitcoin: How a Weakening Dollar Could Redraw the Crypto Landscape appeared on BitcoinEthereumNews.com. While Bitcoin frequently occupies the forefront of cryptocurrency discussions, a weakening trend in the U.S. dollar holds the potential to trigger profound shifts across the entire digital asset spectrum. The symbiotic relationship between the dollar and the crypto market has become increasingly complex over the course of 2025. With Bitcoin continuing to threaten a break beyond its all time high, some analysts attribute this momentum to the ongoing “US dollar deterioration” prompting investors to look beyond conventional assets. This shift in monetary dynamics, however, may only represent the initial phase of a far more extensive transformation poised to impact the entirety of the digital currency space. Alternative Cryptocurrencies Primed for Significant Rallies The sector comprising alternative cryptocurrencies – essentially all digital assets other than Bitcoin – appears strategically positioned for considerable expansion in an environment of dollar depreciation. Unlike Bitcoin, which has garnered significant acceptance among institutional players, many altcoins are still widely considered undervalued relative to their underlying technological capabilities. The digital asset markets have seen swift evolution, with numerous alternative coins demonstrating robust performance throughout 2025. This upward trend is gaining traction as institutional capital begins to diversify beyond solely holding Bitcoin, seeking exposure to a wider array of blockchain innovations and practical use cases. Ethereum continues to maintain its leading role in smart contract functionality, while newer platforms such as Solana have attracted considerable attention due to their enhanced transaction speeds and reduced costs. Market experts anticipate that alternative cryptocurrencies could experience disproportionately large gains during periods when the dollar is showing weakness. This phenomenon occurs because investors often perceive smaller digital assets as opportunities presenting higher risk but also potentially higher rewards. A declining dollar incentivizes investors to tolerate additional risk in pursuit of potentially superior returns. The anticipated introduction of exchange-traded funds (ETFs) focused on…

The post Beyond Bitcoin: How a Weakening Dollar Could Redraw the Crypto Landscape appeared on BitcoinEthereumNews.com.

While Bitcoin frequently occupies the forefront of cryptocurrency discussions, a weakening trend in the U.S. dollar holds the potential to trigger profound shifts across the entire digital asset spectrum. The symbiotic relationship between the dollar and the crypto market has become increasingly complex over the course of 2025. With Bitcoin continuing to threaten a break beyond its all time high, some analysts attribute this momentum to the ongoing “US dollar deterioration” prompting investors to look beyond conventional assets. This shift in monetary dynamics, however, may only represent the initial phase of a far more extensive transformation poised to impact the entirety of the digital currency space. Alternative Cryptocurrencies Primed for Significant Rallies The sector comprising alternative cryptocurrencies – essentially all digital assets other than Bitcoin – appears strategically positioned for considerable expansion in an environment of dollar depreciation. Unlike Bitcoin, which has garnered significant acceptance among institutional players, many altcoins are still widely considered undervalued relative to their underlying technological capabilities. The digital asset markets have seen swift evolution, with numerous alternative coins demonstrating robust performance throughout 2025. This upward trend is gaining traction as institutional capital begins to diversify beyond solely holding Bitcoin, seeking exposure to a wider array of blockchain innovations and practical use cases. Ethereum continues to maintain its leading role in smart contract functionality, while newer platforms such as Solana have attracted considerable attention due to their enhanced transaction speeds and reduced costs. Market experts anticipate that alternative cryptocurrencies could experience disproportionately large gains during periods when the dollar is showing weakness. This phenomenon occurs because investors often perceive smaller digital assets as opportunities presenting higher risk but also potentially higher rewards. A declining dollar incentivizes investors to tolerate additional risk in pursuit of potentially superior returns. The anticipated introduction of exchange-traded funds (ETFs) focused on…

What's Your Reaction?