Real World Assets Tokenization: $65B & Mainstream

The post Real World Assets Tokenization: $65B & Mainstream appeared on BitcoinEthereumNews.com. The tokenization of real world assets (RWAs) is gaining recognition from institutions seeking collateral mobility, issuers making private, alternative assets more accessible to retail investors and crypto enthusiasts engaging in more serious conversations as compared to the NFT and memecoin craze of past years. As predicted earlier this year, tokenization is solidifying its position and moving into the “pragmatists” portion of the adoption bell curve. 2024 ended with a $50 billion market cap and as of May 2025 has surpassed $65 billion, excluding stablecoins. A recent conference, TokenizeThis 2025, brought together industry leaders to dive deep into specific areas of the tokenization space, celebrating innovative accomplishments and evaluating how to tackle remaining challenges to reach mainstream adoption. While the conference panel topics delved into granular areas, a couple overarching themes to highlight include 1) collateral mobility and new utility enhancing real world assets and 2) the effects tokenization will have on investment strategies and workflows. Adding utility and collateral mobility “I think that’s actually what makes this technology so powerful is that you’re talking about the same token but it can be used in very different ways for very different investors as long as of course the risk framework is right,” said Maredith Hannon, head of business development, digital assets at WisdomTree. While tokenizing assets is straightforward, the real opportunity lies in enabling more streamlined usage of assets compared to their traditional counterparts and addressing the needs of different participants. A panel dedicated to this topic shared examples of tokenized treasury products that can be used in both retail and institutional settings. Because blockchain allows an asset to move more freely, a money market fund could be used as collateral on a prime brokerage, eliminating the need to exit from that position thus still earning its corresponding yield for the…

The post Real World Assets Tokenization: $65B & Mainstream appeared on BitcoinEthereumNews.com.

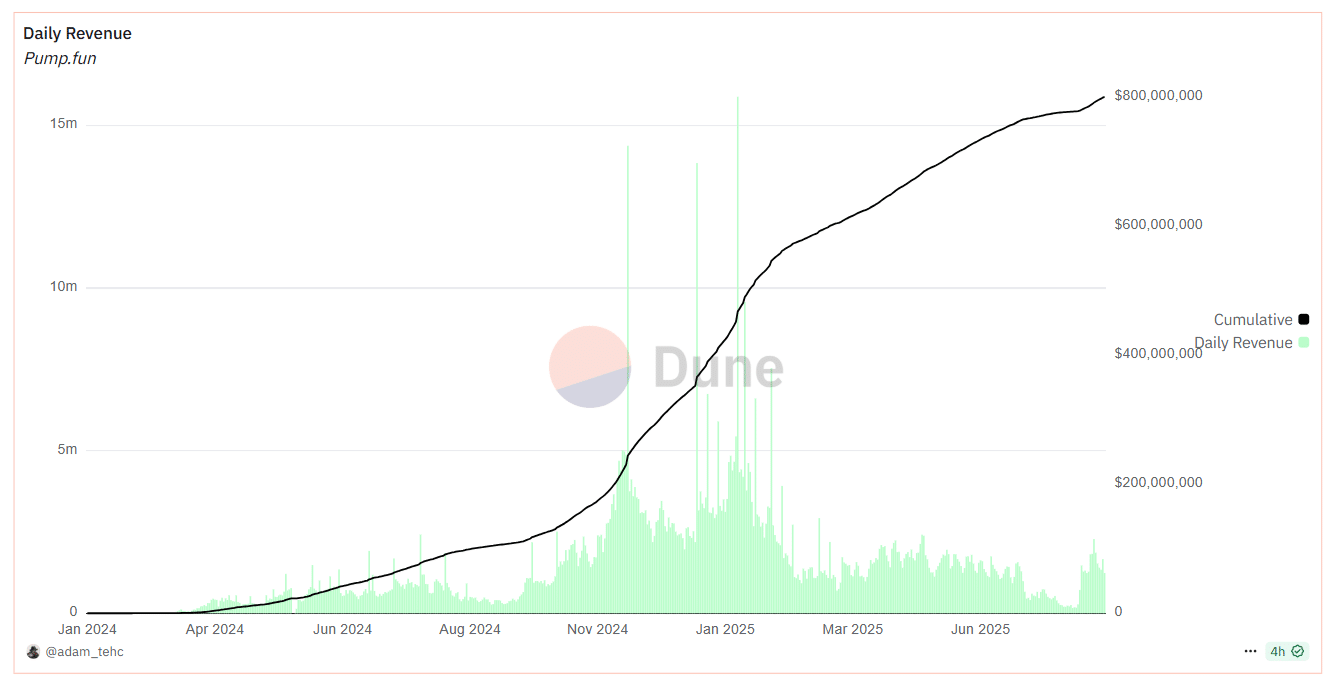

The tokenization of real world assets (RWAs) is gaining recognition from institutions seeking collateral mobility, issuers making private, alternative assets more accessible to retail investors and crypto enthusiasts engaging in more serious conversations as compared to the NFT and memecoin craze of past years. As predicted earlier this year, tokenization is solidifying its position and moving into the “pragmatists” portion of the adoption bell curve. 2024 ended with a $50 billion market cap and as of May 2025 has surpassed $65 billion, excluding stablecoins. A recent conference, TokenizeThis 2025, brought together industry leaders to dive deep into specific areas of the tokenization space, celebrating innovative accomplishments and evaluating how to tackle remaining challenges to reach mainstream adoption. While the conference panel topics delved into granular areas, a couple overarching themes to highlight include 1) collateral mobility and new utility enhancing real world assets and 2) the effects tokenization will have on investment strategies and workflows. Adding utility and collateral mobility “I think that’s actually what makes this technology so powerful is that you’re talking about the same token but it can be used in very different ways for very different investors as long as of course the risk framework is right,” said Maredith Hannon, head of business development, digital assets at WisdomTree. While tokenizing assets is straightforward, the real opportunity lies in enabling more streamlined usage of assets compared to their traditional counterparts and addressing the needs of different participants. A panel dedicated to this topic shared examples of tokenized treasury products that can be used in both retail and institutional settings. Because blockchain allows an asset to move more freely, a money market fund could be used as collateral on a prime brokerage, eliminating the need to exit from that position thus still earning its corresponding yield for the…

What's Your Reaction?