Bitcoin Cross-Border Payments More 'Substantial' Than Public Data Shows

The Bank of International Settlements (BIS) has shed light on the true extent of Bitcoin's impact on cross-border payments.

A new study conducted by the Bank of International Settlements (BIS) has shed light on the true extent of Bitcoin's impact on cross-border payments, revealing that its significance may be even greater than previously believed.

According to a report by Reuters, the findings challenge conventional assumptions and underscore the growing relevance of Bitcoin in the global financial landscape.

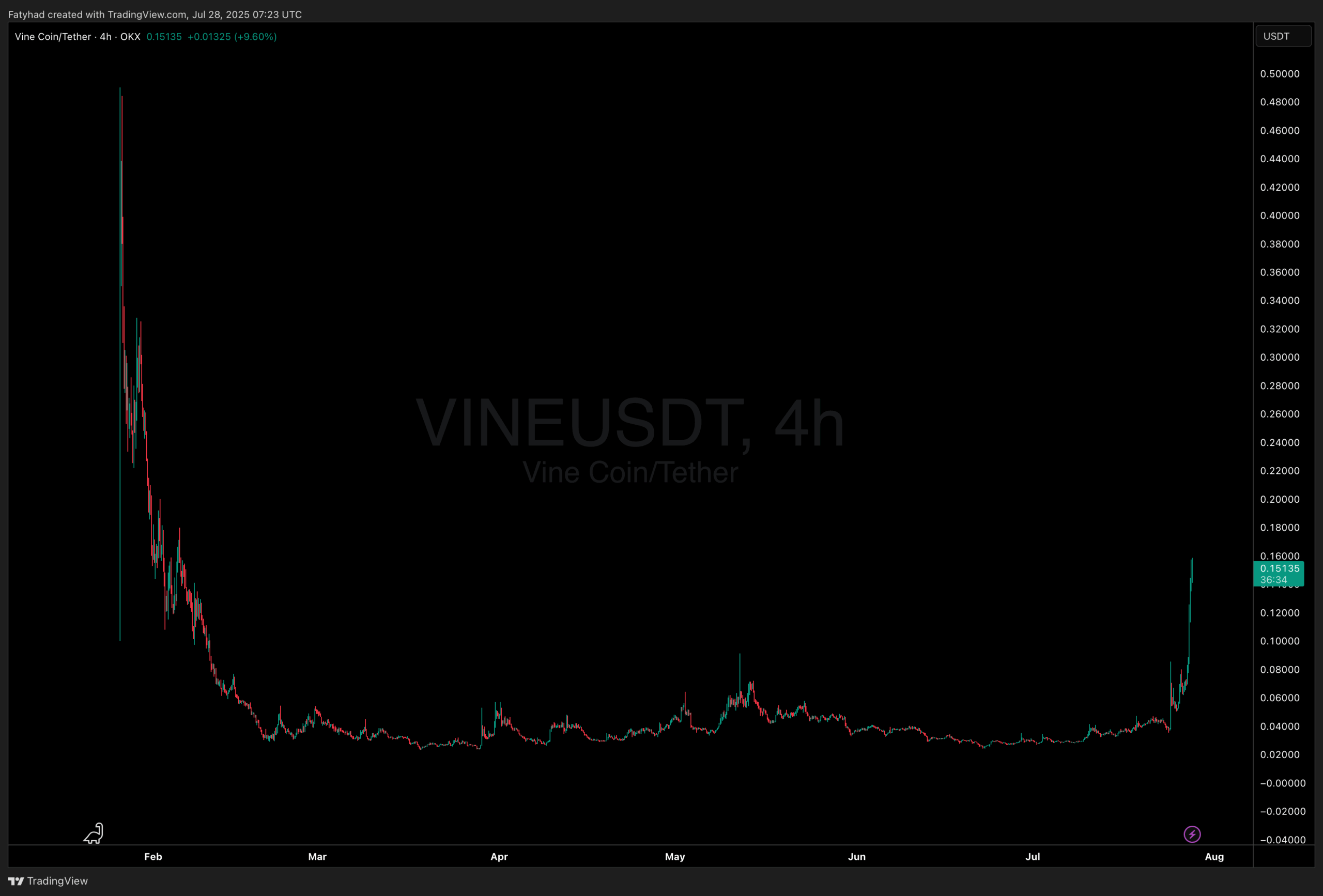

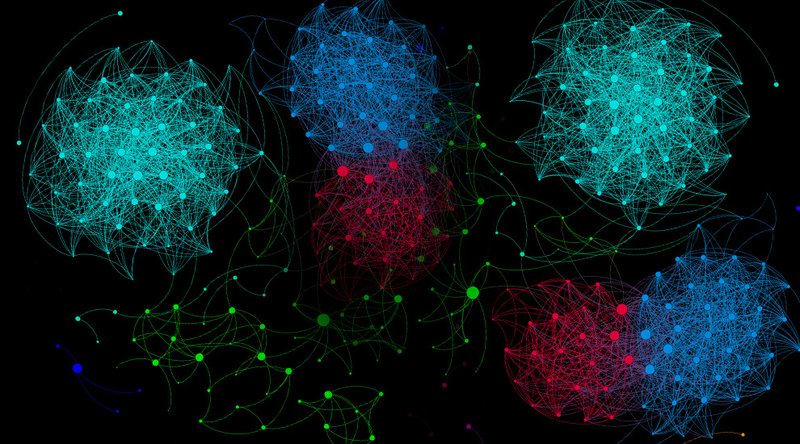

Conducted by the organization's test lab, the study sought to comprehensively examine Bitcoin's role in cross-border transactions. While public data often provides a partial view of cryptocurrency activities, this study utilized a novel approach, including the development of a new "global Bitcoin mapping system" that also reportedly incorporates non-public data from private companies.

Details about the proprietary system were not provided by the report. Notably, however, it did acknowledge that its data is likely imperfect given it remains possible to use Bitcoin anonymously and without identification.

The system tracked transactions, addresses, and wallet movements to paint a more complete picture of Bitcoin's cross-border payment activities, the report said.

Moreover, the study revealed that Bitcoin was increasingly being used for remittances, providing a lifeline for individuals in regions with limited access to traditional banking services. Its borderless nature and ease of use made it an attractive option for sending funds across international boundaries.

The findings of this study are expected to stimulate further discussions among regulators, financial institutions, and policymakers regarding the role of cryptocurrencies in cross-border transactions.

Founded in the 1930s, the BIS is owned by member central banks, and its primary goal is to "foster international monetary and financial cooperation."

As such, the report demonstrates a continued interest in Bitcoin among global central banks, some who want a stronger regulatory approach to the technology.

What's Your Reaction?