BTC USD Slams New ATH at $124K: Can Bitcoin Price Hit $130K This Week?

Crypto is pumping, and behind this uptick is the ever-firm BTC USD price, which skyrocketed above $123,000 yesterday, printing fresh all-time highs of over $124,700. Although the momentum has dropped since the break higher, the uptrend remains, and every low may be an opportunity for aggressive bulls targeting $130,000 this week and $150,000 by the.. The post BTC USD Slams New ATH at $124K: Can Bitcoin Price Hit $130K This Week? appeared first on 99Bitcoins.

Crypto is pumping, and behind this uptick is the ever-firm BTC USD price, which skyrocketed above $123,000 yesterday, printing fresh all-time highs of over $124,700. Although the momentum has dropped since the break higher, the uptrend remains, and every low may be an opportunity for aggressive bulls targeting $130,000 this week and $150,000 by the end of Q3 2025.

Bitcoin Prints Fresh All-Time Highs of Nearly $125,000

From the daily chart, the BTC ▲1.30% price is up by over 60% after dropping to as low as $74,000 in April 2025. At spot rates, buyers are squarely in control, and a close above $125,000 this week will be the spring for $130,000.

What’s needed is a clean close above $125,000 and the chop of July 2025. If this breakout is with higher trading volume, there will be a high probability of the Bitcoin price rallying to as high as $130,000 within the next 48 hours.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

BTC USD Rally: What’s Driving the Surge?

The Bitcoin rally of the past three months has cemented its position as a leading asset, drawing institutions and even comments from politicians and regulators.

Pro-Crypto Policies

Increasingly, more policymakers in the United States and Europe have been monitoring crypto, with their eyes on Bitcoin, thanks in part to its stellar performance over the past eight months after Donald Trump became president for the second time.

Under Trump, Gary Gensler resigned in January, and Paul Watkins was installed in his place. Under his leadership, the United States SEC has expressed full support for some of the best cryptos to buy, including Bitcoin. The regulator has since dropped lawsuits against Ripple, Binance, and Coinbase.

Three proposals, including CLARITY, GENIUS, and Anti-CBDC acts, have since been discussed. The GENIUS Act has since been passed into law. The CLARITY Act, which classifies Bitcoin as a commodity under the CFTC, will also see it enacted in the coming months. On the other hand, the Anti-CBDC Act, which bans the creation of a CBDC in the United States, preserves Bitcoin’s appeal as a decentralized alternative.

Moreover, Trump signed an executive order establishing a United States Strategic Bitcoin Reserve.

Under the proposed BITCOIN Act, the United States is supposed to acquire 1 million BTC over five years, signalling Bitcoin’s role as a national strategic asset.

States like Arizona and New Hampshire have since launched their reserves.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Public Companies Hoarding BTC

Public companies are doubling down on digital gold, adding it to their treasury assets.

The more they buy BTC from the secondary market, the more scarce the asset becomes, reducing its circulating supply. This, in turn, drives prices higher, lifting the demand for some of the best meme coin ICOs in the process.

