Bitcoin (BTC) Price Prediction: Bitcoin Holds Firm After $50B Whale Sell-Off—Can Institutional Control Fuel the $150K Surge?

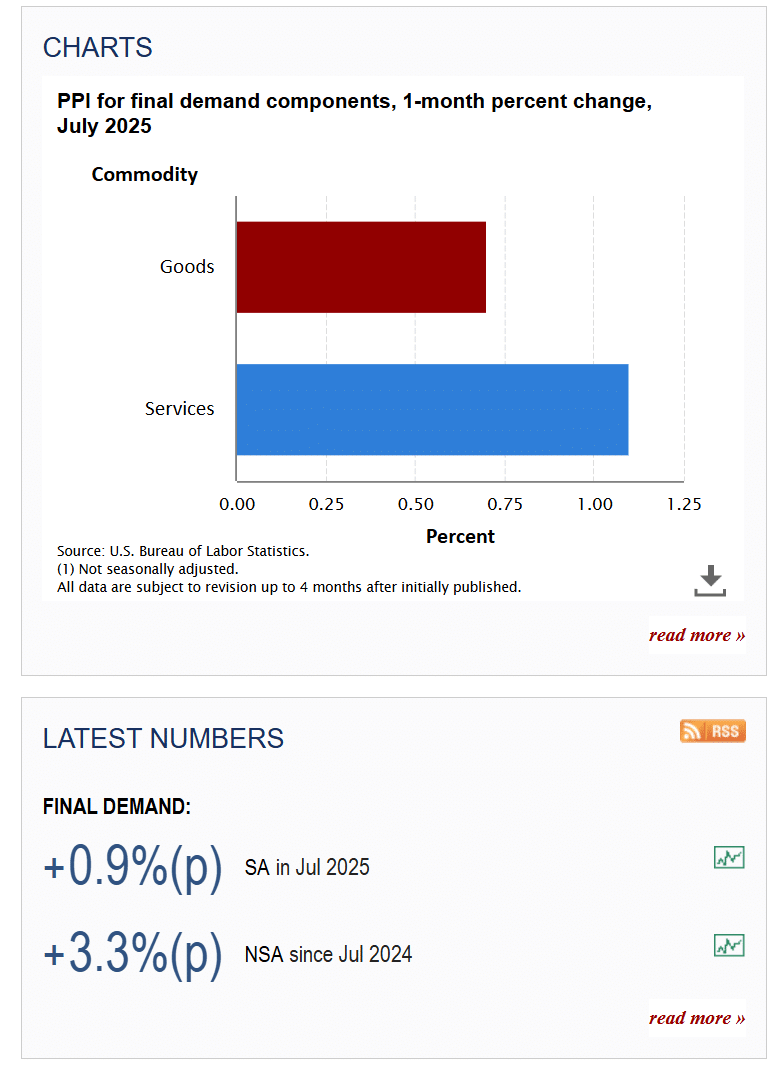

The post Bitcoin (BTC) Price Prediction: Bitcoin Holds Firm After $50B Whale Sell-Off—Can Institutional Control Fuel the $150K Surge? appeared on BitcoinEthereumNews.com. Bitcoin is showing impressive resilience following a $50 billion whale sell-off, with institutional investors stepping in to stabilize the market. As BTC price hovers above key support zones, market watchers are asking: can this renewed institutional dominance drive Bitcoin to $150,000? Bitcoin Market Overview: Technicals Suggest Steady Support Despite the recent turbulence caused by long-time holders offloading over 500,000 BTC, equivalent to more than $50 billion, the Bitcoin price today is holding steady above the $108,500 level. This resilience is largely attributed to institutional demand absorbing the excess supply. On the 2-hour chart, Bitcoin is consolidating between 50% and 61.8% Fibonacci levels, with a “fib squeeze” forming between $107,840 and $108,624. The 50-SMA and 100-SMA are converging, signaling a likely breakout. Bitcoin’s uptrend is likely to continue toward key resistance levels, but a reversal could follow unless the price consolidates above this immediate supply zone. Source: STPFOREX on TradingView If BTC manages to close above the $110,000 resistance, technical analysts suggest the next major targets could be $112,000, $113,200, and even $115,000. On the downside, major support zones lie at $108,350, $107,250, and $105,000. Hourly indicators also remain optimistic: MACD is gaining bullish momentum. RSI is above 50, indicating strengthening buying pressure. This technical stability suggests a controlled, potentially bullish environment, despite underlying volatility. Whales Out, Institutions In: A New Era for Bitcoin While traditional Bitcoin whales have been reducing their exposure, institutional buyers have not only matched but exceeded this selling pressure. According to 10x Research, institutional entities—including spot Bitcoin ETFs, asset managers, and corporate treasuries—have accumulated nearly 900,000 BTC over the past year. According to 10x Research, Bitcoin whales have sold over 500,000 BTC in the past year, totaling more than $50 billion at current prices. Source: Cam via X “We’re seeing whales convert BTC into equity exposure…

The post Bitcoin (BTC) Price Prediction: Bitcoin Holds Firm After $50B Whale Sell-Off—Can Institutional Control Fuel the $150K Surge? appeared on BitcoinEthereumNews.com.

Bitcoin is showing impressive resilience following a $50 billion whale sell-off, with institutional investors stepping in to stabilize the market. As BTC price hovers above key support zones, market watchers are asking: can this renewed institutional dominance drive Bitcoin to $150,000? Bitcoin Market Overview: Technicals Suggest Steady Support Despite the recent turbulence caused by long-time holders offloading over 500,000 BTC, equivalent to more than $50 billion, the Bitcoin price today is holding steady above the $108,500 level. This resilience is largely attributed to institutional demand absorbing the excess supply. On the 2-hour chart, Bitcoin is consolidating between 50% and 61.8% Fibonacci levels, with a “fib squeeze” forming between $107,840 and $108,624. The 50-SMA and 100-SMA are converging, signaling a likely breakout. Bitcoin’s uptrend is likely to continue toward key resistance levels, but a reversal could follow unless the price consolidates above this immediate supply zone. Source: STPFOREX on TradingView If BTC manages to close above the $110,000 resistance, technical analysts suggest the next major targets could be $112,000, $113,200, and even $115,000. On the downside, major support zones lie at $108,350, $107,250, and $105,000. Hourly indicators also remain optimistic: MACD is gaining bullish momentum. RSI is above 50, indicating strengthening buying pressure. This technical stability suggests a controlled, potentially bullish environment, despite underlying volatility. Whales Out, Institutions In: A New Era for Bitcoin While traditional Bitcoin whales have been reducing their exposure, institutional buyers have not only matched but exceeded this selling pressure. According to 10x Research, institutional entities—including spot Bitcoin ETFs, asset managers, and corporate treasuries—have accumulated nearly 900,000 BTC over the past year. According to 10x Research, Bitcoin whales have sold over 500,000 BTC in the past year, totaling more than $50 billion at current prices. Source: Cam via X “We’re seeing whales convert BTC into equity exposure…

What's Your Reaction?