Ethereum Price Nears $4,000 as ETH Weekly Close Looms Large

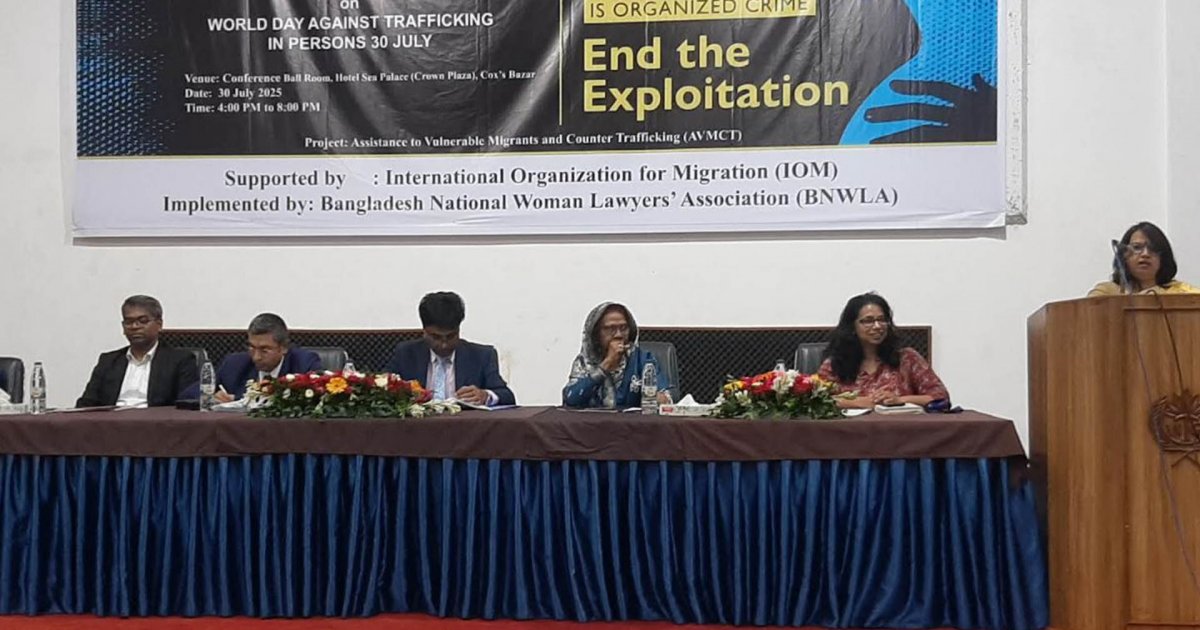

The post Ethereum Price Nears $4,000 as ETH Weekly Close Looms Large appeared on BitcoinEthereumNews.com. TLDR: Ethereum reclaims $2,991 and trades within a $2,200–$4,000 macro demand zone. ETH tapped liquidity near $3,750, suggesting bullish continuation remains in play. Analysts say $3,544 is key support; holding it raises breakout chances above $4,000. Weekly close above $2,991 could confirm the next macro push toward $4,200+. Ethereum is inching closer to the $4,000 mark again, but the next few days could change everything. Price movements are tightening, and technical levels are starting to matter more than ever. Analysts say the market is at a decision point. Whether ETH breaks higher or slides back depends on how it handles this weekend’s close. Right now, traders are watching key levels with one question in mind: will ETH finally flip this range? ETH Price Enters Key Macro Range Crypto analyst Rekt Capital noted that Ethereum had dipped into a major historical demand area in mid-April. Since then, it’s regained ground and re-entered the $2,200 to $4,000 macro range. The current price, as of today, stands at $3,732.85, according to CoinGecko. ETH has gained over 3% this week and is showing signs of momentum. ETH price on CoinGecko Breaking above $2,991 was seen as a major step. According to Rekt Capital, this level historically acts as a midpoint. Above it, ETH targets the upper half of the range, pushing toward $4,000. Below it, the market tends to drift lower, sometimes back to $2,500 or even $2,200. The next weekly candle close will likely dictate which side wins. ETH recently tapped a key liquidity zone near $3,750. According to @CryptoProject6, this sweep of a past order block suggests bullish continuation is still in play. However, a short dip could follow. The analyst expects Ethereum might correct to the $3,250–$3,300 range, where a new fair value gap (FVG) has opened. $ETH just tapped into…

The post Ethereum Price Nears $4,000 as ETH Weekly Close Looms Large appeared on BitcoinEthereumNews.com.

TLDR: Ethereum reclaims $2,991 and trades within a $2,200–$4,000 macro demand zone. ETH tapped liquidity near $3,750, suggesting bullish continuation remains in play. Analysts say $3,544 is key support; holding it raises breakout chances above $4,000. Weekly close above $2,991 could confirm the next macro push toward $4,200+. Ethereum is inching closer to the $4,000 mark again, but the next few days could change everything. Price movements are tightening, and technical levels are starting to matter more than ever. Analysts say the market is at a decision point. Whether ETH breaks higher or slides back depends on how it handles this weekend’s close. Right now, traders are watching key levels with one question in mind: will ETH finally flip this range? ETH Price Enters Key Macro Range Crypto analyst Rekt Capital noted that Ethereum had dipped into a major historical demand area in mid-April. Since then, it’s regained ground and re-entered the $2,200 to $4,000 macro range. The current price, as of today, stands at $3,732.85, according to CoinGecko. ETH has gained over 3% this week and is showing signs of momentum. ETH price on CoinGecko Breaking above $2,991 was seen as a major step. According to Rekt Capital, this level historically acts as a midpoint. Above it, ETH targets the upper half of the range, pushing toward $4,000. Below it, the market tends to drift lower, sometimes back to $2,500 or even $2,200. The next weekly candle close will likely dictate which side wins. ETH recently tapped a key liquidity zone near $3,750. According to @CryptoProject6, this sweep of a past order block suggests bullish continuation is still in play. However, a short dip could follow. The analyst expects Ethereum might correct to the $3,250–$3,300 range, where a new fair value gap (FVG) has opened. $ETH just tapped into…

What's Your Reaction?