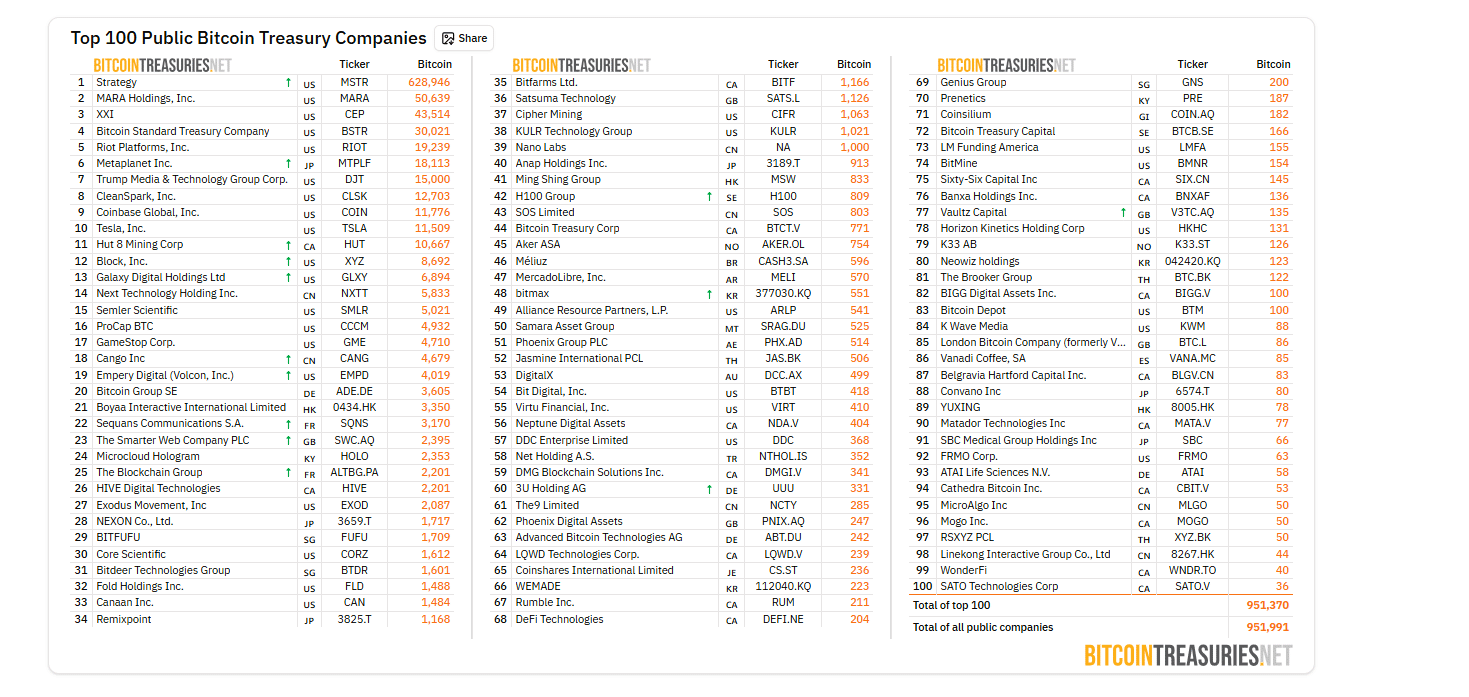

According to Bitcoin Treasuries, the top 100 public companies own over 800,000 BTC.

(Source: Bitcoin Treasuries)

Leading the way is Strategy, which controls 628,946 BTC as of August 14. Other notable holders are MARA Holdings and XXI, which control over 93,000 BTC.

Tesla, Block, and GameStop also hold BTC in their balance sheets, creating scarcity and pushing the BTC USD price higher.

Institutional Demand

Beyond public companies hoarding BTC, there is a massive inflow from institutions.

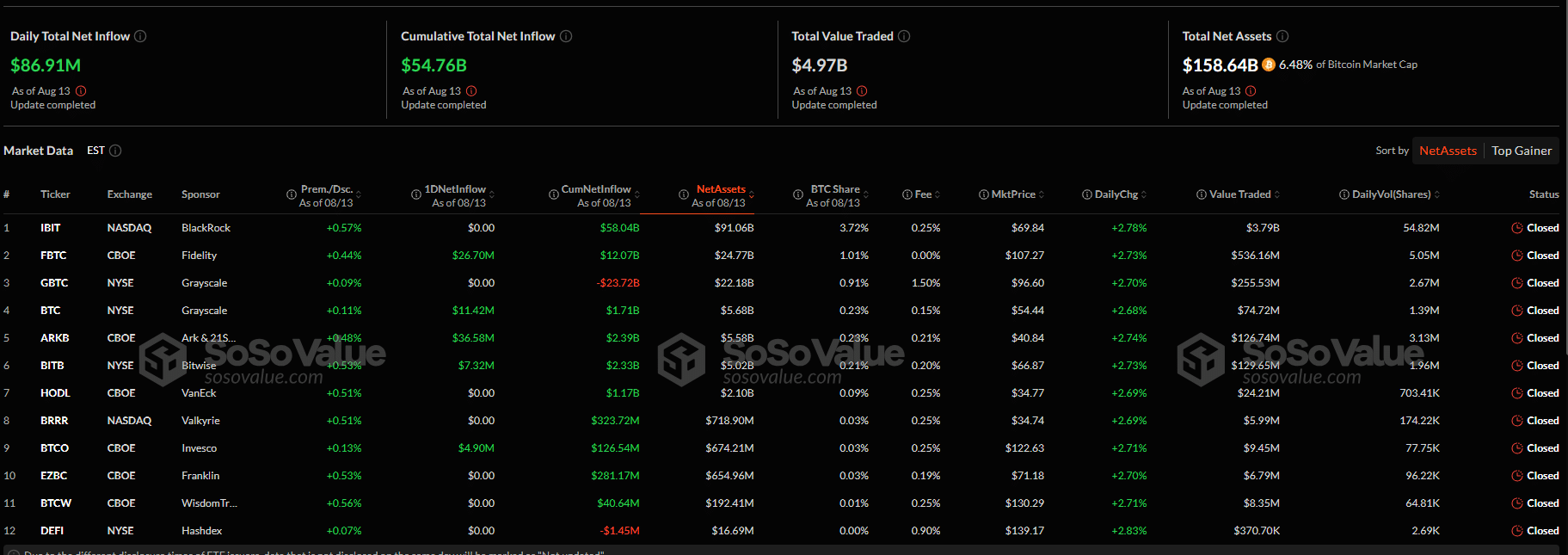

Latest data from SosoValue shows that institutions bought $86.91 million of spot Bitcoin ETFs on August 13, pushing their total holdings to over $158 billion.

(Source: Soso Value)

Institutions, holding shares of various spot Bitcoin ETFs, including those issued by BlackRock and Fidelity, now control over 6.4% of all BTC in the circulating supply.

