Crypto News Today, September 24 – Max Pain as Bitcoin Price Briefly Fell Again Below $112K, BSC Chain Surges: Best Crypto to Buy Right Now?

Another day, another jump-scare for bulls. Bitcoin traders woke up to fresh volatility today, with the price briefly dipping below $112,000 before bouncing from $111,100 and stabilizing near $112,580. The selloff coincided with $104 million in outflows from U.S. spot Bitcoin ETFs on September 23, led by Fidelity’s FBTC, which saw $75.55 million leave the.. The post Crypto News Today, September 24 – Max Pain as Bitcoin Price Briefly Fell Again Below $112K, BSC Chain Surges: Best Crypto to Buy Right Now? appeared first on 99Bitcoins.

Another day, another jump-scare for bulls. Bitcoin BTC ▲0.88% traders woke up to fresh volatility today, with the price briefly dipping below $112,000 before bouncing from $111,100 and stabilizing near $112,580. The selloff coincided with $104 million in outflows from U.S. spot Bitcoin ETFs on September 23, led by Fidelity’s FBTC, which saw $75.55 million leave the fund. Ethereum ETFs also struggled, posting $141 million in outflows with no inflows across nine products. In this uncertain market, investors are asking: what’s the best crypto to buy right now?

EXPLORE: Best Crypto To Buy in 2025

Bitcoin Liquidity Levels and Market Sentiment

Socials are split between bulls and bears. Optimists believe the bottom is already in, calling for a recovery toward $125K. Bears, however, expect further pain, eyeing $110K and $107K as key downside targets. According to Hyblock Capital, $107K hosts the deepest liquidity cluster, where heavy buy and sell orders sit. Large liquidity levels often act like magnets, attracting price action before stabilizing. Traders tend to place orders around these levels, reinforcing the potential for a bounce.

$BTC retested the $111,000 support level today.

For now, Bitcoin has bounced back but is still looking weak.

Institutional demand has gone down, so a dip towards the $108,000 level could happen. pic.twitter.com/nVy8Z3cgy8

— Ted (@TedPillows) September 24, 2025

The ETF outflows highlight weakening institutional demand in the short term, but liquidity depth suggests strong support could emerge if Bitcoin dips further. The next move may define whether September’s correction is nearing its end or just beginning.

DISCOVER: What is Quanto Crypto? Best Crypto Presales as QTO Price Fires +500%

Beyond Bitcoin: Altcoins and the Best Crypto to Buy Right Now

Not all corners of the market are bleeding. The BNB Chain ecosystem is showing strength, fueled by Aster’s explosive momentum. Aster’s perpetual futures exchange recently surpassed Hyperliquid in 24-hour volume, hitting $11.8 billion. Its native token is trading near $2.33 with over $2.4 billion in daily turnover. BNB ▼-0.42% itself broke the $1,000 barrier, setting a new all-time high around $1,080, trading now at $1028.

