XRP flashes major ‘sell signal’ as temporary price buffer is identified

The post XRP flashes major ‘sell signal’ as temporary price buffer is identified appeared on BitcoinEthereumNews.com. Although XRP has gained some ground in the last 24 hours in a bid to breach the $3 resistance, the asset’s technical structure is painting a concerning picture for the short term. According to analysis by Ali Martinez, the TD Sequential recently flashed a sell signal on the three-day chart, prompting a notable price pullback below the $3 mark, he noted in an X post on August 3. The warning signal came after XRP reached highs above $3.60, with the bearish cue suggesting that the latest rally could be running out of steam. The 9-count TD Sequential signal, known for predicting trend exhaustion, appeared just as XRP approached a resistance zone between $3.60 and $4. Since then, prices have been sliding steadily, and the token is now approaching a key short-term support level. XRP price analysis chart. Source: TradingView At the same time, on-chain data shows that past accumulation behavior points to $2.80 as a temporary buffer for XRP, but real support begins below $2.48. To this end, Martinez identified $2.40 as the critical zone to watch. If XRP continues to bleed lower, this level could act as a final line of defense for bulls to regroup. A failure to hold above $2.40 may open the door for deeper losses, possibly revisiting the $2.00 region. XRP URPD price chart. Source: Glassnode XRP price analysis At press time, XRP was trading at $2.92, having rallied over 5% in the last 24 hours. On the weekly timeframe, however, the asset has plunged nearly 10%. XRP seven-day price chart. Source: Finbold At the current value, XRP’s 50-day Simple Moving Average (SMA) of $2.65 shows the price is holding above the short-term trend, hinting at bullish sentiment. Meanwhile, the 200-day SMA at $1.875269 reflects a long-term upward trend. Featured image via Shutterstock Source: https://finbold.com/xrp-flashes-major-sell-signal-as-temporary-price-buffer-is-identified/

The post XRP flashes major ‘sell signal’ as temporary price buffer is identified appeared on BitcoinEthereumNews.com.

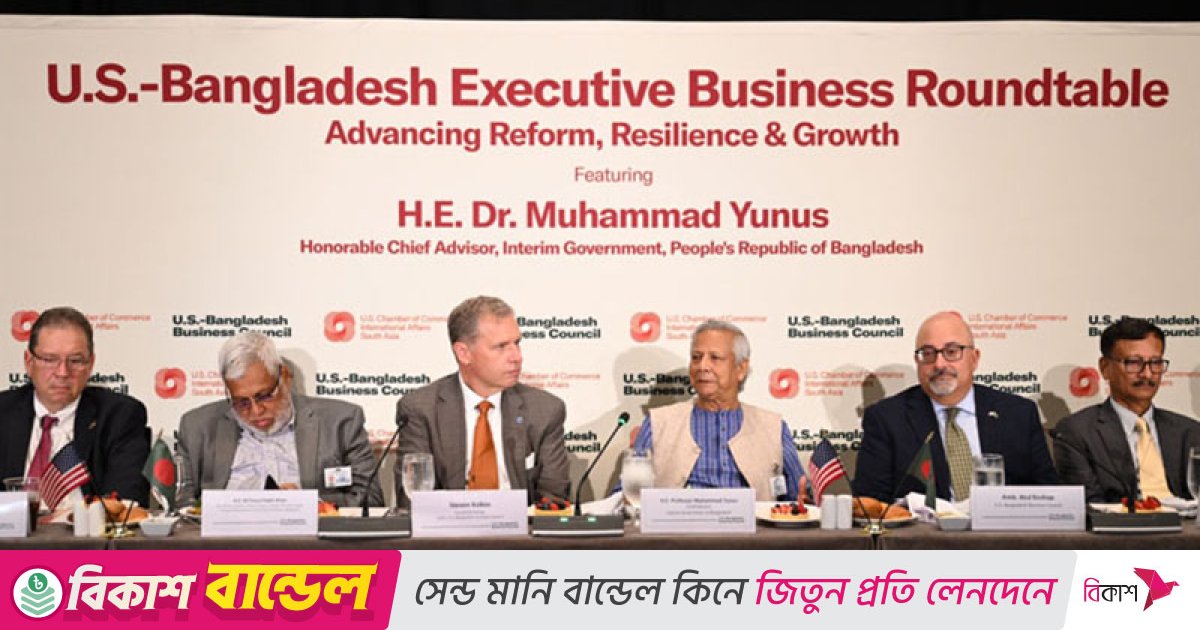

Although XRP has gained some ground in the last 24 hours in a bid to breach the $3 resistance, the asset’s technical structure is painting a concerning picture for the short term. According to analysis by Ali Martinez, the TD Sequential recently flashed a sell signal on the three-day chart, prompting a notable price pullback below the $3 mark, he noted in an X post on August 3. The warning signal came after XRP reached highs above $3.60, with the bearish cue suggesting that the latest rally could be running out of steam. The 9-count TD Sequential signal, known for predicting trend exhaustion, appeared just as XRP approached a resistance zone between $3.60 and $4. Since then, prices have been sliding steadily, and the token is now approaching a key short-term support level. XRP price analysis chart. Source: TradingView At the same time, on-chain data shows that past accumulation behavior points to $2.80 as a temporary buffer for XRP, but real support begins below $2.48. To this end, Martinez identified $2.40 as the critical zone to watch. If XRP continues to bleed lower, this level could act as a final line of defense for bulls to regroup. A failure to hold above $2.40 may open the door for deeper losses, possibly revisiting the $2.00 region. XRP URPD price chart. Source: Glassnode XRP price analysis At press time, XRP was trading at $2.92, having rallied over 5% in the last 24 hours. On the weekly timeframe, however, the asset has plunged nearly 10%. XRP seven-day price chart. Source: Finbold At the current value, XRP’s 50-day Simple Moving Average (SMA) of $2.65 shows the price is holding above the short-term trend, hinting at bullish sentiment. Meanwhile, the 200-day SMA at $1.875269 reflects a long-term upward trend. Featured image via Shutterstock Source: https://finbold.com/xrp-flashes-major-sell-signal-as-temporary-price-buffer-is-identified/

What's Your Reaction?