DISCOVER: 20+ Next Crypto to Explode in 2025

Macroeconomic Tailwinds

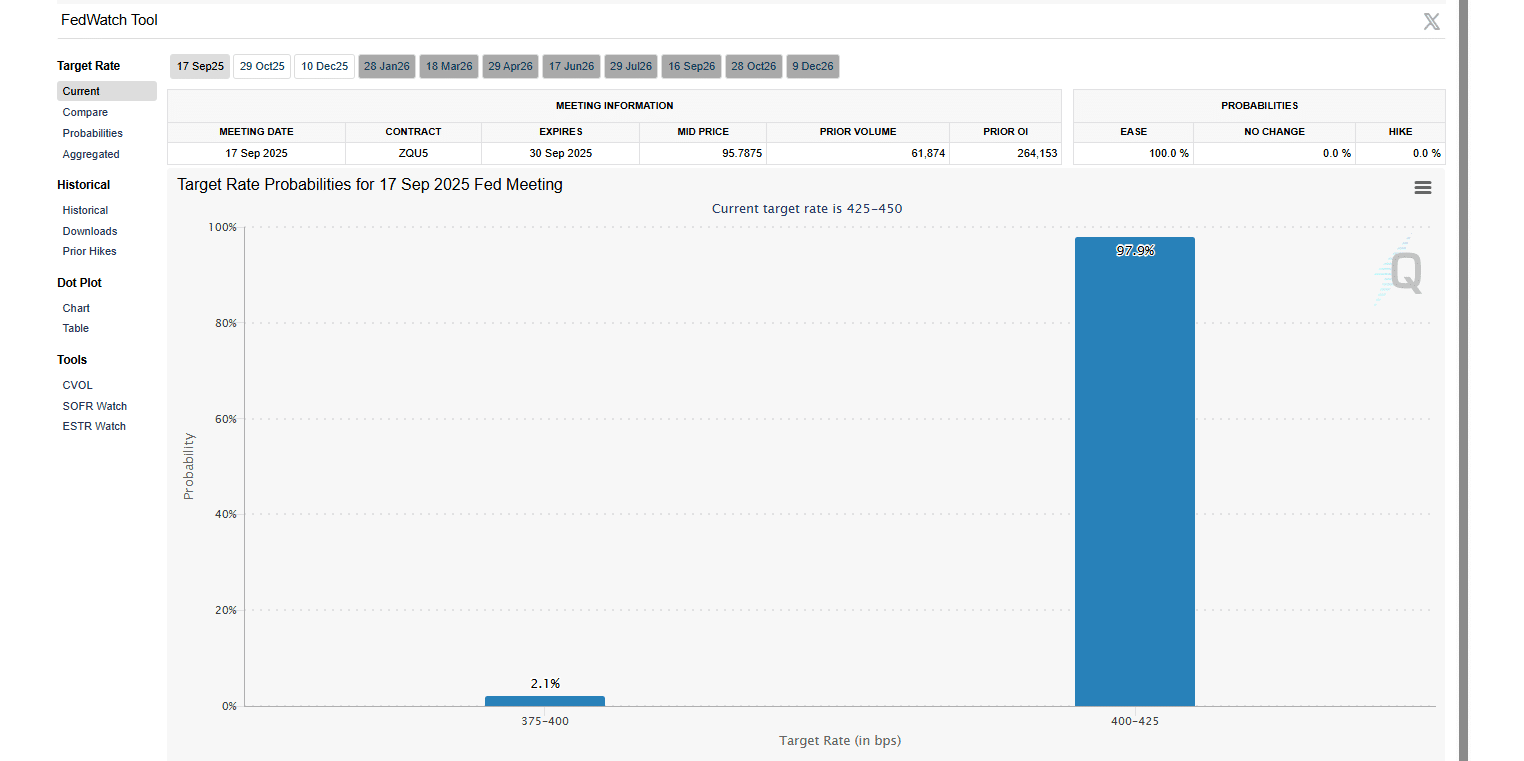

Bitcoin is also seen as a hedge against inflation. Inflation in the United States is rising, but the Federal Reserve will likely slash rates in September.

Treasury Secretary Scott Bessent expects a “series of rate cuts,” starting with a 50 basis point cut in September. Goldman Sachs expects the Federal Reserve to cut rates by 75 basis points by the end of the year.

Still, according to the CME FedWatch, there is a 98% chance of the Federal Reserve keeping rates unchanged at around the 4.25-4.50% range.

(Source: CME FedWatch)

Regardless of the margin, any rate cut makes Bitcoin and other safe havens appealing.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

BTC USD Prints New ATH, Bitcoin Price To $130K This Week?

- BTC USD breaks $123,000, prints fresh all-time highs

- Will the Bitcoin price reach $130,000 this week?

- Bitcoin is soaring on favorable crypto policies, institutional demand, and accumulation by public companies

- Will the Federal Reserve cut rates in September?

The post BTC USD Slams New ATH at $124K: Can Bitcoin Price Hit $130K This Week? appeared first on 99Bitcoins.

What's Your Reaction?