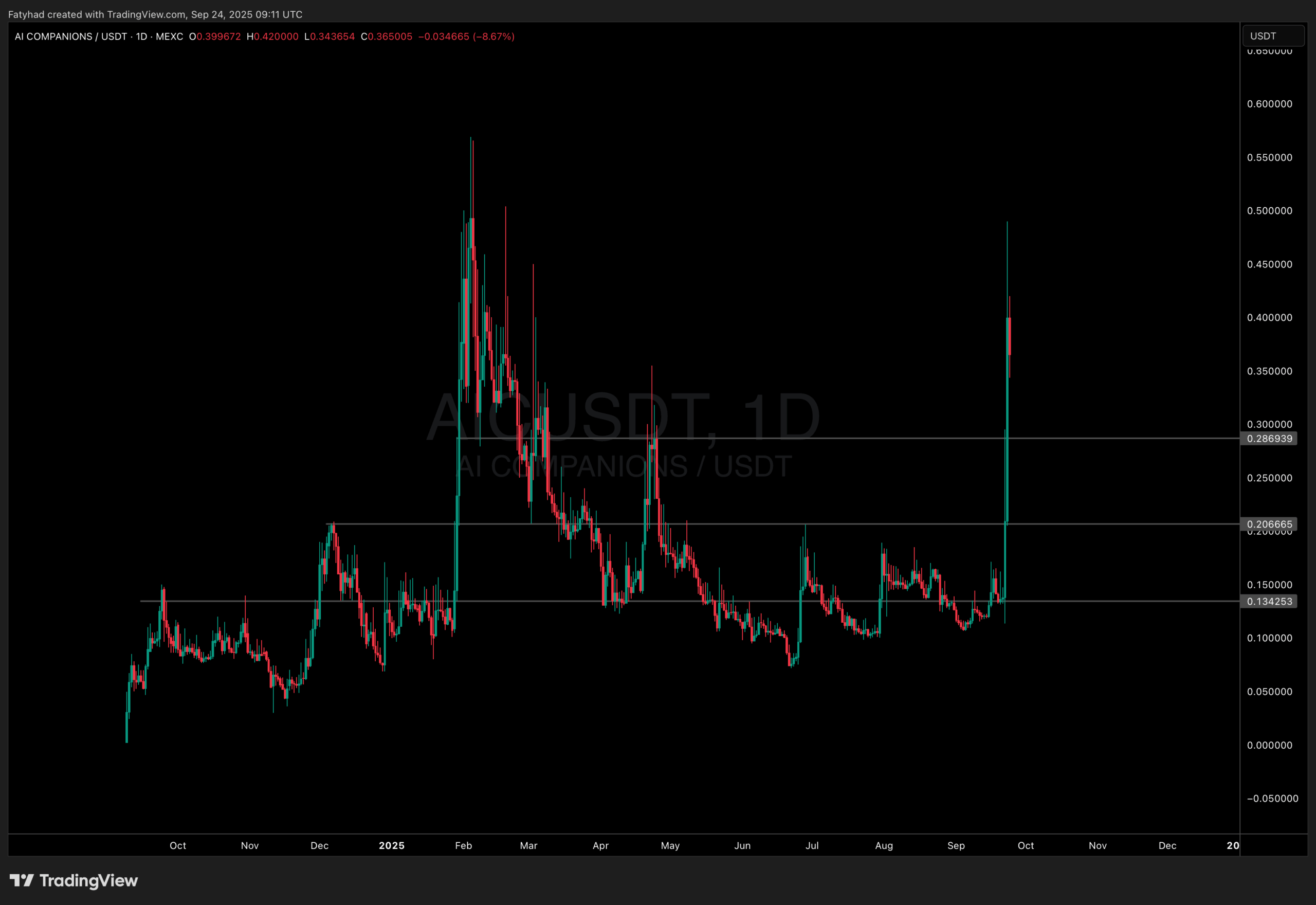

Meanwhile, AI-focused tokens like AIC are gaining traction. AIC surged 333% in just three days, peaking at $0.5 before retracing to $0.38, leaving it with a $380 million market cap. With capital rotating into BSC midcaps, these tokens could represent the best crypto to buy right now for those looking beyond Bitcoin.

(Source: Coingecko)

At the policy level, SEC Chair Paul Atkins has proposed an “innovation exemption” to help crypto firms launch products faster, signaling a regulatory shift that could encourage fresh market activity into 2026.

STBL crypto has quickly emerged as one of the most talked-about new tokens on BNB Chain, attracting strong trading interest and institutional attention.

Launched as the backbone of USST, a “Stablecoin 2.0” project by Tether co-founder Reeve Collins, STBL is designed to combine yield, transparency, and real-world asset (RWA) backing. USST separates yield from principal, meaning users can spend their stablecoins while still earning returns from regulated, yield-bearing assets like U.S. treasuries.

Introducing Multi Factor Staking (MFS) A world-first model where: This is how we align long-term holders with real utility. — STBL (@stbl_official) September 22, 2025

The price action has been nothing short of explosive. STBL launched below $0.03 with a $16 million market cap, then skyrocketed to a $264 million ATH. As of today, STBL trades around $0.44, up 15% in 24 hours and 150% in the past week.

Coinbase will soon list two local currency stablecoins—AUDD and XSGD—marking the first Australian Dollar and Singapore Dollar-backed stablecoins on the platform. Starting September 29 at 19:00 UTC, these fiat-backed tokens will be available globally via Coinbase.com and the mobile app.

AUDD, issued by AUDC Pty Ltd, is fully collateralized and redeemable 1:1 for AUD, designed for institutional-grade programmable finance. XSGD, issued by StraitsX, is compliant with Singapore’s upcoming Single Currency Stablecoin regulatory framework, providing secure, regulated access to the local currency.

With the stablecoin market surpassing $250B in June 2025 and projected to grow significantly, Coinbase’s move aligns with its mission to onboard one billion users to crypto. Surveys show over 70% of crypto owners in Australia and Singapore are interested in using local currency stablecoins.

In just the last 12 months, crypto millionaires have exploded in number, surging by 40% to a record 241,700 globally. Visibly, high-net-worth investors are increasingly favouring cryptocurrency and gold over traditional assets.

The Crypto Wealth Report 2025 from Henley & Partners, published on 23 September 2025, reveals a meteoric rise in not only crypto millionaires but also crypto billionaires.

Institutional adoption is at an all-time high. Crypto billionaires surged by 29, to 36 globally. Cryptocurrencies are even being launched by the sitting US President and the First Lady!

“At the apex of the crypto wealth pyramid, the number of ultra-wealthy individuals is rising sharply,” the report said. 450 centi-millionaires now control crypto portfolios worth $100 million or more, up 38% since last year.

Most airdrops end the same way: tokens get claimed, then dumped. Yeezy did it; hell the President and First Lady did it. But BLESS token jumped +250% on launch, climbing from $0.03 to over $0.08 after 3,200 tokens were dropped to Binance Alpha users.

The Bless crypto chart points to momentum holding. Support lines up near $0.085, where the 20-day moving average has caught dips.

Resistance sits at $0.097–$0.10, with a golden cross now in play as the 20-day SMA moves above the 200-day. A cup-and-handle pattern is also forming, with upside targets of $0.11–$0.12.

Here’s what’s next for Bless Crypto:

STBL and Tether’s $500B Ambition: Is This the Next Crypto to Explode?

– Lock $STBL → earn more $STBL

– Boost with $USST

– Keep earning yield via $YLD

Specs just dropped! Read them here: https://t.co/VUNh1omNVv https://t.co/wYGjiLdbVh

Coinbase Lists First AUD and SGD Stablecoins, Expanding Global Crypto Access

40% Increase In Crypto Millionaires In 12 Months: Report Finds World’s Wealthy Prefer Crypto And Gold

Bless Crypto Network Rockets 250% at Launch: Can It Really Take on Big Tech?

The post Crypto News Today, September 24 – Max Pain as Bitcoin Price Briefly Fell Again Below $112K, BSC Chain Surges: Best Crypto to Buy Right Now? appeared first on 99Bitcoins.

What's Your Reaction?