Coinbase Struggles as Market Volatility Rises

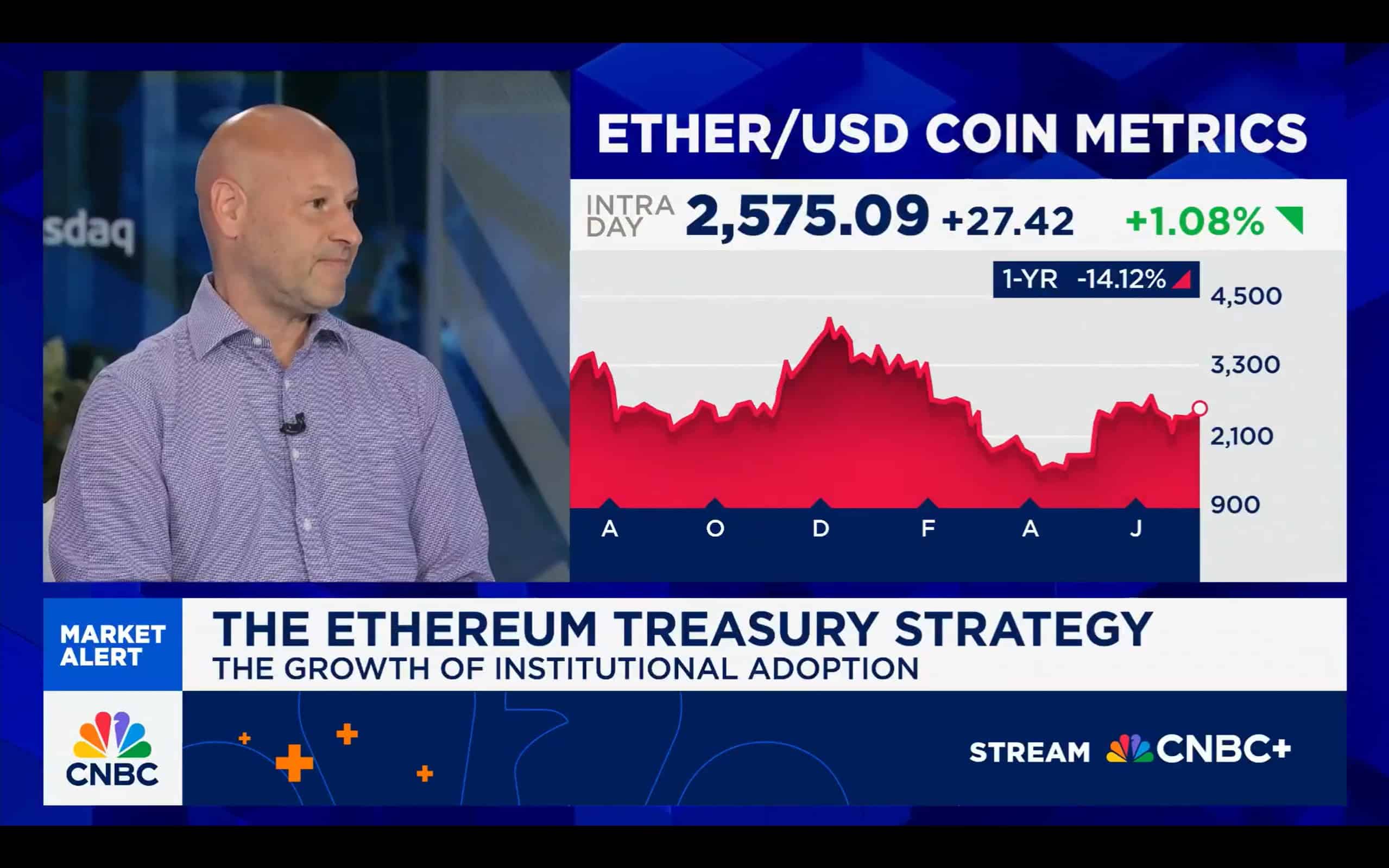

The post Coinbase Struggles as Market Volatility Rises appeared on BitcoinEthereumNews.com. Coinbase’s financial performance during the first quarter highlighted significant challenges posed by economic unpredictability and a sluggish market environment. Reporting earnings of $2 billion, the cryptocurrency exchange fell short of the previous quarter’s $2.27 billion. These figures reflect the broader impact of economic instability in the U.S. and a downturn within the market. What Impacted Coinbase’s Performance?Can the Market Rebound Soon? What Impacted Coinbase’s Performance? The company’s earnings per share came to just $0.24, much lower than the anticipated $1.93. Trading volumes also experienced a 10% decline, bringing them down to $393.1 billion. This drop contributed to a 19% decrease in transaction revenues. Challenges from economic uncertainties and heightened cryptocurrency volatility were key factors driving these outcomes. Can the Market Rebound Soon? There are signs suggesting a possible improvement in the market. Despite broader market declines influenced by tariff policies, a January upswing in Bitcoin prices offers some optimism. Reports from financial analysis firms like J.P. Morgan and Barclays express cautious outlooks, though recent developments point to a more positive second quarter ahead. Coinbase strategically disclosed its acquisition of Deribit just before releasing its earnings. This move reflects the company’s strategic foresight, aiming for significant investments in the crypto sector through the year. Yet, on the day of this announcement, Coinbase’s shares still dipped by 2.7% during after-hours trading. Additionally, MARA Holdings Inc. posted a robust 30% rise in first-quarter earnings, amassing $213.9 million. This surge came alongside substantial increases in Bitcoin holdings, demonstrating a swift enhancement in energy and infrastructure operations. MARA’s revenue growth from $165.2 million to $213.9 million highlights its successful strategies, contrasting with Coinbase’s struggles. Key insights from the first quarter include: Coinbase’s revenue failed to meet previous quarterly results, showing a financial hit. The company observed a 10% reduction in trading volumes, greatly impacting profits.…

The post Coinbase Struggles as Market Volatility Rises appeared on BitcoinEthereumNews.com.

Coinbase’s financial performance during the first quarter highlighted significant challenges posed by economic unpredictability and a sluggish market environment. Reporting earnings of $2 billion, the cryptocurrency exchange fell short of the previous quarter’s $2.27 billion. These figures reflect the broader impact of economic instability in the U.S. and a downturn within the market. What Impacted Coinbase’s Performance?Can the Market Rebound Soon? What Impacted Coinbase’s Performance? The company’s earnings per share came to just $0.24, much lower than the anticipated $1.93. Trading volumes also experienced a 10% decline, bringing them down to $393.1 billion. This drop contributed to a 19% decrease in transaction revenues. Challenges from economic uncertainties and heightened cryptocurrency volatility were key factors driving these outcomes. Can the Market Rebound Soon? There are signs suggesting a possible improvement in the market. Despite broader market declines influenced by tariff policies, a January upswing in Bitcoin prices offers some optimism. Reports from financial analysis firms like J.P. Morgan and Barclays express cautious outlooks, though recent developments point to a more positive second quarter ahead. Coinbase strategically disclosed its acquisition of Deribit just before releasing its earnings. This move reflects the company’s strategic foresight, aiming for significant investments in the crypto sector through the year. Yet, on the day of this announcement, Coinbase’s shares still dipped by 2.7% during after-hours trading. Additionally, MARA Holdings Inc. posted a robust 30% rise in first-quarter earnings, amassing $213.9 million. This surge came alongside substantial increases in Bitcoin holdings, demonstrating a swift enhancement in energy and infrastructure operations. MARA’s revenue growth from $165.2 million to $213.9 million highlights its successful strategies, contrasting with Coinbase’s struggles. Key insights from the first quarter include: Coinbase’s revenue failed to meet previous quarterly results, showing a financial hit. The company observed a 10% reduction in trading volumes, greatly impacting profits.…

What's Your Reaction?